The Pacific developing member countries (DMCs) of the Asian Development Bank are a heterogeneous group of economies with different levels of economic development and economic size. However, when it comes to choosing an optimal exchange rate, the Pacific DMCs face similar challenges. All of the Pacific economies are relatively small and have underdeveloped financial and exchange rate markets. Most also fall into the lower-middle-income category, as defined by the World Bank, which makes it difficult for them to allocate the necessary financial and technical resources to establish and run a central monetary authority.1 All these elements make it difficult for the countries to choose their optimal exchange rate regimes. A recent ADBI study (Helble, Prasetyo, and Yoshino 2015) suggests a new way to determine the optimal weights of foreign currencies in an exchange rate basket. The new approach would allow those Pacific DMCs using a basket currency to lower their economic fluctuations and exchange rate swings.

Most Pacific DMCs have exchange regimes that are characterized by low flexibility. According to the International Monetary Fund (2013), 8 out of the 14 Pacific DMCs use the currency of another country as their sole legal tender and have thus given up monetary control. These Pacific DMCs all have a population of less than 150,000, except for Timor-Leste, with a population of 1.3 million. Several of the larger Pacific economies, however, maintain exchange rate regimes that offer more flexibility. Four of these, Fiji, Samoa, the Solomon Islands, and Tonga, have adopted currency-basket regimes, with baskets weights that typically correspond to the importance of their respective trading or financial partners. Another two Pacific economies, Papua New Guinea and Vanuatu, have even more flexible regimes in place. These economies have “managed floating” exchange rate regimes, where central banks manipulate exchange rates without having specific exchange rate paths or targets.

Recent ADBI research by Helble, Prasetyo, and Yoshino (2015) has analyzed the exchange rate choices of the four economies that do not use external currencies. Looking at the evolution of their exchange rates over the past decade, the researchers find that they were successfully able to establish exchange rate policies that kept the volatility of their currencies toward leading international currencies low. However, the low exchange rate volatility came at a price—economic volatility in these countries was much higher than in the Pacific DMCs that were using external currencies. Real economic activity thus played the role of a shock absorber, keeping exchange rate volatility low. In their analysis, the researchers argue that high volatility in economic output should be avoided and propose a new theoretical approach.

Building on Yoshino et al. (2003), the authors build a new theoretical model to give the currency-basket regime Pacific DMCs a new tool to better manage their exchange rate policies. The model has two new important features: First, it includes a loss function that allows for the minimization of gross domestic product (GDP) and exchange rate fluctuations. Second, the authors explicitly model tourism flows. Solving the model, the authors calculate the theoretically optimal weights for two foreign currencies in the currency basket, given a specific objective function. The Australian dollar and the US dollar are assumed to be the two main currencies in the currency baskets of the Pacific DMCs.

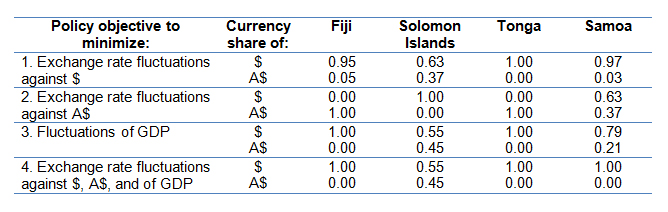

Applying this theoretical model to the case of the Pacific DMCs, the study shows various simulations assuming different policy objectives of the monetary authorities. The findings are summarized in Table 1. The simulations indicate that, for example, Fiji should allocate 95% of its currency basket to the US dollar if it aims to minimize exchange rate fluctuations against the US Dollar (1st objective). The theoretical model can thus yield helpful guidance for monetary authorities in the Pacific to optimize monetary policy, depending on their respective policy objectives.

Table 1: Monetary policy objectives and optimal shares of the US dollar and Australian dollar in Pacific developing member country currency baskets

GDP = gross domestic product.

Note: Calculations are based on the year 2012.

Source: Authors.

This ADBI study reminds us that exchange rate policy is an important determinant of economic performance. This is particularly true for small open economies, such as the Pacific DMCs. Currently, most Pacific DMCs maintain exchange regimes that have a low degree of flexibility, namely managed float regimes, currency baskets, or even external currency regimes. Most of these countries have tried to achieve a stable exchange rate, but have had difficulties in stabilizing GDP. The newly proposed theoretical model offers a solution to this dilemma by predicting the optimal currency basket weights for governments aiming to lower GDP volatility. Smoother economic development would certainly be beneficial to most of the Pacific DMCs.

_____

1 For 2013, the World Bank defined lower-middle-income economies as those with a gross national income per capita, calculated using the World Bank Atlas method, of more than $1,036 but less than $4,085.

References:

Helble, M., A. Prasetyo, and N. Yoshino. 2015. Hard Pegs versus Intermediate Currency Arrangements in the Pacific. ADBI Working Paper 524. Tokyo: Asian Development Bank Institute.

International Monetary Fund. 2013. Annual Report on Exchange Rate Arrangements and Exchange Restrictions. Washington, DC.

Yoshino, N., S. Kaji, and A. Suzuki. 2003. A Comparative Analysis of Exchange Rate Regimes. In Exchange Rate Regimes and Macroeconomic Stability, edited by L. Ho and C. Yuen. Massachusetts: Kluwer Academic Publishers. 107–131.