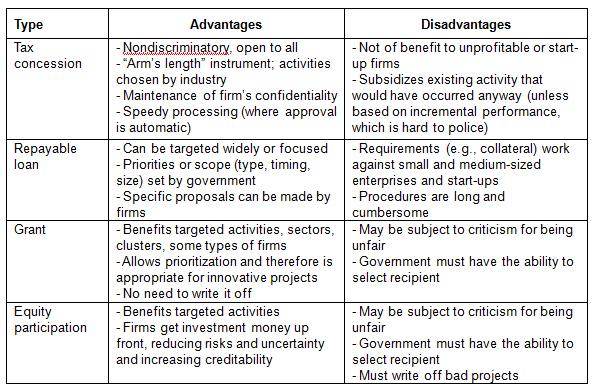

Small and medium-sized enterprises (SMEs) in developing economies often have difficulties improving their technological capabilities in terms of product or process innovation. Therefore, some kind of government support is necessary. Policies for stimulating technological development and innovation in SMEs can be divided into three groups: (i) supply-side policies aim at increasing firms’ incentives to invest in innovation by reducing costs; (ii) demand-side policies are public actions to induce innovation and/or speed up the diffusion of innovation; and (iii) systemic policies focus on strengthening interactive learning between actors in innovation systems. Policies can be implemented using various instruments such as tax incentives, grants or direct subsidies, low-interest loans, and direct equity participation by the government. These instruments have pros and cons (see table below).

Technology and innovation policy instruments: advantages and disadvantages

The experiences of four late-industrializing East Asian economies—Malaysia, Singapore, Malaysia, Thailand, and Taipei,China—provide key lessons:

(i) In the more successful economies—Singapore and Taipei,China—policy instruments co-evolved with firms’ technological and innovative capabilities. Different levels of technological and innovative capabilities of firms require different policy instruments. The ability to initiate and implement new policy instruments to fit the changing needs of firms at different levels of capability over time is critical.

(ii) Singapore, Taipei,China, and, to a lesser extent, Malaysia have a higher level of flexibility and policy coordination and learning. They offer a much greater variety of policy instruments that cater selectively to the particular needs of industrial sectors, clusters, technologies, types of firms, or even individual firm demands. Incentives should be formulated and executed so that they complement each other and contribute to overall industrial technology development strategy. For example, Singapore’s research and development (R&D) tax incentives for start-ups can be converted to grants, since those firms do not make a profit in their initial years.

(iii) Developing firms’ technological and innovative capabilities takes a long time. The amount, duration, and continuity of government-supported schemes are crucial as they reflect policy priorities and the commitment of governments.

(iv) Policy makers must have a deep understanding of innovations and innovation systems and how they evolve. While Thailand narrowly focused on R&D-led innovation, Singapore and Taipei,China broadened their incentives to other activities important in innovation, both inside and outside a single firm, such as services, business models, and solutions, among others.

(v) Singapore and Taipei,China demonstrate the effective use of systemic policies. In the case of Singapore, policies were deployed at various points of time to establish and upgrade linkages between transnational corporations and local firms, especially SMEs. In Taipei,China, public research institutes, especially the Industrial Technology Research Institute, played very important roles in diffusing foreign knowledge to local SMEs.

(vi) Innovation financing policies require corresponding policy initiatives that produce qualified human resources, attract foreign talent, and help organizations work together. Examples of this synergy are entrepreneurial universities in Singapore and public research institutes in Taipei,China.

(vii) Institutional factors shape choices and policy implementation. They include laws and regulations, unity and capability of government bureaucracy, trust, entrepreneurship, attitudes toward corruption, and the government’s role in supporting private firms. Institutional shortcomings can, to some extent, be corrected. Successful economies can use financing innovation incentives as well as other government mechanisms (e.g., using public research institutes as intermediaries in innovation systems as in Taipei,China) and initiatives (e.g., credit rating agencies for SMEs in Malaysia and promotion of business angel networks in Singapore) to overcome or mitigate these shortcomings.

_____

References:

P. Intarakumnerd and A. Goto. 2016, forthcoming. Technology and Innovation Policies for Small and Medium-Sized Enterprises in East Asia. ADBI Working Paper Series.

Comments are closed.