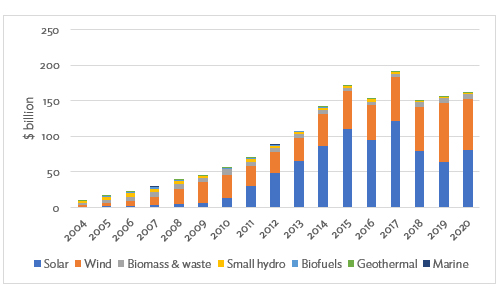

The mobilization of climate finance is critical for limiting global warming to within 1.5°C and preventing catastrophic climate change (IPCC 2018). Annual green investments totaling $1.5 trillion are needed (United Nations 2017). Despite the falling cost of renewable energy technologies, energy investments remain dominated by investments in fossil fuels. In Asia and the Pacific, annual investments fell after 2017 and until 2020 remained below the 2017 level (Figure 1). Investments in renewable energy are challenged by subsidized electricity and fossil fuels, the high initial capital costs of renewable energy technologies, lack of skills or information, and uncertainties. Many countries globally have implemented policies aimed at promoting investment in renewable energy by reducing these barriers. This is a particularly important policy issue in the case of Asia, which accounts for around 50% of global energy consumption, with around 50% of that embodied in fossil fuels.

Figure 1: Investments in Renewable Energy in Asia and the Pacific

Source: BloombergNEF (2020).

Raising private investment in renewable energy is key to meeting Asia’s surging energy demand, which is fueled by economic growth, population growth, and enhanced energy access (Azhgaliyeva, Kapoor, and Liu 2019). Two-thirds of global energy-demand growth will occur in developing Asia by 2040. This underscores the importance for Asia to progress on its shift to a decarbonized greener economy, with less reliance on fossil fuels for energy. For Asia in particular, with a growing demand for energy as the population rises, coupled with insufficient domestic fossil fuels to meet rising energy demand, it is of crucial importance for the region to develop its renewable energy sector. Earlier related work by Chen, Kim, and Yamaguchi (2014) noted that less-conservative efforts for the development of the renewable energy sector are needed in the economies of East Asia. Other studies on the effectiveness of renewable energy policies in stimulating private investment overall in Asia include Chang, Fang, and Li (2016), who find significant cross-country heterogeneity across a sample of 16 East Asia Summit countries, with the People’s Republic of China (PRC), India, the Republic of Korea, and Japan among the highest-ranking in terms of the impact of their renewable energy policies.

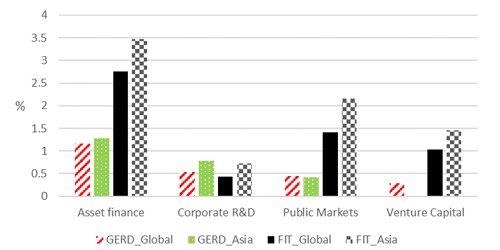

Against this backdrop, recent ADBI research (Azhgaliyeva, Beirne, and Mishra 2021) assesses the drivers of private investment in renewable energy by the type of financing, namely asset finance, corporate research and development (R&D), public markets, and venture capital. The research focuses on a panel of 13 advanced and emerging economies over the period 2008–2018 and a sub-panel comprised of 4 Asian economies, namely Japan, the Republic of Korea, the PRC, and India. Controlling for a range of domestic macroeconomic, financial, and structural factors, as well as global financial factors, the paper analyzes the drivers of private investment in renewable energy. The main results are summarized in Figure 2.

Figure 2: GERD and FIT Estimated Elasticities on Private Investment by Funding Source

Note: Reported are the coefficients on government expenditure on R&D (GERD) and feed-in tariffs (FITs) from panel regressions on the drivers of private investment in renewable energy by financing source globally and in Asia.

Source: Azhgaliyeva, Beirne, and Mishra (2021).

While some heterogeneity is found in the effectiveness of renewable energy policies across the Asian and global samples, the main finding is that feed-in tariffs (FITs) have the greatest overall effect in Asia in driving private investment in renewable energy, particularly for asset finance compared to other funding sources. The impact of FITs in Asia is also greater than that of the global sample. The analysis further shows that the impact of FITs is amplified in the presence of lower regulatory quality, which may be related to ease of market entry. In addition, an important role in Asia is found for government expenditure on R&D (GERD) in stimulating private investment. The magnitudes of the effects in Asia are broadly in line with the global sample. Azhgaliyeva, Beirne, and Mishra (2021) also find that technology costs are less elastic on private investment in Asia compared to globally in affecting private investment in renewable energy across all funding sources, which may be related to the prevailing strong cost competitiveness of Asian economies in renewable energy provision.

The results have important implications for policy makers in two key respects. First, while FITs in Asia and globally have the strongest impacts on driving asset finance-based private investment, other sources of financing, namely corporate R&D, public markets, and venture capital, also demonstrate positive and statistically significant effects on private investment in renewable energy. Policy makers therefore should be encouraged to develop appropriate policies aimed at encouraging financing from these other avenues. Second, in the case of Asia, while the sample included only four countries for which data were available and that are relatively more developed in terms of renewable energy adoption and maturity, there are important implications of the results for other Asian economies that may be at an earlier stage of development, particularly regarding the significance of FITs and to a lesser extent GERD in driving asset finance-based private investment in renewable energy.

_____

References:

Azhgaliyeva, D., J. Beirne, and R. Mishra. 2021. What Matters for Private Investment Financing in Renewable Energy Globally and in Asia? ADBI Working Paper 1246. Tokyo: ADBI.

Azhgaliyeva, D., A. Kapoor, and Y. Liu. 2019. Green Bonds for Financing Renewable Energy and Energy Efficiency in South-East Asia: A Review of Policies. Journal of Sustainable Finance & Investment 10(2): 113–140.

BloombergNEF. 2020. New Energy Outlook 2020. Bloomberg New Energy Finance.

Chang, Y., Z. Fang, and Y. Li. 2016. “Renewable energy policies in promoting financing and investment among the East Asia Summit countries: Quantitative assessment and policy implications”. Energy Policy 95: 427-436

Chen, W.-M., H. Kim, and H. Yamaguchi. 2014. Renewable Energy in Eastern Asia: Renewable Energy Policy Review and Comparative SWOT Analysis for Promoting Renewable Energy in Japan, South Korea, and [Taipei,China]. Energy Policy 74: 319–329.

Intergovernmental Panel on Climate Change (IPCC). 2018. Global Warming of 1.5 °C. IPCC.

United Nations. 2017. Bridging Climate Ambition and Finance Gaps. UN Climate Press Release, 13 November.