Looking at the varying patterns of the capital flows into Asia in the last decade, the period after the taper tantrum on 21 May 2013 until 31 October 2015 is of particular interest from both global and local perspectives. Globally, the wave of capital flows became more volatile due to various international factors: (i) the pace of monetary policy normalization in the United States (US), (ii) the slowdown in the People’s Republic of China, (iii) the slide in oil prices, and (iv) higher political uncertainty and elevated geopolitical tensions. Locally, the growth momentum in Asia slowed down due to weaker balance of payments, worsening external debt conditions, and reduction in real economic activity. Monetary policy in Asia therefore became more accommodative to support growth. This, in turn, lowered expected relative interest returns and caused capital to flow out of Asia. Moreover, the exchange rate return on investing in Asian assets, which previously had been a byproduct of investment, declined. This is because there was greater risk aversion on Asian assets and there was downward pressure on all emerging Asian currencies due to weaker economic fundamentals.

The pattern of capital flows into Asia over the last decade

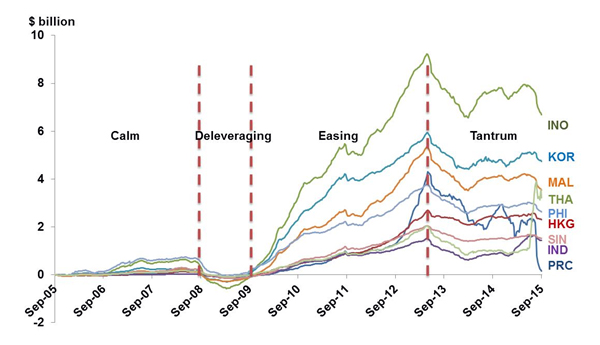

The figure below illustrates the cumulative bond flows into Asian economies during September 2005–September 2015 over the four periods of analysis. There are clear differences in the behavior of international capital flows in the four periods.

Cumulative net capital flows into local bond markets, September 2005–September 2015

Source: EPFR Global Database.

(1) Calm period (1 January 2005–14 September 2008)

Before the crisis, there was a gradual increase in portfolio flows into Asia for profit seeking and for rebalancing portfolios toward emerging markets. This was due to an improvement in the economic fundamentals and the current account position in Asia after the Asian financial crisis. In addition, Asian economies started to liberalize their capital accounts. The inflows were in the form of foreign direct investment, bank flows, and portfolio flows. This phenomenon ended on 15 September 2008 when Lehman Brothers filed for chapter 11 bankruptcy protection.

(2) Deleveraging period (15 September 2008–24 November 2009)

The global deleveraging period saw a short-term US dollar squeeze right after the crisis erupted. There were strong portfolio capital flows back into the bonds of some advanced economies. Consequently, there was a decrease in the cumulative net capital flows into Asian economies shown in the figure.

(3) Monetary easing (25 November 2009–20 May 2013)

During the monetary easing of advanced economies, interest rates in advanced economies reached the zero lower bound and there was cheap international US dollar liquidity after the quantitative easing, QE1, which began on 25 November 2008. Capital flows in Asia boomed and rose to unprecedented volumes as illustrated in the figure. This was due to the series of monetary policy easing of advanced economies and the global rebalancing of the portfolio flows. The inflow was driven not only by cyclical factors, but also by structural factors. Cyclical factors refer to the cyclical widening of differentials between advanced economies and those in Asia and the Pacific, both in terms of nominal yields and real growth rates. Advanced economies, faced with weak growth prospects and high unemployment, had to maintain low interest rates and accommodative liquidity conditions. In contrast, many emerging markets had to begin hiking interest rates to curb rising inflationary pressures. Interestingly, structural factors played an increasingly important role as the inflows were due to the fundamentals-based rebalancing of institutional portfolios toward emerging market assets. Investor perceptions of the risks associated with emerging market assets abated during the period as emerging markets were resilient to the global financial crisis, with better external and fiscal fundamentals than many advanced economies. This has been reflected in the positive trend of emerging market sovereign ratings, reinforcing the attractiveness of these markets for foreign investors.

(4) Taper tantrum (21 May 2013– 31 October 2015)

This period began when the market started to form expectations about the Fed’s tapering and the monetary policy normalization after the taper tantrum on 21 May 2013. The taper tantrum refers to the expectation that the Fed would wind down asset purchases. Because of this, capital flows became vulnerable to sudden changes in the market’s mood. It triggered financial market turmoil in the “fragile five” economies: Brazil, India, Indonesia, South Africa, and Turkey. These countries experienced large capital outflows and a sudden increase in the credit default swap spread. Several factors characterized the vulnerabilities in these countries including significant current account deficit problems, political uncertainty, and large shares of foreign holdings of local bond and equity. The fragile five created worries of crisis contagion and short-term financial stress among economies in Asia and the Pacific. Since then, international investors have tended to differentiate between emerging economies based on their degree of macroeconomic stability and financial sector vulnerabilities, which include current account condition, fiscal balance, dependence on external financing, potential growth, soundness of macroeconomic policy, and political stability. The series of expectations of an interest rate hike following the Fed meeting and after the announcement of the US macroeconomic indicators have also resulted in the exchange rate volatility. As a result, one can see from the figure that the net capital flows into Asia in this period fluctuated considerably.

Given the volatility in the net capital flows during the taper tantrum period, we are interested in whether or not the fundamental factors within these Asian economies push or pull the capital flows in the same manner during the periods of outflow and inflow of capital. In our second article, we therefore take a look at the effect of the push/pull factors on the distribution of capital flows into Asia.

Comments are closed.