The increasing use of the internet in recent years has caught the fancy of consumers and producers, in commodities, services, and leisure activities. The wide prevalence of wireless internet access and the portability of devices such as smartphones and tablets have increased access and diffusion of related services and products as possibly no other technology in history.

Slowly but surely, governments are getting into the act by using the cyberspace to provide services. This range of government activities related to the internet is loosely termed e-government. For instance, governments use the internet to provide information and access to various government services such as health advice, tax filings, passport applications, applications for government employment, and business registrations. E-government serves to increase accountability through transparency, enhance the efficient use of public resources, and improve the delivery of public services. Given the wide geographical area over which government services offered via the internet can be accessed, e-government can also be viewed as a form of virtual government decentralization.

Corruption and the underground economy1 are two widely prevalent white-collar crimes that undermine the effectiveness of government policies and signify diminished institutional quality.

E-government, although not universally applicable to all types of services that governments provide, can potentially reduce both corruption and the underground or shadow economy. Regarding corruption, greater proximity between bureaucrats and the public may promote greater transparency—or make forming corrupt relationships easier. However, e-government reduces the possibility of formation of corrupt relations as there is little or no physical contact between the bureaucrat and the users of government services. With respect to the underground economy, the transparency associated with government proximity can enable better monitoring of shadow activities.

In recent work, Goel and Saunoris (2016) have formally examined the effect of e-government or virtual decentralization (see UNDESA [2014] for details) on the two white-collar crimes denoted by corruption and the shadow economy for more than 100 countries. Given the underlying measurement issues, the authors used alternate measures of these white-collar crimes (with perhaps the Corruption Perceptions Index from Transparency International being the best known). Further, the effects of virtual decentralization are compared to the other traditional forms of government decentralization—fiscal decentralization and physical decentralization. In recent years, however, there has been an increasing global trend toward government decentralization.

Fiscal decentralization involves the devolution of taxing or spending powers to lower levels of government (e.g., setting of property taxes by local governments), while physical decentralization deals with a greater number of government tiers (e.g., federal, state, and local governments). Government decentralization influences the quality and delivery of government functions, which can impact illegal activities, by altering the proximity between service users and their providers. On the one hand, local governments are better attuned to local needs and there is greater transparency; however, there is the potential downside of their capture by vested interests. As a practical matter, fiscal and virtual decentralization are relatively easy for governments to change, while physical decentralization is difficult to alter, as changes in levels of government often entail lengthy legislative and administrative processes.

The effects of various forms of decentralization on corruption and the shadow economy differ, however. For instance, physical decentralization can provide better two-way communication between government bureaucrats and the public than virtual decentralization. Fiscal decentralization may make rent-seeking easier at the local level, yet also be coupled with the threat of greater transparency and exposure.

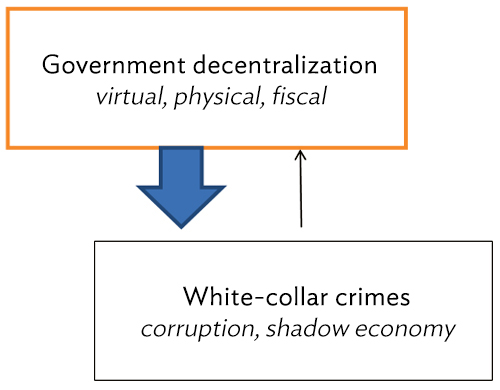

Unlike corruption, involvement of government officials in shadow activities is indirect. Private parties engage in shadow operations (either directly or via outsourcing) to skirt regulations or to avoid taxes. There are several potential channels of influence of decentralization on the underground sector. For instance, greater decentralization, especially via e-government, lowers costs of obtaining information, encouraging compliance with laws. Further, government presence online may act as a deterrent to certain shadow operations online. There is also the possibility of reverse feedbacks where decentralization may be affected by white-collar crimes (Figure 1).

Figure 1: Government decentralization and white-collar crimes

Source: Authors.

In their formal analysis, Goel and Saunoris (2016) find that virtual decentralization is relatively more effective in controlling both corruption and the shadow economy, compared to other forms of decentralization. This is consistent with the view that greater transparency and the impersonal nature of e-government serve to reduce white-collar crimes.

Goel and Saunoris (2016) also considered whether Asian countries were different. Asia includes many of the most populated and several of the most densely populated nations in the world. Plus, many countries in Asia were colonized in previous centuries. All of these factors either shaped institutions over time or altered propensities to engage in illegal acts. Results showed that countries in Asia tend to have more public corruption, but not necessarily a larger underground sector. Therefore, corruption–control payoffs from e-government are likely to greater for Asian countries.

Based on these findings, it can be concluded that policy makers looking to improve governance and to control corruption and the shadow economy should consider the potential benefits of virtual decentralization. The internet-based provision of government services may be cheaper, amenable to faster alterations, have a greater geographic reach, and be relatively less bound by legislative red tape. Although not all government services are as equally amenable to virtual decentralization, as the digital divide narrows and more user-friendly technologies are developed, these benefits are likely to expand.

_____

1 The underground, shadow, or informal economy is economic activity that escapes official records and thus is untaxed (e.g., unlicensed taxis).

References:

Goel, R. K., and J. W. Saunoris. 2016. Forms of Government Decentralization and Institutional Quality: Evidence from a Large Sample of Nations. ADBI Working Paper 562. Tokyo: Asian Development Bank Institute.

Transparency International.

United Nations Department of Economic and Social Affairs (UNDESA). 2014. United Nations E-Government Survey 2014. New York.

Comments are closed.