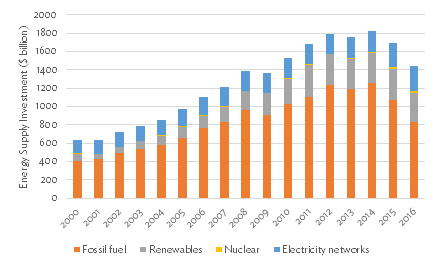

Investment in renewable energy of $9 trillion is required to meet global energy supply needs by 2040 (International Energy Agency 2016), but investments in fossil fuels still dominate those in renewable energy (Yoshino and Taghizadeh-Hesary 2018: Figure 1). Many countries are implementing national energy policies, including fiscal, financial, information and education, institutional support, strategic planning, regulatory, and voluntary measures, to promote greater private investment in renewable energy.

Figure 1. Global Energy Supply Investment

Source: Created by author using data collected from International Energy Agency (2017).

Interestingly, fiscal and financial policies, such as feed-in tariffs, loans, tax reliefs, grants, and subsidies, are more popular in developed countries than in developing and least-developed countries. This can be explained by the higher cost of such policies, but empirical evidence on the effectiveness of fiscal and financial energy policies is needed to equip developing countries with evidence-based policy recommendations.

Feed-in tariffs have played a major role in increasing renewable energy capacity in Europe, particularly in Germany, Spain, and France. Feed-in tariffs are pre-determined tariffs that a government can commit to for purchasing renewable energy by signing fixed long-term contracts with renewable energy suppliers. They are designed to attract private investment in renewable energy sources by providing government-guaranteed compensation above the electricity market price. By providing feed-in tariffs, governments can promote private investment in renewable energy in two ways. First, by setting tariffs, governments can create fixed rather than uncertain revenue flows, thus reducing the risk of investing in renewable energy. Second, by setting a tariff above the market price, governments can increase the profitability of renewable energy projects.

Grants and subsidies are another measure that allow governments to partially cover the cost of renewable energy technologies. By providing these grants and subsidies, governments can reduce the cost of renewable energy technologies, which increases the profits from renewable energy projects, thus attracting greater private investment.

Loans can also be provided at lower interest rates for financing renewable energy projects. These lower rates reduce the cost of renewable energy projects, leading to an increase in profits. Usually, banks are incentivized to provide lower interest rates for renewable energy projects by receiving compensation from the government. In 2016, bank lending for renewable energy sources remained high, comprising $86.4 billion of non-recourse project finance deals for new installations and $72.7 billion of asset acquisitions and refinancing (Frankfurt School-UNEP Centre/BNEF 2017).

Tax reliefs or tax credits are also widely used to promote renewable energy deployment. In the United States, production tax credits are commonly used to promote wind energy, while investment tax credits are used for solar energy. These tax credits can be used by companies to reduce deductions from income taxes or corporate taxes in exchange for investment in renewable energy.

Much of the empirical literature studying the determinants of investment in renewable energy focuses on total investment. However, studying the impacts of policies on total rather than private investment can overestimate the effectiveness of policies due to the high share of public investment in renewable energy in some countries. That is why it is important to study the impact of policies on private investment in renewable energy rather than total investment (which includes public and private investment). Azhgaliyeva, Kapsalyamova, and Low (2018) provide an example of such an approach.

Using multi-level annual data from 13 countries and across six renewable energy sources, including biofuel, geothermal, small hydro, solar, wind, wave, and tidal energy, over the period 2004–2016, Azhgaliyeva, Kapsalyamova, and Low (2018) study the impacts of fiscal and financial policy instruments, i.e., feed-in tariffs, loans, tax relief, grants, and subsidies, on private investment in renewable energy. Their estimation method, a random intercept and random coefficient multi-level model with unstructured covariance (Rabe-Hesketh and Skrondal 2012), was selected based on the analysis of data properties using Hausman (1978) and log-likelihood tests (Azhgaliyeva 2019).

Their findings show that private investment in renewable energy is driven by energy policies and fuel prices. Two energy policy instruments are effective in promoting private investment in renewable energy: (1) feed-in tariffs and (2) loans. Feed-in tariffs and loans can increase private investment in renewable energy as a share of total investment by 0.10% and 0.18%, respectively. The results fail to support the effectiveness of grants, subsidies, and taxes in promoting private investment in renewable energy. Both feed-in tariffs and loans are long-term policies that allow renewable energy projects to receive long-term government support, while grants, subsidies, and taxes usually do not require a long-term commitment from governments. As such, we can conclude that feed-in tariffs and loans are better at attracting investment in renewable energy projects.

Although feed-in tariffs and loans can be expensive as they require long-term commitments from governments, policy makers should still prioritize their implementation due to their effectiveness at attracting private investment in renewable energy.

Read the working paper here.

_____

References:

Azhgaliyeva, D., Z. Kapsalyamova, and L. Low. 2018. Implications of Fiscal and Financial Policies for Unlocking Green Finance and Green Investment. ADBI Working Paper 861. Tokyo: Asian Development Bank institute.

Azhgaliyeva, D. 2019. Codes for: Implications of Fiscal and Financial Policies on Unlocking Green Finance and Green Investment. ScholarBank@NUS Repository. Dataset. https://doi.org/10.25540/TV5A-89QY

Frankfurt School–UNEP Centre/Bloomberg New Energy Finance (BNEF). 2017. Global Trends in Renewable Energy Investment 2017. Frankfurt School of Finance & Management GmbH.

International Energy Agency (IEA). 2016. World Energy Outlook 2016. Paris: International Energy Agency. doi: 10.1787/weo-2016-en.

International Energy Agency (IEA). 2017. World Energy Investment 2017. Paris: International Energy Agency. doi: 10.1787/9789264277854-en.

Hausman, J. A. 1978. Specification Tests in Econometrics. Econometrica 46: 1251–1271.

Yoshino, N., and F. Taghizadeh-Hesary. 2018. A Model for Utilizing Spillover Taxes and Community-Based Funds to Fill the Green Energy Financing Gap in Asia. ADBI Working Paper 899. Tokyo: Asian Development Bank institute.

Rabe-Hesketh, S., and A. Skrondal. 2012. Multilevel and Longitudinal Modelling Using Stata. Texas: STATA Press.

Comments are closed.