While Asia is striving for decarbonization, it remains highly dependent on fossil fuels. Achieving significant emissions reductions will require vast financing, with corporate climate-related disclosures playing an essential role.

In 2023, the International Sustainability Standards Board (ISSB) published a set of global climate disclosure standards for accelerating the trend toward standardization. In response, in February 2025, the Asian Development Bank Institute (ADBI) surveyed 12 Asian financial regulators to gauge progress on the adoption of the standards as part of the ADBI-ADB Asian Climate Finance Dialogue project, with important survey findings.

Mandatory Adoption of the ISSB Standards

Mandatory disclosure is widely recognized as important, as it enables comparison of companies both within and across jurisdictions. The ADBI survey results showed that 67% of respondents have either made the standards mandatory or plan to do so, while 33% stated they have not yet decided. Among those opting for mandatory implementation, approximately 60% indicated that they have established or plan to establish an implementation timeline, while the remaining 40% have not yet done so.

The International Financial Reporting Standards Foundation has noted that fragmentation in regulatory requirements, particularly modifications that remove or exclude requirements in ISSB Standards, could hinder the delivery of timely and comparable information to capital markets. Around 25% of the survey respondents indicated they have fully adopted or plan to fully adopt the ISSB Standards without any modifications, while another 25% have adopted or plan to adopt them with some modifications. Sharing information among financial regulators on how certain jurisdictions have modified the standards could serve as a reference for other countries considering implementation.

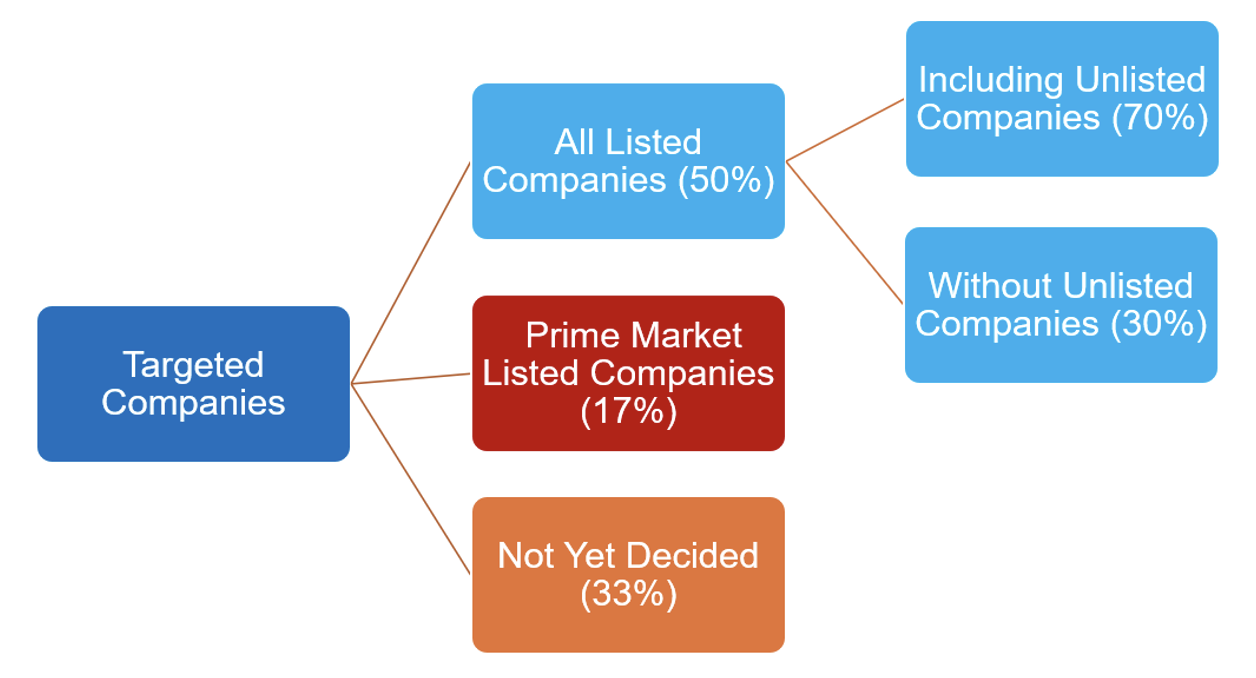

The ISSB Standards are primarily intended for large companies listed on stock exchanges, especially those on prime or standard markets. Surprisingly, about half of the respondents indicated that they have applied or plan to apply the ISSB Standards to all listed companies, including those on prime, standard, and growth markets (Figure 1). In contrast, only 17% have applied or plan to apply the standards exclusively to companies listed on the prime market. The survey also asked whether respondents applying the standards to all listed companies have covered or plan to cover some unlisted companies. About 70% of these respondents confirmed that their application of the ISSB Standards extends to certain unlisted companies.

Figure 1. Scope of Companies Subject to ISSB Standards

Source: Author.

Rising Awareness of the Critical Role of Greenhouse Gas (GHG) Emissions Data

GHG emissions data are essential and a top priority under the ISSB Standards. The ISSB encourages companies to disclose Scope 1, 2, and 3 emissions in line with the GHG Protocol. Approximately 42% of financial regulators said they have mandated or plan to mandate disclosure of all three emission scopes. About 25% have opted to mandate or recommend disclosure of only Scopes 1 and 2, while just 8% have recommended or plan to recommend disclosure of all three scopes.

Independent third-party assurance, especially on GHG emissions data, plays an important role in building trust and confidence in the integrity and reliability of climate-related financial information disclosures. The survey results show that around 33% of respondents intend to mandate independent external audits or assurance for all target companies, while about 8% plan to do so for certain target companies.

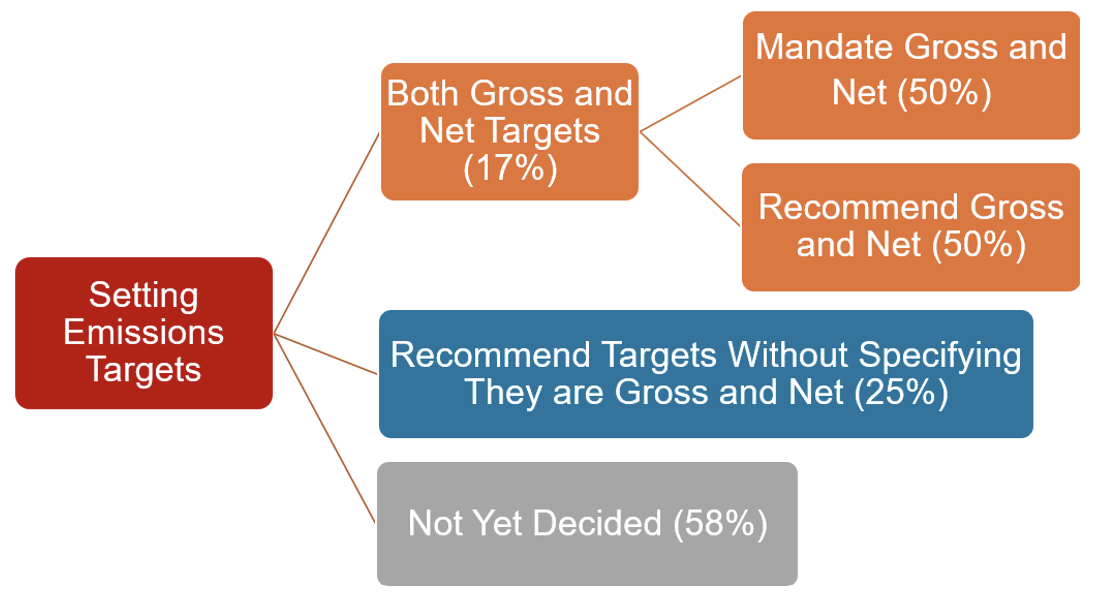

Under the ISSB Standards, companies must specify whether their emissions target is gross or net, and disclose this if a net target is used. The survey asked regulators whether companies are required to disclose both gross and net targets. The majority of respondents have not yet decided on their approach (Figure 2). Around 25% said they intend to recommend that target companies disclose emissions reduction targets without distinguishing between gross or net.

Figure 2. Gross and Net Emissions Reduction Targets

Source: Author.

Overall, the findings of the survey confirm that understanding of the ISSB Standards and preparations for their adoption in Asia have advanced significantly compared to early last year, when the previous survey was conducted. However, the survey also highlights that disclosing GHG emissions data can take time due to the difficulty of collecting the relevant information.

To support disclosure, governments could consider initiating cross-ministerial efforts to publish emissions factors and promote digital tools to ease reporting burdens. The survey further suggests that greater use of third-party assurance will require efforts to build capacity and maintain the quality of assurance providers. Strengthening such foundational information infrastructure and enhancing regional cooperation will be key to expanding green finance markets across Asia.