Green hydrogen—an energy carrier produced solely from renewable energy through the use of electrolysis to split water into hydrogen and oxygen—could be a game-changing solution for both energy security and ambitious climate targets. By the end of 2022, over 70 countries worldwide had drafted or already developed national hydrogen strategies (UNECE 2023). Central Asia, in particular, has enormous potential for green hydrogen development and production owing to its untapped renewable energy resources and vast area available for renewables installations. Among the countries in the region, Uzbekistan is drafting its national hydrogen strategy and in 2021 approved a presidential decree on measures for the development of renewable and hydrogen energy (UNECE 2023), while Kazakhstan is also drafting a national hydrogen concept.

Green hydrogen—an energy carrier produced solely from renewable energy through the use of electrolysis to split water into hydrogen and oxygen—could be a game-changing solution for both energy security and ambitious climate targets. By the end of 2022, over 70 countries worldwide had drafted or already developed national hydrogen strategies (UNECE 2023). Central Asia, in particular, has enormous potential for green hydrogen development and production owing to its untapped renewable energy resources and vast area available for renewables installations. Among the countries in the region, Uzbekistan is drafting its national hydrogen strategy and in 2021 approved a presidential decree on measures for the development of renewable and hydrogen energy (UNECE 2023), while Kazakhstan is also drafting a national hydrogen concept.

Advantages of green hydrogen

Green hydrogen has advantages in reliability (like fossil fuels) as well as cleanliness and sustainability (like renewables). Indeed, the main disadvantage of renewables such as solar and wind is that they are highly intermittent (not reliable) and have limited ability to generate high heat (also called industrial heat), which is necessary in some sectors (also called hard-to-abate sectors), for example for steel production. Moreover, green hydrogen production does not emit greenhouse gases unlike so-called gray hydrogen, which is produced from fossil fuels, and blue hydrogen, which is produced from fossil fuels combined with carbon capture, utilization, and storage technologies. In 2021, as much as 95% of hydrogen production was fossil-fuel based (IEA 2022; IRENA 2021; Kane and Gil 2022).

The most promising use of green hydrogen is where renewable energy cannot be used, such as: (i) decarbonizing hard-to-abate sectors—for example, heavy industries such as steel, cement, and petrochemicals; (ⅱ) energy storage (such as seasonal/long-term storage or the storage of excess renewable energy); and (iii) cross-border trade where electricity transmission lines (which are necessary for electricity generated from renewable energy) are not available (Azhgaliyeva, Seetha Ram, and Zhang 2023). Countries with high potential for renewable energy, particularly those in Central Asia, South Asia, Southeast Asia, Australia, and the Middle East, have shown growing interest in opportunities for the export of green hydrogen to economies with high energy demand, such as Japan, the European Union, and the Republic of Korea. The global green hydrogen market was valued at $676 million in 2022 and is projected to grow to $7.3 billion by 2027 (Markets and Markets 2022).

Drivers and barriers to green hydrogen development in Central Asia

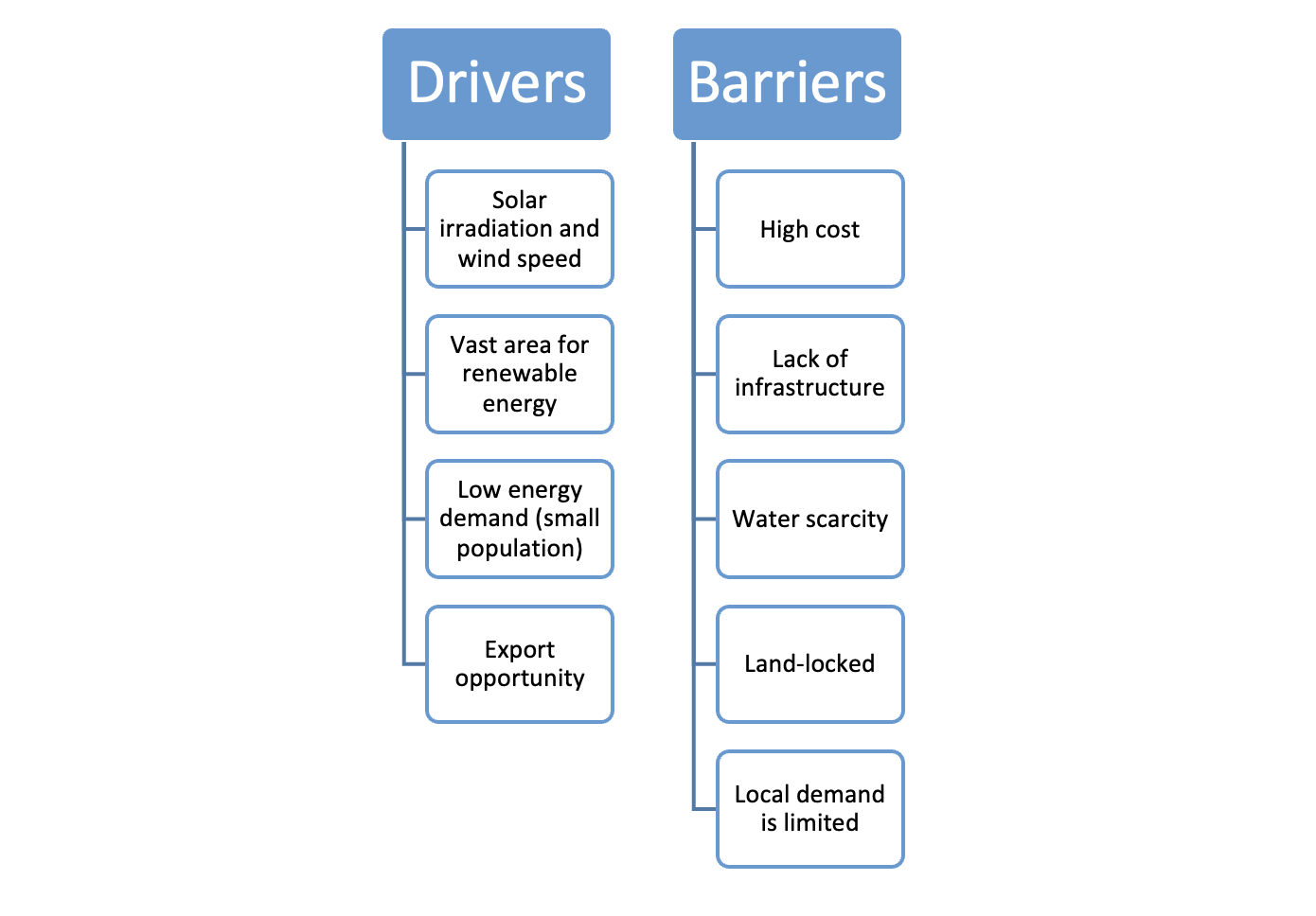

Central Asia’s untapped renewable resources (primarily solar and wind), the vast area available for renewable energy installations, relatively low local energy demand (due to the small population density), and prosperous export opportunities can help drive the production of green hydrogen in the region, but there are also some challenges. The production cost of green hydrogen is a major hindering factor. However, the cost is expected to significantly decrease by 2030–2050 due to cost reductions in renewables. Only then it is expected that green hydrogen will become cost-competitive with fossil fuel-based hydrogen (blue or gray) (Durakovic, Crespo del Granado, and Tomasgard 2023). Large-scale production could also help to reduce costs (Azhgaliyeva, Seetha Ram, and Zhang 2023). However, low local demand and uncertain international demand for green hydrogen may hinder this. Another challenge is a lack of infrastructure for the production, transportation, and utilization of green hydrogen (Zholdayakova et al. 2022). Land-locked Central Asia needs long-distance land transportation infrastructure (Figure 1) unlike other countries that have sea access.

Figure 1: Drivers and Barriers for Green Hydrogen in Central Asia

Source: Authors.

Investing in green hydrogen projects in Central Asia

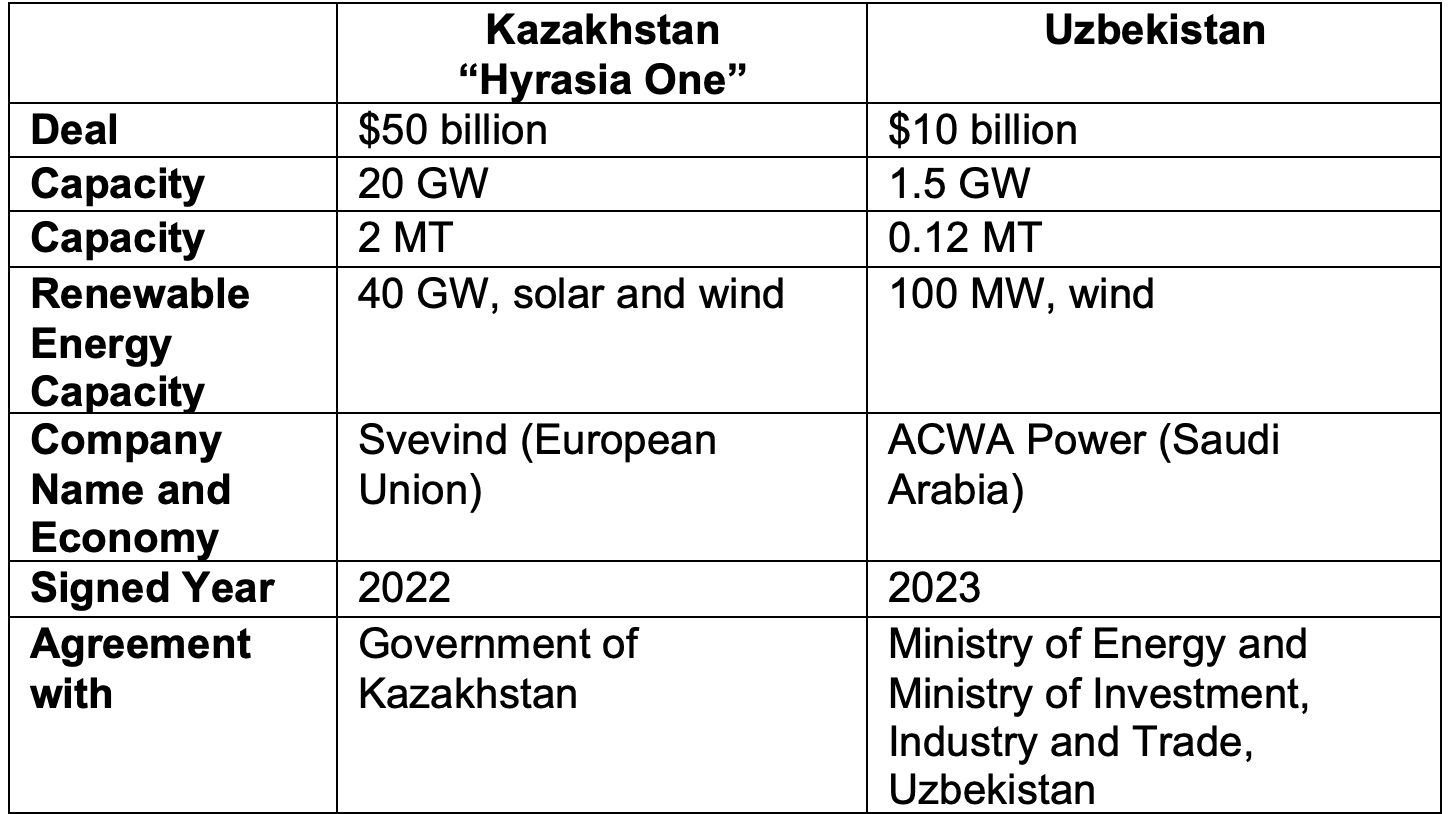

Financing renewable energy and green hydrogen production is vital for accelerating green hydrogen development in Central Asia. In 2022–2023, we have witnessed agreements on two joint mega projects on the development of renewables, especially wind and solar, and green hydrogen production using this renewable energy in Kazakhstan and Uzbekistan:

1. In 2022, Svevind, a Swedish-German renewable energy firm, signed a $50 billion deal with the government of Kazakhstan for 20 gigawatts (GW) of green hydrogen production in Western Kazakhstan by 2030 named “Hyrasia One” (Dezem 2022; Astana Times 2022, 2023). Kazakhstan could become one of the world’s largest suppliers of green hydrogen (Official Information Source of the Prime Minister of the Republic of Kazakhstan, 2022; Astana Times, 2022).

2. In 2022, ACWA Power, a Saudi Arabian company, signed a $10 billion 5-year investment agreement with the Ministry of Energy of Uzbekistan for the development of large-scale green hydrogen production (ACWA Power 2023).

Table 2: Green Hydrogen Signed Agreements in Central Asia

Source: Authors using ACWA Power (2023), Astana Times (2022, 2023).

What can be done to further accelerate green hydrogen development?

Green hydrogen projects could help countries attract foreign and private green finance. For Central Asian countries aiming to play a leading role in establishing and strengthening global green hydrogen value chains, supportive policies and further studies could help to promote green hydrogen production:

- Production: In the production phase, the high production cost is the major hindering factor for the application of green hydrogen. Cost reduction could be achieved by reducing the cost of renewable energy and improving electrolyzer technologies. The latter could be achieved through innovation, performance improvements, and upscaling to large-scale (multi-gigawatt) projects (IRENA 2020). The cost of green hydrogen is expected to significantly decrease by 2030–2050 due to cost reductions in renewables. Only then will green hydrogen become cost-competitive with fossil fuel-based hydrogen (blue or gray). For more detailed recommendations for cost reduction see IRENA (2020). Water scarcity could limit hydrogen generation, thus studying water supply for hydrogen production will benefit sustainable hydrogen production in Central Asia.

- Distribution: Cross-border, especially long-distance, transportation of green hydrogen is a major obstacle for land-locked countries. Exploring transportation methods and their cost-effectiveness will help to unlock Central Asia’s potential as a green hydrogen exporter. Active involvement with international dialogues and agreements on taxonomy and the certification of green hydrogen will be vital for securing external demand for green hydrogen (Kodama et al. 2023). As hydrogen transportation is challenged by its low volumetric energy density, it is also important to consider the export opportunities of derivatives of green hydrogen, like green ammonia, and energy-intensive “green products” such as steel produced using green hydrogen. This entails decarbonizing hard-to-abate sectors in the region and beyond and promoting the export potential of Central Asia.

References

ACWA Power. 2023. ACWA Power Expands Sustainable Energy Portfolio in Uzbekistan with Milestone Wind and Green Hydrogen Agreements.

Astana Times. 2022. Kazakhstan Seeks to Develop Green Hydrogen, Accelerates Energy Transition.

Astana Times. 2023. German President, Kazakh PM Launch Test Drilling at Huge Green Hydrogen Plant.

Azhgaliyeva, D., K. E. Seetha Ram, and H. Zhang. 2023. Hydrogen in Decarbonization Strategies in Asia and the Pacific. Tokyo: ADBI.

Dahan, M. E., and S. Fenton. 2023. UAE’s Masdar to develop renewable energy projects in Kyrgyzstan. 10 January. Reuters.

Dezem, V. 2022. Kazakhstan Signs Deal to Make Hydrogen at a $50 Billion Plant. 22 October. Bloomberg.

International Energy Agency (IEA). 2022. Global Hydrogen Review 2022.

International Renewable Energy Agency (IRENA). 2021. Making the Breakthrough: Green Hydrogen Policies and Technology Costs.

IRENA. 2020. Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5⁰C Climate Goal. Abu Dhabi: IRENA.

Kane, M. K., and S. Gil. 2022. Green Hydrogen: A Key Investment for the Energy Transition. 23 June. The World Bank Blog.

Kodama, W., R. Mishra, and D. Azhgaliyeva. 2023. Opportunities, Challenges, and Policy of Green Hydrogen in India. In D. Azhgaliyeva, K. E. Seetha Ram, and H. Zhang. 2023. Hydrogen in Decarbonization Strategies in Asia and the Pacific. Tokyo: ADBI.

Markets and Markets. 2022. Market Research Report: Green Hydrogen Market.

Official Information Source of the Prime Minister of the Republic of Kazakhstan. 2022. Kazakhstan Signs Agreement on Green Hydrogen Projects with Fortescue.

United Nations Economic Commission for Europe (UNECE). 2023. Sustainable Hydrogen Production Pathways in Eastern Europe, the Caucasus and Central Asia.

Zholdayakova, S., Y. Abuov, D. Zhakupov, B. Suleimenova, and A. Kim. 2022. Toward Hydrogen Economy in Kazakhstan. ADBI Working Paper 1344. Tokyo: ADBI.

Comments are closed.