Effective infrastructure projects not only construct infrastructure, such as roads, railways, water supply, and electricity, but can boost economic growth in the surrounding region through “spillover effects” (Yoshino, Azhgaliyeva, and Mishra 2021). The infrastructure benefits firms by lowering costs and improving connectivity and the ease of doing business, leading to greater sales and exports.

Based on the last few waves of the World Bank Enterprise Survey, a recent collaborative ADBI working paper and forthcoming book chapter by ADBI and CAREC Institute staff (Azhgaliyeva et al. 2021a; Azhgaliyeva et al. 2021b) examine the impact of infrastructure on firm performance in nine Central Asia Regional Economic Cooperation (CAREC) countries: Afghanistan, Azerbaijan, Georgia, Kazakhstan, the Kyrgyz Republic, Mongolia, Pakistan, Tajikistan, and Uzbekistan.

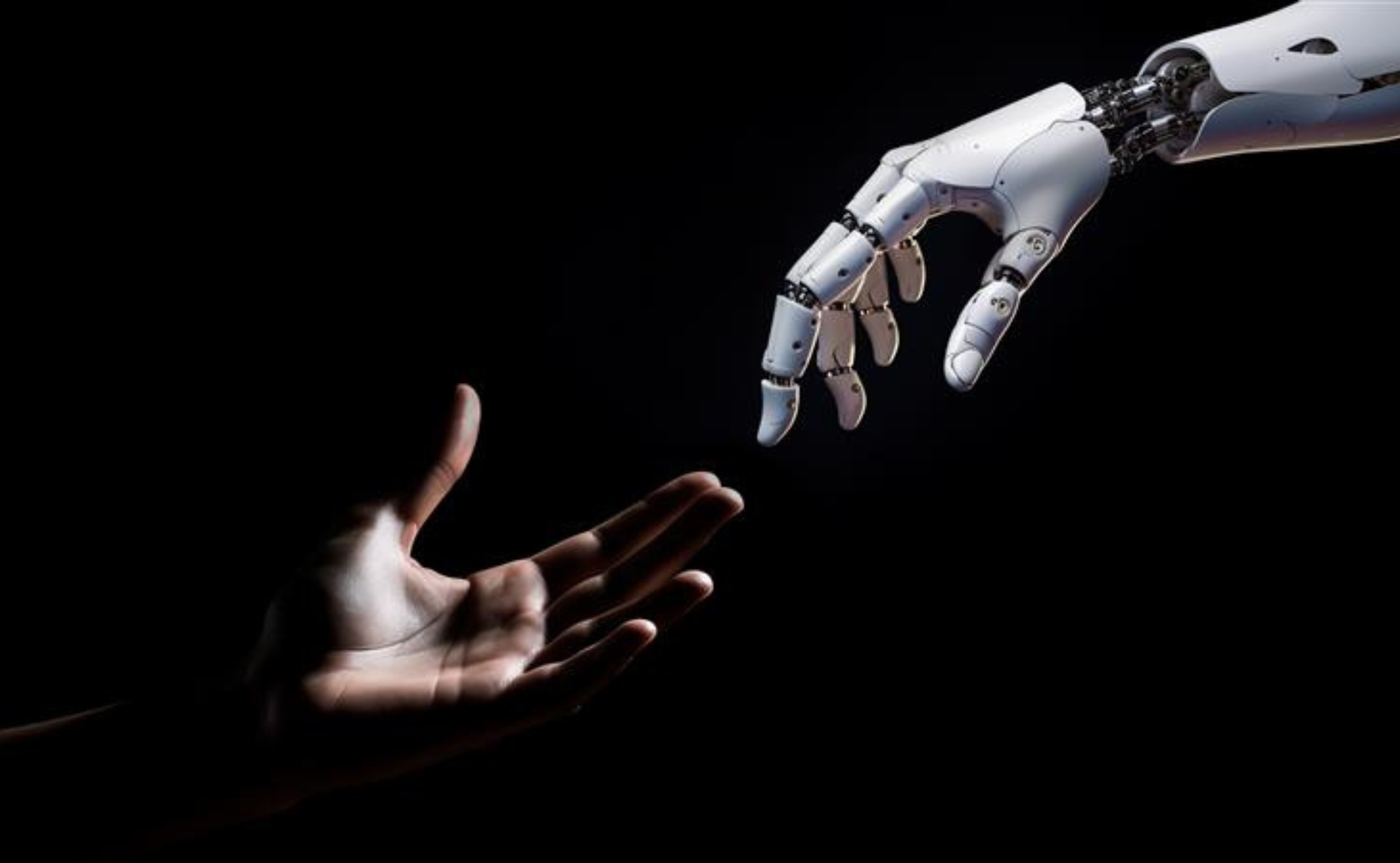

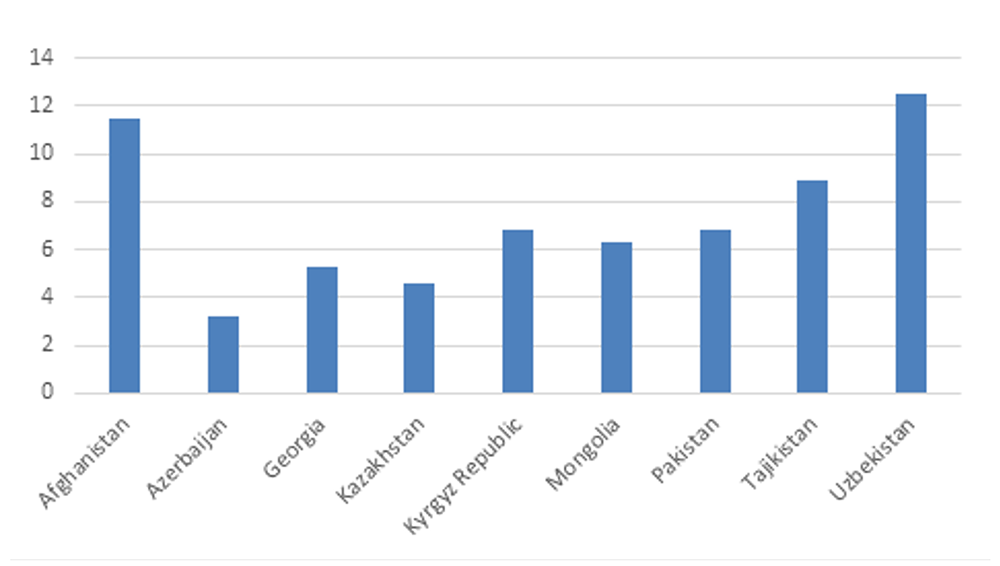

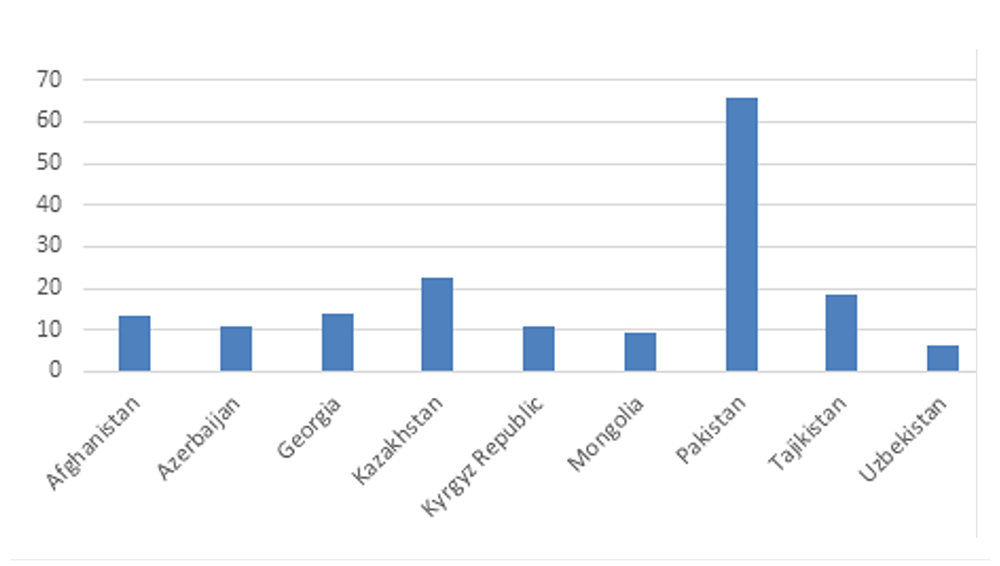

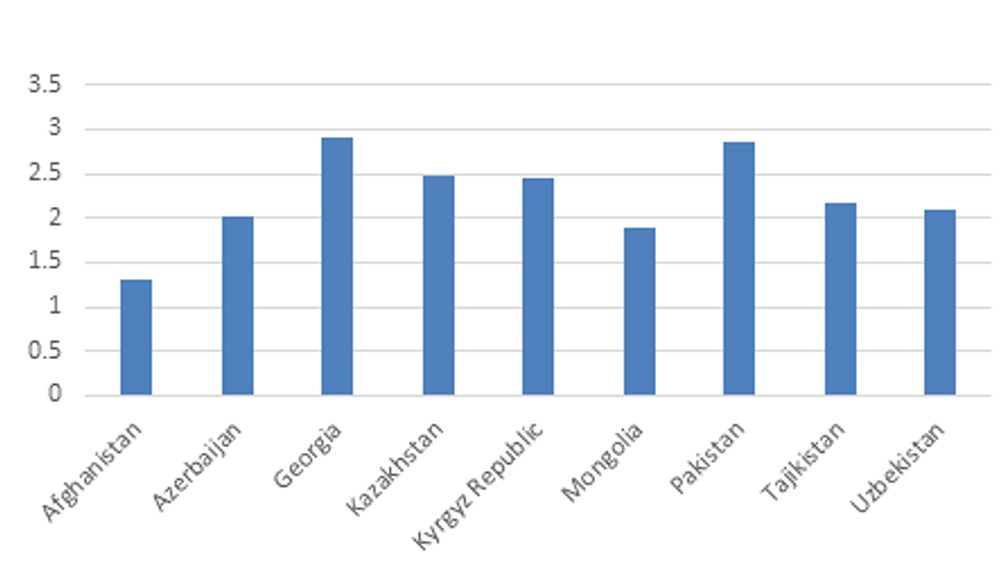

The data show that access to infrastructure and its quality vary significantly across CAREC countries. Figures 1(a)–1(d) compare infrastructure-related variables for the sample countries. The average duration of power outages is relatively higher in Uzbekistan and Afghanistan, at more than 12 hours and 11 hours, respectively, while it is comparatively low in Azerbaijan and Georgia, at about 3 hours and 5 hours (Figure 1(a)). For electricity expenses, the share of total sales in Pakistan is more than 60%, while Azerbaijan and Uzbekistan indicate a low share of only around 10% (Figure 1(b)). As an approximation of telecommunication infrastructure, access to broadband internet data show that in Kazakhstan, more than 80% of firms have access to broadband internet, while in Afghanistan and Uzbekistan, the shares were 10% and 40%, respectively (Figure 1(c)). Meanwhile, in terms of customs scores, Georgia and Pakistan rank the highest, while Afghanistan is the lowest (Figure 1(d)).

Figure 1(a): Average Duration of Power Outages by Country

(hours per month)

Figure 1(b): Average Electricity Expenses

(% of total sales)

Figure 1(c): Average Access to Broadband Internet

(%)

Figure 1(d): Customs Efficiency Index

Source: Authors’ elaboration using data from World Bank (2008, 2009, and 2013).

The empirical model used by Azhgaliyeva et al. (2021a) explores the effect of infrastructure on firm performance using the above indicators as proxies for infrastructure. Firm performance is measured by total sales, the share of utilized capacity, whether a firm exports or not, and the share of export sales. In addition, the study shows how the impact differs for small, medium-sized, and large firms.

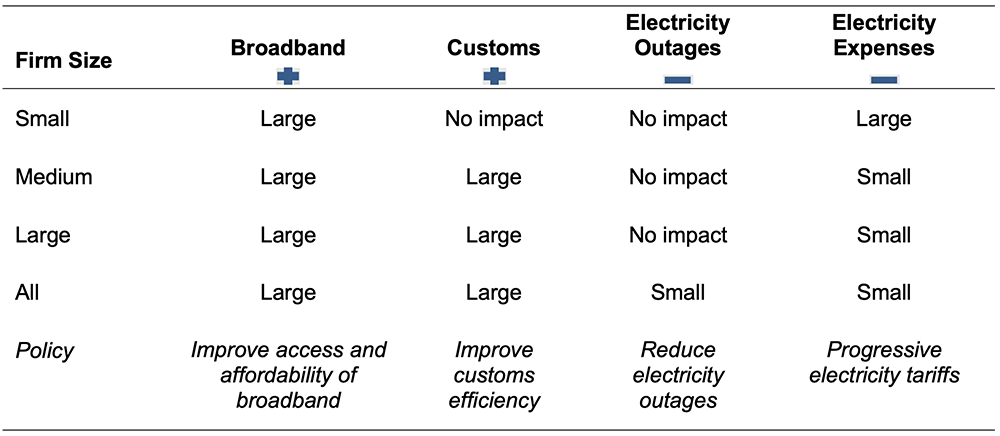

The results indicate that firm performance measured through sales and capacity utilization is negatively affected by a higher duration of power outages and electricity expenses. Moreover, access to broadband internet significantly increases the total sales and export sales of small firms, while customs efficiency increases the exporting activities of medium and large firms. The study also demonstrates the positive spillover effects of access to infrastructure and its quality, i.e., access to broadband, customs efficiency, and the quality of electricity connections, on firms’ sales, including exports.

For the development of the private sector and international trade in CAREC countries, the study recommends sustainable access and greater quality of electricity and telecommunications and customs efficiency as important objectives for government policy. Since improvements in access infrastructure and its quality require substantial investment, differentiated policy support for small, medium-sized, and large firms will allow firms to be supported in a cost-effective way. The main results and policy implications can be summarized as shown in Table 1.

Table 1: Infrastructure Impacts on Firm Performance

Source: Azhgaliyeva et al. (2021a) and Azhgaliyeva et al. (2021b).

Policy implications

The policy recommendations provided by Azhgaliyeva et al. (2021a) and Azhgaliyeva et al. (2021b) for CAREC member countries can be summarized as follows:

- Improving access to, and the affordability of, broadband internet connections can positively affect sales, including export sales. Policy in this direction can be oriented toward widening internet access and affordability for firms.

- Improvements in customs efficiency could positively affect firms’ exports, particularly for medium-sized and large firms. Further bilateral and multilateral cooperation for reducing trade barriers, accelerating digitalization, and implementing other measures for improving customs efficiency may stimulate firms’ engagement in international trade.

- Ensuring a stable energy infrastructure will decrease the number of power outages and improve firm performance, particularly in Uzbekistan and Afghanistan.

- High electricity expenses can have a significant negative impact, particularly on small firms. Reducing electricity expenses for small firms could improve their performance, particularly in Pakistan, Kazakhstan, and Tajikistan. Government policies to achieve this could include introducing progressive electricity tariffs with lower rates for smaller consumers/firms.

References

Azhgaliyeva, D., R. Mishra, N. Yoshino, and K. Karymshakov. 2021a. Infrastructure and Firm Performance in CAREC Countries: Cross-Sectional Evidence at the Firm Level. ADBI Working Paper 1265. Tokyo: ADBI. https://www.adb.org/publications/infrastructure-firm-performance-carec-countries

Azhgaliyeva, D., R. Mishra, N. Yoshino, and K. Karymshakov. 2021b. Infrastructure and Firm Performance in CAREC Countries: Cross-Sectional Evidence at the Firm Level. Forthcoming. In Unlocking Transport Connectivity in the Trans-Caspian Corridor, edited by D. Azhgaliyeva and Y. Kalyuzhnova.

Yoshino, N., D. Azhgaliyeva, and R. Mishra. 2021. Financing Infrastructure Using Floating-Interest-Rate Infrastructure Bond. Journal of Infrastructure, Policy and Development 4(2): 306–315. https://dx.doi.org/10.24294/jipd.v4i2.1236