Energy, especially from oil and its derivatives, is a key factor of production in an economy and is widely used in different sectors—including transportation, agriculture, and industry—in households, and as a raw material in the production of petrochemical products. As such, energy has great value and affects other commodity prices. Since the first oil price shock of 1973, examining the effects of changes in energy prices, especially of oil, on macro and microeconomic levels has become one of the most fundamental issues of energy economics (Taghizadeh-Hesary et al. 2013).

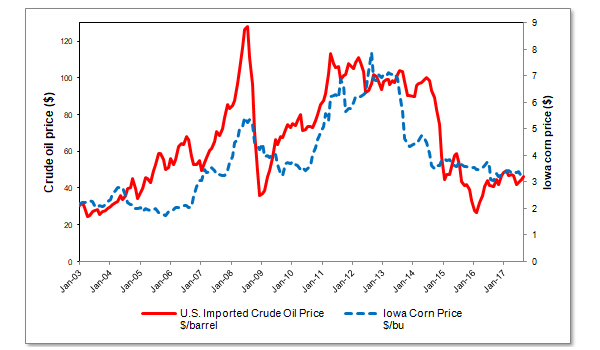

Rising food prices during 2002–2011 raised the question of whether oil markets might have any explanatory power regarding the recent upward movements in agricultural food prices. Statistics for imported crude oil prices and corn prices in the United States (US) (see Figure 1) show a positive correlation between these two variables.

Figure 1. Correlation between imported oil prices and corn prices in the United States, January 2003–October 2017

Sources: The US imported crude oil price is from the Energy Information Administration database. The Iowa corn price is from the United States Department of Agriculture, National Agricultural Statistics Service database.

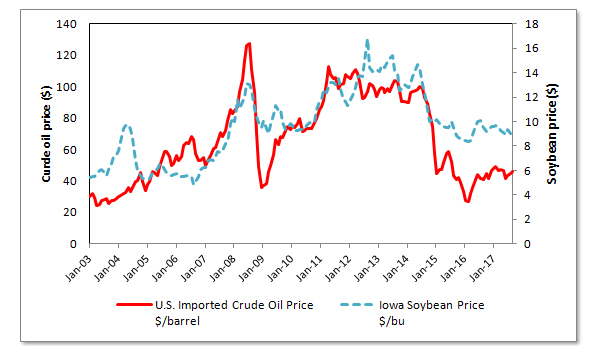

We can see that from 2003 until the end of 2017, US imported crude oil prices increased along with corn prices. The correlation can also be found for imported crude oil prices and soybean prices. Figure 2 shows evidence of this positive relationship between the two variables for the US.

Figure 2. Correlation between imported oil prices and soybean prices in the US, January 2003–October 2017

Source: The US imported crude oil price is from the Energy Information Administration database. The Iowa soybean price is from the United States Department of Agriculture, National Agricultural Statistics Service database.

Taghizadeh-Hesary, Rasoulinezhad, and Yoshino (2018) examine the linkages between energy prices and food prices over the period 2000–2016 using a panel-VAR model for the case of eight Asian economies, namely Bangladesh, the People’s Republic of China, Indonesia, India, Japan, Sri Lanka, Thailand, and Viet Nam. They find a major result from the accumulated response of food prices to different impulses of a positive response of food prices to the oil price. This means that any sharp increase in the global oil price leads to an increase in agricultural food prices. Further, the response of agricultural food prices to any positive shock from the labor wage rate is positive, whereas the response to any shock from other production inputs, i.e., agriculture land, is negative. Moreover, any sharp increase in the inflation rate leads to an increase in the prices of agricultural products, while a sudden increase in the real interest rate significantly increases food prices for six periods but after that becomes insignificant. Agricultural food prices respond positively to any biofuel price shock.

Examination of the responses for all other variables to any shock from the oil price reveals that gross domestic product has a negative response to any shock from oil prices. Meanwhile, inflation responds positively to oil price shocks. The real interest rate has a negative response to a shock from oil prices that is significant for two periods but then becomes insignificant. The response of biofuel prices to any sharp positive change in global oil prices is negative. Food prices have a positive response to any impulse from global oil prices.

The food price variance decomposition analysis reveals that oil fluctuation represents the major share of food price volatility. The second-highest share is for the food price itself, which causes 22.59% of the variance in food prices in the 20th period. The third-highest reason is the general inflation rate, which explains about 6.27% of the variance in food prices in the 20th period.

Due to the relationship between agricultural products prices and energy price fluctuations, and the increasing share of industrialized agricultural production and greenhouse gas emissions as a result of the use of fossil fuels in this sector, it is necessary to diversify energy consumption and move away from over-reliance on fossil fuels to an optimal combination of renewable and non-renewable energy resources. Energy diversification in the agriculture sector is needed to encompass other adoptable energy sources for the environment.

Read the working paper here.

_____

References:

Taghizadeh-Hesary, F., E. Rasoulinezhad, and N. Yoshino. 2018. Volatility Linkages between Energy and Food Prices: Case of Selected Asian Countries. ADBI Working Paper 829. Tokyo: Asian Development Bank Institute.

Taghizadeh-Hesary F., N. Yoshino, G. Abdoli, and A. Farzinvash. 2013. An Estimation of the Impact of Oil Shocks on Crude Oil Exporting Economies and their Trade Partners. Frontiers of Economics in China 8(4): 571–591.

Comments are closed.