Over the past 25 years, central banks in emerging Asia have improved their monetary policy frameworks, helping to anchor inflation expectations and support broader macroeconomic stability. While this has also contributed to enhancing the resilience of Asian economies to external shocks, the exchange rate channel remains a key transmission mechanism of disturbances to the real economy and financial markets.

In 2022, aggressive United States (US) monetary policy tightening in the face of soaring inflation triggered exchange rate-driven inflationary pressures at the global level, with the US dollar appreciating to levels not observed in decades. Given the US dollar pricing of international commodities, net commodity importers during this period experienced sharp currency depreciations and imported inflation. Central banks therefore need to pay close attention to exchange rate developments that might affect their price stability mandates.

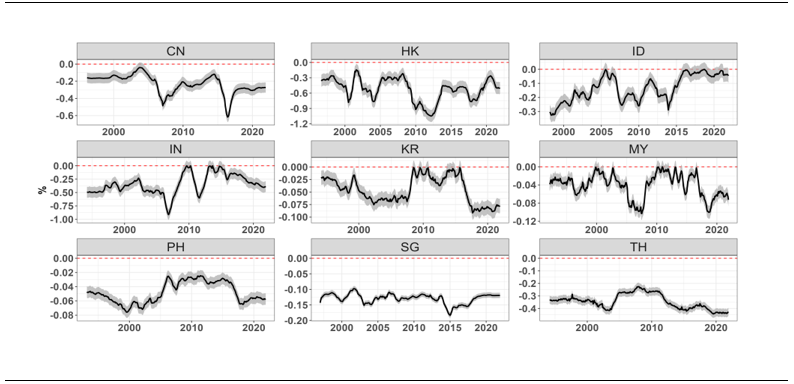

Since most developing economies depend on foreign currency for engaging in international trade, their exchange rate pass-through (ERPT) elasticity can be subject to significant variations related to the sectoral composition of the economy and exposure to external economic and financial developments (Burstein and Gopinath 2014; Forbes, Hjortsoe, and Nenova 2018). In addition, given rising levels of global financial integration, emerging market economies (EMEs) are vulnerable to global financial shocks and monetary spillovers, notably via the exchange rate channel (Han and Wei 2018). A new ADBI paper by Beirne, Renzhi, and Panthi (2023) examines the evolution of ERPT to prices for emerging economies in Asia. Time-varying estimates of ERPT reveal that it has been declining for most Asian EMEs since around 2010, which corresponds to the period after the global financial crisis. Figure 1 shows the estimates relative to consumer prices.

Figure 1: Time-Varying ERPT to Consumer Prices: Yearly

Notes: The figure plots yearly time-varying impulse responses of consumer prices to a 1 percentage point appreciation shock of the exchange rate, with 90% confidence intervals. The vertical axis unit is percentage points, and the unit of the horizontal axis refers to months. The labels CN, HK, IN, ID, KR, MY, PH, SG, and TH represent the People’s Republic of China; Hong Kong, China; India; Indonesia; the Republic of Korea; Malaysia; the Philippines; Singapore; and Thailand, respectively.

Notes: The figure plots yearly time-varying impulse responses of consumer prices to a 1 percentage point appreciation shock of the exchange rate, with 90% confidence intervals. The vertical axis unit is percentage points, and the unit of the horizontal axis refers to months. The labels CN, HK, IN, ID, KR, MY, PH, SG, and TH represent the People’s Republic of China; Hong Kong, China; India; Indonesia; the Republic of Korea; Malaysia; the Philippines; Singapore; and Thailand, respectively.

Source: Beirne, Renzhi, and Panthi (2023).

During the post-global financial crisis period, Asian economies significantly enhanced their overall macrofinancial resilience capacities, supported by improved central bank credibility. Nonetheless, Asian EMEs continue to remain vulnerable to external real and financial shocks, albeit to differing degrees depending on the nature of the shock. Beirne, Renzhi, and Panthi (2023) also show that ERPT is incomplete and mostly higher for producer than consumer prices and mostly greater in magnitude over a longer horizon of 12 months.

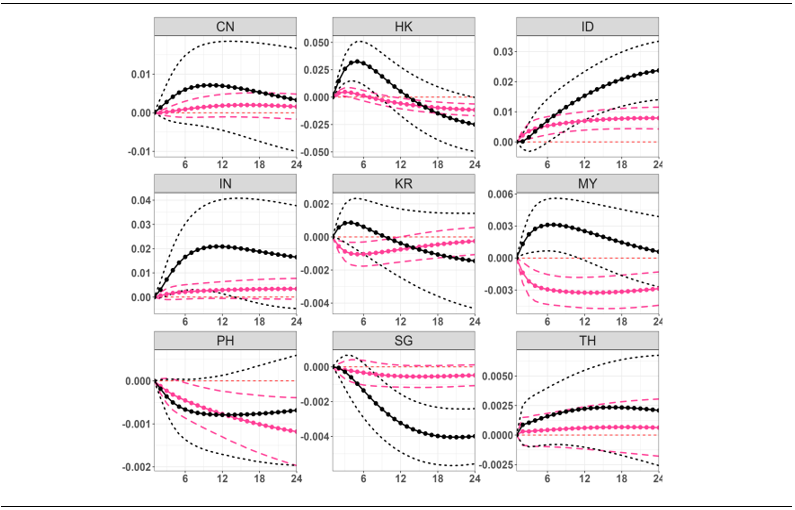

Regarding the significance of global shocks, the authors find that oil price and global output shocks mostly affect longer-term producer price ERPT in emerging Asia, while US monetary policy and global financial market volatility shocks mostly affect longer-term consumer price ERPT in emerging Asia. The response of ERPT to consumer prices to US monetary policy shocks is shown in Figure 2. While some heterogeneity is found in magnitude and duration of statistical significance, US monetary policy tightening shocks amplify ERPT to consumer prices in emerging Asia in most cases, with the results most pronounced over the longer-term horizon.

Figure 2: Response of ERPT to Consumer Prices: US Monetary Policy Shocks

Notes: Impulse responses with 95% confidence bands are reported. Red lines refer to the short-term ERPT and black lines refer to the yearly ERPT. The vertical axis unit is percentage points, and the unit of the horizontal axis refers to months. The labels CN, HK, IN, ID, KR, MY, PH, SG, and TH represent the People’s Republic of China; Hong Kong, China; India; Indonesia; the Republic of Korea; Malaysia; the Philippines; Singapore; and Thailand, respectively.

Notes: Impulse responses with 95% confidence bands are reported. Red lines refer to the short-term ERPT and black lines refer to the yearly ERPT. The vertical axis unit is percentage points, and the unit of the horizontal axis refers to months. The labels CN, HK, IN, ID, KR, MY, PH, SG, and TH represent the People’s Republic of China; Hong Kong, China; India; Indonesia; the Republic of Korea; Malaysia; the Philippines; Singapore; and Thailand, respectively.

Source: Beirne, Renzhi, and Panthi (2023).

Policy implications for central banks in emerging Asia

While ERPT has in general trended downward and varies somewhat across economies in terms of the size of its elasticity, it has a material and statistically significant effect on inflation, with evidence of persistence. This implies that exchange rate developments are important considerations for central banks in the sense that they can affect their core mandates for price stability. While recognizing the shock-absorbing capacity of exchange rates in flexible exchange rate regime settings, a persistently high rate of ERPT could trigger an assessment of the appropriateness of the monetary policy framework.

The findings from the paper also have implications for policy makers and central banks in shielding their economies from the ERPT effects of global economic and financial shocks. For example, amplified ERPT to producer prices from oil price shocks could trigger an acceleration in efforts aimed at reducing concentration risks through the diversification of energy supply networks. For central banks, the dominant role of US monetary policy in driving the global financial cycle makes it a difficult proposition for emerging Asian economies to have buffers in place against US monetary policy shocks. However, strong macroeconomic fundamentals are important considerations in this regard, including adequate foreign exchange reserve accumulation.

Finally, these results can also help central banks to improve forecasts of inflation that derive from exchange rate movements. While fraught with difficulty and notoriously bound by wide margins of error, the lags in monetary policy in affecting inflation mean that accuracy in inflation forecasting is central to effective monetary policy. The incorporation of time-varying ERPT estimates into inflation forecasting models may be an area worth further examination.

References

Beirne, J., N. Renzhi, and P. Panthi. 2023. Exchange Rate Pass-Through in Emerging Asia and Exposure to External Shocks. ADBI Working Paper No. 1379. Tokyo: Asian Development Bank Institute.

Burstein, A., and G. Gopinath. 2014. International Prices and Exchange Rates. In Handbook of International Economics, edited by G. Gopinath, E. Helpman, and K. Rogoff. Elsevier: 391–451.

Forbes, K., I. Hjortsoe, and T. Nenova. 2018. The Shocks Matter: Improving Our Estimates of Exchange Rate Pass-Through. Journal of International Economics 114: 255–275.

Han, X., and S.-J. Wei. 2018. International Transmissions of Monetary Shocks: Between a Trilemma and a Dilemma. Journal of International Economics 110: 205–219.

Comments are closed.