Environmental, social, and governance (ESG) investment is critical for achieving inclusive growth in Asia and can play a critical role in reducing the income inequality caused by the coronavirus disease (COVID-19).

ESG investment focuses on corporate initiatives that are not reflected in financial figures, specifically environmental, social, and corporate governance factors. The concept has increased in popularity in recent years and began to gain ground particularly from 2006, when key investors started to join the United Nations Principle of Responsible Investment, and with the adoption of the United Nations Sustainable Development Goals (SDGs) in 2015. The global financial crisis in 2008 further spurred a widespread movement to rethink excess capitalism and overemphasis on profits, while the younger generation, with figures such as Greta Thunberg, has also brought ESG issues into the spotlight among the public and in the media. In 2018, global ESG investment reached $31 trillion, 7 times its value in 2014.

Despite a slow start at first, Asia and the Pacific has also seen a strong and rapid uptake in ESG investment. ESG investment can help to support Asian countries by boosting their potential growth. If companies promote environmental protection, employee education, and women’s participation, for example, their corporate value will increase, spurring economic growth in a virtuous cycle.

Companies with high ESG scores are less susceptible to market fluctuations

Constraints on ESG investment can include declines in the value of investor assets, declines in profits, and shifts toward safe assets, such as cash and government bonds. Firms may also face difficulties in continuing investment in the environment and society under periods of significant economic deterioration or crisis. In fact, the Millennium Development Goals, the predecessors to the SDGs, were delayed in achieving their targets due to the economic deterioration in developed countries after the global financial crisis of 2008.

Recent investment, however, has continued to grow to include ESG factors. According to a report by the Institute of International Finance, the amount of money flowing into publicly traded mutual funds invested based on ESG ratings during January–April 2020 increased by 30% from the total inflow in 2019. ESG factors are especially important for investors looking for medium-to-long-term returns who want to avoid long-term risks, such as changes in consumer orientation and declines in corporate brands.

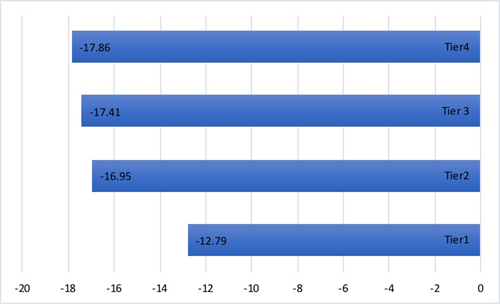

From a corporate perspective, ESG initiatives support resilience against market fluctuations. Recent leading studies have shown that there is a strong correlation between ESG evaluation and stock price performance in situations where corporate trust is questioned, such as during a financial crisis (Lins and Ane 2019). In a simple approach, we divided the top-100 Japanese listed companies into four groups based on their ESG ratings and compared the performance of stock prices in the first quarter of 2020. Although most of the firms faced a decline in equity prices, the group with high ESG ratings showed a lower rate of decline and more stable stock prices than the other groups (Figure 1).

Figure 1: Comparison of Stock Price Changes in Q1 2020 among Top-100 Japanese Listed Companies Grouped by ESG Rating

Notes: Tier 1 group has the highest corporate social responsibility (CSR) ranking, and Tier 4 group has the lowest CSR ranking. The CSR ranking reflects employment, environment, society, and governance factors. The sample comprises the top-100 listed Japanese firms with high market capitalization.

Source: ESG evaluation based on CSR rankings by Toyo Keizai in 2020.

Social factors are attracting more attention

Amid the COVID-19 crisis, society has started to focus more on the health and safety of its employees, such as by securing employment and responding to customers’ needs. Until now, social factors were considered to have a relatively small impact on stock prices and corporate value compared to environment and governance-related factors. This view is now gradually changing, with significant implications for the investment landscape.

In the United States, the unemployment rate rose to 14.7% in April, more than three times its rate in the previous month. Although, job creation showed some improvement in May, the employment situation remains fragile and exposed to the trends of infected persons and structural changes in industry and is continuing to deteriorate rapidly. Some companies have been severely criticized by investors for maintaining their high compensation rates for management staff and for high dividends payout while cutting large parts of their workforce. The Financial Times (2020) has highlighted that companies cannot ignore the fact that they should focus on the interests of diverse stakeholders, not only stockholders. When confronted with criticisms of its working conditions, Amazon announced that it would add more than 170,000 jobs and invest in improved safety measures, which could lead to declines in profit in the second quarter.

To look at the importance of social factors, we further analyzed the relationship between capital costs and ESG factors for the top-100 Japanese companies based on the CSR Enterprise Rankings by Toyo Keizai for 2020 and controlling for corporate size, revenue growth, industry, and leverage. Our results showed that companies with excellent human resource utilization, such as in diversity, human rights, and working conditions, tend to have low capital costs, namely high corporate value.

Asia should join to create effective ESG standards

ESG investment could be crucial for supporting sustainable growth in Asia, but there are several challenges. First is the problem of ensuring the quality and accuracy of information. The financial data of listed firms is checked by auditing firms, but nonfinancial data are not endorsed by third-parties in many cases. The rules of disclosure vary, and the conversion and standardization of disclosure guidelines still need to be developed. Second, it is not easy to analyze and evaluate the huge amount of necessary information. Investors are increasingly referring to ESG indexes, but there are criticisms that not all of the specific features of industries and companies are fully factored in when compiling these indexes. Third, many of the criteria and standards have been developed mainly in European countries. Applying uniform standards to countries with differing stages of economic development could result in the misallocation of economic resources.

To overcome these obstacles, policy makers and companies in Asia need to be proactive in disclosing ESG information, encouraging ongoing dialogue with global investors, and actively engaging in the creation of effective investment standards. Full discussion on these challenges and the benefits of ESG investment growth are discussed in a new ADBI book, Environmental, Social, and Governance Investment: Opportunities and Risks for Asia. The book examines the current state of ESG investment in Asia and offers insights into leveraging the benefits of ESG investment for sound and sustainable development.

_____

References

Financial Times. 2020. Proxy Battles Heat Up as Investors Target Climate and Social Issues, 24 April.

Institute of International Finance. 2020. Sustainable Debt Monitor, 12 May.

Lins, K., and T. Ane. 2019. Social Capital, Trust, and Corporate Performance: How CSR Helped Companies During the Financial Crisis( and Why it Can Keep Helping Them). Sustainable Finance Management, Vol 31, IV-2.

Nemoto, N., and P. J. Morgan. 2020. Environmental, Social, and Governance Investment: Opportunities and Risks For Asia. Tokyo: ADBI.

Great blog! Yes, Customer satisfaction is very important. I agree with you that If you provide excellent service then it will leave a mark. If your customer is not satisfied with your products or services you can’t grow your business.