This article assesses the case for promoting financial education in Asia. It argues that the benefits of investing in financial education can be substantial. Data are limited, but indicate low financial literacy scores for selected Asian countries. As economies develop, access to financial products and services will increase, but households and small and medium-sized enterprises (SMEs) need to be able to use the products and services wisely and effectively. More effective management of savings and investment can contribute to overall economic growth. Moreover, as societies age and fiscal resources become stretched, households will become increasingly responsible for their own retirement planning. Asia’s evolving experience suggests that more national surveys of financial literacy are needed and that coherent, tailored national strategies for financial education are essential for success.

Benefits and costs of investing in financial education in Asia

In the aftermath of the global financial crisis (GFC) of 2007–2009, financial literacy and financial education are receiving increasing attention worldwide.2 For example, mis-selling of financial products contributed directly to the severity of the GFC, both in developed economies and in Asia.3 Financial education can be viewed as a capacity building process over an individual’s lifetime, which results in improved financial literacy and well-being. It is hard to quantify the benefits and costs of investing in financial education. With some exceptions, Asian economies have only devoted limited resources to financial education, but we argue that there are substantial benefits to increased investment in financial education in Asia.

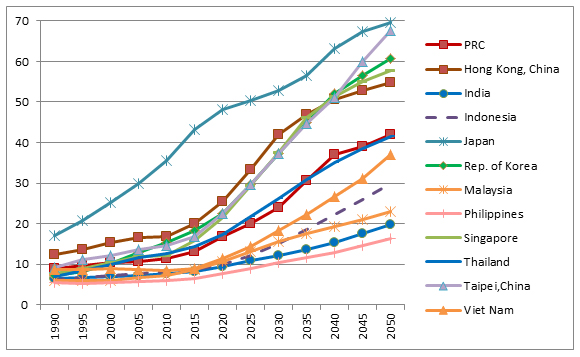

The following benefits can arise from investing in financial education. First, a more financially literate population can take greater advantage of financial inclusion of both households and SMEs. Second, a more financially literate population is likely to increase domestic savings rates, thereby reducing reliance on foreign capital. Third, higher and better-allocated savings can result in faster economic growth. Fourth, better financial education of households and SME entrepreneurs can reduce financial stability risks such as the probability of household or SME loan defaults. Fifth, better financial literacy will improve retirement planning and preparation for old age. Figure 1 shows the trend of the ratio of the population aged 65 and over to the working-age population (aged 15–64) through the year 2050. Aging will occur especially rapidly in Hong Kong, China; the Republic of Korea; Singapore; and Taipei,China; followed by the People’s Republic of China (PRC) and Thailand. The general tendency to shift from defined benefits to defined contribution pension plans will further increase the need for adequate financial education and planning.

Figure 1: History/projections of dependency ratio (aged 65+/aged 15–64)

PRC = People’s Republic of China.

Sources: United Nations, Department of Economic and Social Affairs, Population Division. 2013. World Population Prospects: The 2012 Revision. Available at: http://data.un.org/Data.aspx?q=dependency+ratio&d=PopDiv&f=variableID%3a44

National Development Council (Taipei,China). 2014. Population Projections for [Taipei,China]: 2014–2060. Available at: http://www.ndc.gov.tw/encontent/m1.aspx?sNo=001457

However, various costs also need to be factored in when considering investment in financial education. For instance, the effectiveness and reach of financial education programs may be unclear. Additionally, the capacity of teachers and educational systems to deliver financial education may be limited. Finally, large financial costs could arise from broad-based financial education programs.

Current status of financial literacy in Asia

Mapping the current status of financial literacy in Asia presents challenges to researchers and policy makers alike. It is a new area with limited data. The coverage of available surveys is relatively spotty and methodologies are not consistent. Only a limited number of Asian economies and target groups within them have been surveyed so far and their results vary widely. There is some relation with per capita income but rankings differ significantly across different studies. Greater coverage of target groups (such as students, seniors, SMEs, and the self-employed) is needed.

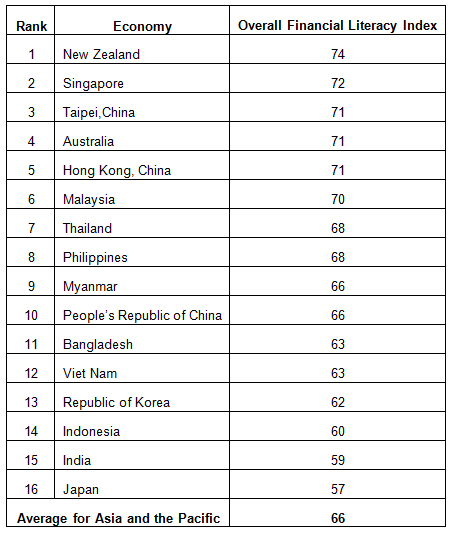

The MasterCard Index of Financial Literacy (MasterCard 2013) illustrates some of these points. The index is based on a survey of over 7,000 individuals aged 18–64 years on three aspects of basic financial literacy: money management, financial planning, and investment. As Table 1 shows, New Zealand is ranked top, while Japan is ranked at the bottom. Strikingly, high-income Japan is ranked lower than less-developed economies like Bangladesh and Myanmar.

Table 1: MasterCard Index of Financial Literacy Report, 2013

Source: MasterCard (2013).

Asian economies are only sparsely represented in other international surveys.4 The Organisation for Economic Co-operation and Development (OECD)/International Network on Financial Education (INFE) survey of adult financial literacy only includes Malaysia in Asia, and the OECD Program for International Student Assessment (PISA), which covers 15-year-old high school students, only includes Shanghai (ranked top). At the national level, the Bank of Thailand conducted a survey of financial literacy modeled on the OECD/INFE survey, and Japan carried out a survey of high school teachers involved with financial education.4 Because of the importance of having internationally comparable results, more Asian economies should be included in future rounds of OECD/INFE and PISA surveys.

Current policies and gaps in financial education in Asia

There are still many policy gaps in Asia in the areas of financial literacy and financial education. The starting point for financial education is to have a national strategy, but so far in Asia, only India, Indonesia, and Japan have implemented such strategies. Pakistan is just in the process of finalizing its national policy. Central banks active in this area include the Reserve Bank of India, Bank Indonesia, Bank of Japan, Bank Negara Malaysia, Bangko Sentral ng Pilipinas, and Bank of Thailand. Financial regulators active in this area include the Financial Services Authority of Indonesia and the China Banking Regulatory Commission in the PRC.

However, most financial education programs in Asia tend to be small scale and targeted at individual groups rather than the broad population. Only Japan actually includes financial education in its school curriculum, but the program faces many problems, including a lack of experienced teachers, lack of time, and lack of motivation of students.5 Few programs address the needs of seniors or SMEs, either.

Lessons from Asia’s evolving experience

Asia’s experience in the area of financial education is still limited, but we believe there are significant potential gains from more concerted policy efforts in this area. International experience offers several valuable lessons for promoting financial education.

First, existing national surveys of various target groups—such as those relating to financial literacy, access to finance, and consumer finance—are useful tools for understanding the needs and challenges of financial education. But more national surveys are required, particularly of poorer Asian countries, with consistent and internationally comparable methodology. Using international standard methodologies (such as the OECD/INFE and PISA surveys) would enable benchmarking across countries and enrich national strategy development.

Second, coherent national strategies for financial education tailored to national circumstances are essential for success. Effective national strategies for financial education seem to contain four key elements: (a) coordination among major stakeholders, including regulatory authorities (central banks and financial supervision agencies), educational institutions, financial intuitions (e.g., commercial banks, non-bank financial institutions, and microfinance institutions), and civil society institutions; (b) emphasis on customer orientation and addressing demand-side as well as supply-side gaps; (c) combination of broad-based functional interventions and targeted programs for vulnerable groups (e.g., women, youth, the elderly, and SMEs) according to availability of resources; and (d) adoption of a long-term time horizon with flexibility to respond to changing needs.

Third, monitoring and evaluation of national strategies for financial education is vital for lesson learning and program adaptation. With the appropriate incentives, think tanks and universities can help in monitoring and evaluation efforts.

Fourth, since government support programs will not be enough to maintain adequate financing, the private sector, such as life insurance firms, must supply long-term financial products suitable for self-protection. Long-term asset allocation by households can support infrastructure and other investments where long-term finance is required.

_____

1 This article is based on a presentation made by the authors at the ADBI–Japan–OECD High-level Global Symposium on “Promoting Better Lifetime Planning through Financial Education” held at ADBI in Tokyo on 22–23 January 2015.

2 The OECD has been very active in this area, including development of the OECD–INFE and PISA financial literacy survey programs. See, e.g., OECD (2013, 2014).

3 Sales of Lehman “mini-bonds” caused significant losses for individual investors in both Singapore and Hong Kong, China.

4 See Study Group on the Promotion of Financial and Economic Education (2014).

5 See Study Group on the Promotion of Financial and Economic Education (2014).

References:

MasterCard. 2013. China Overtakes Hong Kong with the Most Proficient Investors in Asia/Pacific: MasterCard Index of Financial Literacy. 3 July.

Organisation for Economic Co-operation and Development (OECD). 2013. Financial Literacy and Inclusion: Results of OECD/INFE Survey across Countries and by Gender. Paris: OECD.

———. 2014. PISA 2012 Results: Students and Money: Financial Literacy Skills for the 21st Century (Volume IX). Paris: OECD.

Study Group on the Promotion of Financial and Economic Education. 2014. Report on Comprehensive Survey of Financial and Economic Education in Japan’s Junior High and High Schools. Tokyo: Japan Securities Dealers Association.

A modified version of this article appeared in Nikkei Asian Review.