To meet obligations under the Paris Agreement, major investments in renewable energy production and infrastructure are necessary. However, as public budgets are tight and because of Basel capital requirements, major public investments are unlikely to provide sufficient liquidity. Since most renewable energy projects are considered risky, many financiers are reluctant to lend to them or they lend at high interest rates. This lack of financing has to be overcome. Therefore, new innovative forms of raising money are needed to make the energy transition a success story. For instance, a Moldovan university uses cryptocurrencies to fund a solar energy project to overcome the lack of financing. Combining recent technical developments in blockchain and distributed ledger technologies (DLT)1 with classical, community-based approaches, we propose a new trustful financing tool to finance local renewable energy projects, in particular in developing countries.

The scheme we propose is based on the idea of hometown investment trust funds (HITs) in Japan. HITs are a new source of financing to support solar and wind power projects. The basic objective of the funds is to connect local investors with projects in their own locality. Individual investors choose their preferred projects and invest small amounts (about $100 to $5,000 per investor) via the internet (Yoshino and Kaji 2013). Local banks have also started to use the information provided by the HIT funds. If these projects are done properly and received well by individual investors, banks can start to grant loans to them. In this way, renewable projects can be supported by the HIT funds until they are able to borrow from banks. The use of alternative financing vehicles, such as HIT funds, has therefore assisted the growth of solar and wind projects in Japan (Yoshino and Taghizadeh–Hesary 2017).

Similar green financing tools like climate funds, green bonds, sustainability bonds, or fair world funds are already used by federal or local governments, green banks, and local initiatives. However, those are always based on trust in the fund or bond that the money will be used for the defined purpose. A further issue concerns the validity of the sustainable impact of supported projects. Thus, green banks like the German GLS Bank carry out both roles: the intermediary who channels the investments to projects as well as the validator of the project’s impact. Therefore, investors have to put a lot of trust on those omnipresent entities. At the same time, a variety of economic sectors are exploring or have already begun to implement DLTs—mainly Blockchain-based—as they offer multifarious potentials. Only the future will show if they revolutionize the shipping, banking, supply-chain management, finance, or investment sectors. Nonetheless, with inherent characteristics of all-embracing security, transparency, and auditability, Bitcoin, Ethereum, Iota and co. offer unique technical features that can be utilized to shape the energy sector of the future. Using those features we propose a new type of investment to foster investments in renewable energy projects.

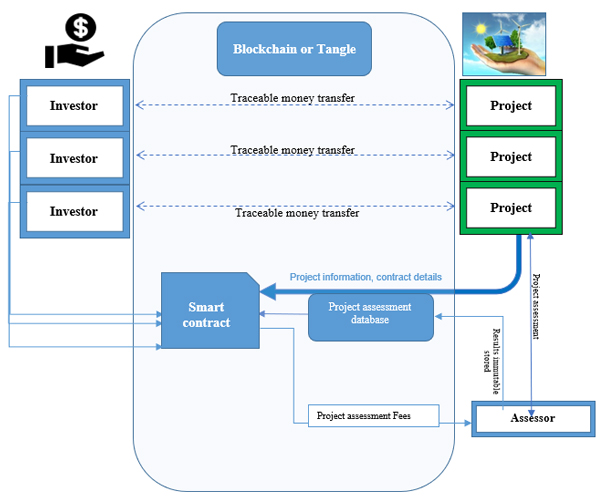

Financing scheme for renewable energy projects using Trust-by-Design Investments based on Blockchain or Tangle

Source: Authors’ compilation.

Figure description: Projects are assessed by an assessor who stores his results in the project assessment database. This database is grounded on a DLT (Blockchain or Tangle), so that the stored data cannot be changed once included. Moreover, the project issuer provides project details and determines the terms and conditions of future investment contracts they hope to conclude. On the other side, investors are entering a smart contract 2 that regulates the whole business relationship. First, they consult the assessment database to gather information to decide whether they want to invest or not. If they decide not to invest, nothing happens and they leave the table. However, if investors decide to invest and accept the terms and conditions, the contract is automatically set in motion, a fee is transferred to the assessor, the investment sum is forwarded from investors to the project as well as future revenue shares the opposite way.

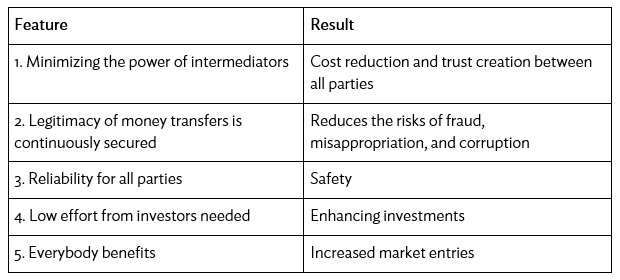

The proposed financing scheme has several benefits. First, it establishes a direct connection between the investor and the project issuer by making use of the auditability characteristic of DLT. Investors are able to track money streams, thus, ensuring that their money reaches the chosen project so that legitimacy of money transfers is continuously secured. This creates transparency and trust, which is crucial as the “Trust-by-Design Investment” has to compete with already existing investment products. Second, by minimizing the power of intermediators, service costs can be reduced, and investments forwarded more efficiently. Projects are assessed in a more transparent way which in the long run ensures higher quality across projects. Third, investors can mitigate investment risks by consulting securely stored assessment information of a third party to evaluate potential investment projects. Fourth, smart contracts are executed if investors agree with the contract details. This ensures full implementation of the contract details without any possibility to change them in the future. This feature creates trust and security for both parties and enables direct investments between partners who would not have collaborated without the Trust-by-Design Investment. Fifth, project issuers determine contract conditions, so that local benefits are ensured by design. Sixth, for the functionality of the instrument only the technical features of DLTs are essential and the use of Bitcoin, Ethereum, or Iota as currency is not a necessary requirement. The money streams could either take the direct form of cryptocurrencies or the form of an automatic combination with a fiat linkage. The former means that for example, Iotas are directly invested in a project. The latter means an investment in for example, yen, is made and the amount automatically exchanged in the used cryptocurrency to conduct the transfers. Independent which of the two designs is used, both ensure traceability, security, and full transparency for all parties.

Our goal is to bring investors from developed countries together with projects in developing countries. Optimally, issuers would be local communities that collaborate with governmental structures or private companies to develop a project, which is then implemented with the help of foreign investors. Those investors will financially gain for a limited period of time. Afterwards projects will be fully owned by the local community and can contribute to further local economic development.

Advantages of Trust-by-Design Investment

Source: Authors.

_____

1 Distributed ledgers (DL) store data across a distributed network of participants. The correctness of the data is ensured through a consensus process between all interacting parties.

2 Smart contracts are immutable contracts. Once started they will carry out their code whatever happens.

References

Yoshino, N., and S. Kaji (eds). 2013. Hometown Investment Trust Funds. Tokyo: Springer.

Yoshino, N., and F. Taghizadeh–Hesary. 2017. Alternatives to Bank Finance: Role of Carbon Tax and Hometown Investment Trust Funds in Development of Green Energy Projects in Asia. ADBI Working Paper 761. Tokyo: Asian Development Bank Institute.

Comments are closed.