It has been widely acknowledged that services play an important role for other industries, in particular manufacturing. A study by the Organisation for Economic Co-operation and Development (OECD) finds that services represent at least 30% of the value added in manufacturing exports (OECD 2014). Another study by the World Bank suggests that countries with a higher services content in their downstream economies are also those producing more complex goods (Saez et al. 2015). These developments are strongly linked to the emergence of global value chains, which depend on the quality of embedded services, ranging from quality control, logistics, storage facilities, packaging, insurance, and distribution (Taglioni and Winkler 2016).

Services not only serve as inputs to the manufacturing sector but are also a relevant source of productivity spillovers, i.e., knowledge diffusion in the form of unintentional transmission or intentional transfer. The strong dependency of firms on services inputs implies that improvements in services sectors, including services firms’ performance and services reforms, are likely to affect all downstream sectors. Second, the performance of downstream sectors depends to a larger extent on the availability and quality of domestic services firms due to the limited cross-border tradability of services compared to material inputs (Javorcik 2008).

However, there is still a knowledge gap on the spillovers from services to manufacturing, in particular for low- and middle-income countries, which our new study aims to fill. Several studies suggest a performance-enhancing effect of services usage within sectors and firms. Others point to the relevance of services inputs to downstream industries, in particular manufacturing sectors. Using a cross-section of more than 38,000 manufacturing and 24,000 services firms in 105 low- and middle-income countries over the period 2010 to 2017 from the World Bank’s Enterprise Surveys, our new study focuses on the productivity and technology spillovers from services to manufacturing firms as well as the role of firm characteristics and a country’s services liberalization in mediating spillovers (Winkler 2018).1

Our study confirms positive spillovers to manufacturing firms resulting from the higher average regional productivity and technology intensity of services firms but rejects the existence of spillovers from the presence of services firms alone. This finding is of high policy relevance as it suggests that the number of services firms in a region and their share in a region’s total output are not sufficient to generate spillovers—what matter are the productivity and technology intensity of services firms.

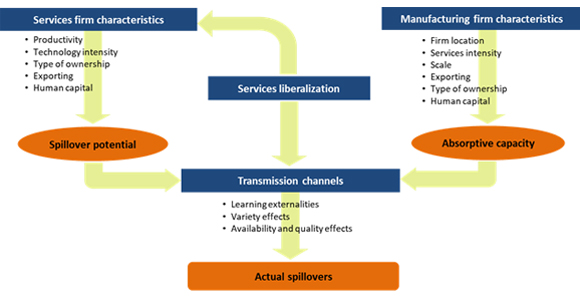

Our analysis also highlights the importance of firm heterogeneity in influencing spillovers, both from the perspective of services and manufacturing firms. The extent of spillovers depends on both the potential of services firms to generate spillovers and the capacity of manufacturing firms to internalize them (see Figure 1). Our findings suggest that some types of manufacturing firms benefit more strongly from services spillovers than others, in particular those that are large, foreign-owned, and exporters. At the same time, some types of services firms have a higher spillover potential: foreign ownership status and the top manager’s experience are linked to a higher productivity and technology spillover potential, whereas exporting is only associated with the latter.

Figure 1: Conceptual framework of services spillovers

Source: Author’s own illustration, partially drawing on the conceptual framework on foreign direct investment spillovers by Farole, Staritz, and Winkler (2014).

A country’s income status also matters for services spillovers. Our results suggest a U-shaped effect for productivity spillovers from services firms, i.e. spillovers are larger in upper-middle and low-income countries than in lower-middle income countries. The results are different for technology spillovers, which benefit lower-middle and low-income countries more. In addition, our findings show that the productivity of services firms is more sensitive to firm characteristics in low-income countries.

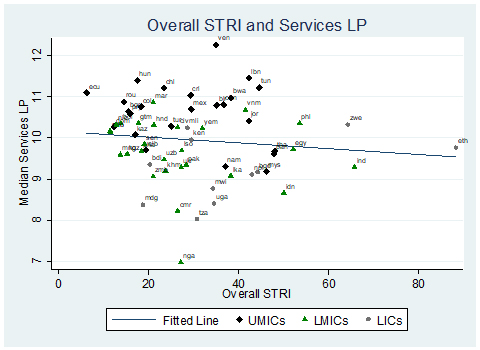

Finally, we find that greater liberalization in mode 1 and mode 3 services trade increases spillovers from services firms to manufacturing firms via a productivity-enhancing effect in the services sectors. The results suggest that lower regulations in mode 1 services trade (cross-border trade) increase productivity spillovers, whereas a lower restrictiveness in mode 4 services supply (presence of natural persons) reduces them. Testing for the direct link between services liberalization and services firm productivity, our study finds a positive connection for mode 1 and mode 3 (commercial presence abroad) services trade but a negative one for mode 4 services trade. Since mode 4 services supply is estimated to represent only a small fraction of total services trade, the correlation with overall services liberalization is still positive (see Figure 2).

Figure 2: Overall Services Trade Restrictiveness Index and median services labor productivity

LICs = low-income countries, LMICs = lower-middle income countries, STRI = Services Trade Restrictiveness Index, UMICs = upper-middle income countries.

Notes: Services labor productivity is measured as output per worker. A lower STRI score indicates greater services liberalization.

Source: Author’s illustration using data from the World Bank Enterprise Surveys.

Several policy implications can be derived from our analysis:

- First, openness to foreign investment and trade helps magnify both the absorptive capacity of manufacturing firms and the spillover potential of services firms.

- Second, policies aiming at skills and technological upgrading can increase the spillover potential of services firms, while manufacturing firms benefit from policies facilitating their growth.

- Third, the findings suggest that policy interventions that improve the productivity of services firms and the absorptive capacity of manufacturing firms have a larger impact in lower-income countries.

- Finally, services trade reforms increase productivity spillovers to manufacturing firms, but not across all modes of services supply. While liberalization in mode 1 and 3 services supply seems to be beneficial, liberalization in mode 4 services trade reduces both the spillover potential and actual spillovers.

Click here to read the working paper.

_____

1 The study is closest in nature to the study by Hoekman and Shepherd (2017), who find evidence for regional productivity spillovers from services to manufacturing firms using the World Bank Enterprise Surveys for the period 2006–2011.

References:

Farole, T., C. Staritz, and D. Winkler. 2014. Conceptual Framework. In Making Foreign Direct Investment Work for Sub-Saharan Africa: Local Spillovers and Competitiveness in Global Value Chains, edited by T. Farole and D. Winkler. Washington, DC: World Bank, 23–55.

Hoekman, B., and B. Shepherd. 2017. Services Productivity, Trade Policy and Manufacturing Exports. Special Issue: Services and Manufacturing Activity, World Economy, 40, 3, 499–516.

Javorcik, B. 2008. Can Survey Evidence Shed Light on Spillovers from Foreign Direct Investment? World Bank Research Observer, 23, 2, 139–159.

Organisation for Economic Co-operation and Development (OECD). 2014. Global Value Chains and Africa’s Industrialisation. African Economic Outlook 2014. Paris: OECD.

Saez, S., D. Taglioni, E. van der Marel, C. H. Hollweg, and V. Zavacka. 2015. Valuing Services in Trade: A Toolkit for Competitiveness Diagnostics. Washington, DC: World Bank.

Taglioni, D., and D. Winkler. 2016. Making Global Value Chains Work for Development. Washington, DC: World Bank.

Winkler, D. 2018. Productivity Spillovers from Services Firms in Low- and Middle-income Countries: What Is the Role of Firm Characteristics and Services Liberalization? ADBI Working Paper No. 884. Tokyo: Asian Development Bank Institute.

Comments are closed.