There is much discussion about the rapid expansion of capital market issuances by emerging market firms in international markets. This expansion has been driven by deepening financial globalization, which started in the 1990s, and, more recently, by low interest rates in advanced economies after the 2008–2009 global financial crisis.

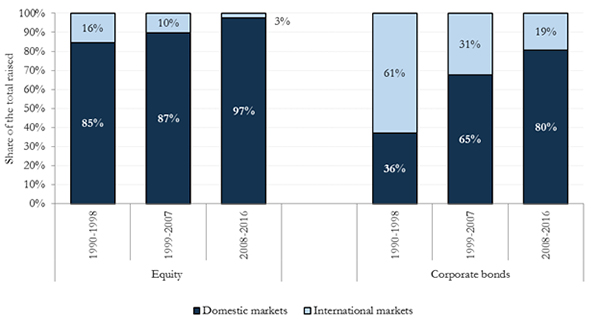

In contrast to the importance ascribed to international capital markets, the role of domestic markets has been largely overlooked. In a new paper (Abraham, Cortina, and Schmukler 2019), we examine the case of East Asia and document how the use of domestic capital markets by firms in this region has grown significantly faster than that of international markets since the 1990s. As a result, domestic markets are now the main place where issuance activity takes place (Figure 1).

Figure 1. Share of Domestic and International Issuances, Median East Asian Economy

Source: Abraham, Cortina, and Schmukler (2019).

As domestic markets have developed, more firms have gained access to equity and corporate bond financing. Driven by a higher participation of firms in domestic markets, the average number of issuing firms per year in the median East Asian economy more than tripled between 1990–1998 and 2008–2016. Because domestic markets attract relatively small firms compared to international markets, the size of issuers has declined as the extensive margin has expanded. Despite being smaller, issuing firms are still relatively large corporations.

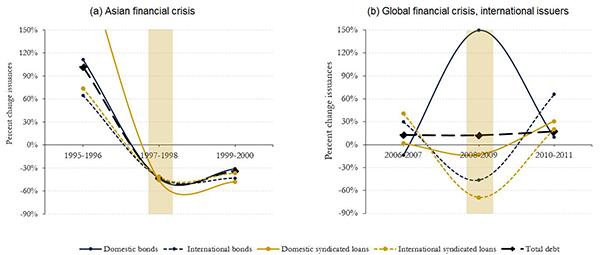

Domestic capital markets have also helped diversify financing sources for the largest issuers. Whereas relatively small issuers rely almost exclusively on domestic capital markets, the largest firms raise funds in both domestic and international markets. Access to various markets can be beneficial because when the supply of funds from specific markets declines, firms can compensate by raising more funds in less affected markets. For example, when international debt markets collapsed during the global financial crisis, firms in East Asia moved from international to domestic bond markets. This “spare tire” function was not present during the Asian financial crisis, when domestic capital markets were less developed (Figure 2).

Figure 2. Issuance Activity in East Asia during Crises

(% change in the number of issuances)

Note: International issuers are those that issued international debt at least once before 2008.

Source: Abraham, Cortina, and Schmukler (2019).

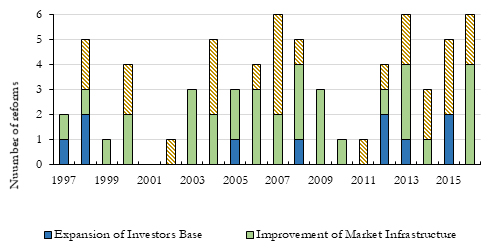

Our analysis raises some relevant questions about domestic capital markets in East Asia. First, why have domestic capital markets developed so much? In part, this growth could be a result of the capital reforms implemented in response to the Asian financial crisis. However, identifying which specific policies helped jumpstart the process is not easy because East Asian economies implemented diverse reforms over an extended period (Figure 3).

Figure 3. Number of Capital Market Reforms in East Asia Per Year

Note: The figure includes 68 reforms compiled for Indonesia, the Republic of Korea, Malaysia, the Philippines, and Viet Nam.

Source: Abraham, Cortina, and Schmukler (2019).

Second, why do these markets fail to attract many small firms? Do the reasons lie in the supply or the demand side of funds? Even when specific capital markets aimed at small and medium-sized enterprises have been established, the main users of these markets have been large firms.

Third, even if relatively few firms use domestic capital markets, to what extent do their actions produce spillovers to non-issuers and smaller firms? A more intensive use of capital markets by large firms could free bank funding that could be channeled to smaller firms. In addition, large firms could act as financial intermediaries, raising funds at low interest rates in capital markets and then on-lending the proceeds to other firms.

_____

References:

Abraham, F., J. J. Cortina, and S. L. Schmukler. 2019. The Rise of Domestic Capital Markets for Corporate Financing. World Bank Policy Research Working Paper 8844. World Bank.

Comments are closed.