A feature of the academic literature on financial cycles relates to the fact that it almost exclusively focuses on selected advanced economies, the findings of which may not necessarily hold for emerging economies. Global capital flow developments and monetary policies in advanced economies mean that financial cycle dynamics may differ substantially in emerging economies, not only in terms of turning points but also with regard to which asset market cycle best characterizes the financial cycle. Early work on financial cycles can be traced back to Kindleberger (1978) and Minsky (1986), who examined the role of credit booms leading to crisis events. Prior to the global financial crisis, direct work on financial cycles was not prevalent, with many analyses examining the effect of asset prices and credit aggregates on economic activity (e.g., Detken and Smets 2004; Goodhart and Hofmann 2008; Schularick and Taylor 2012). After the crisis, more direct analysis on financial cycles was undertaken. Drehmann, Borio, and Tsatsaronis (2012) showed that financial cycle peaks are closely associated with financial crises. Moreover, they found that credit aggregates and property prices played a strong role in characterizing the financial cycle in advanced economies.

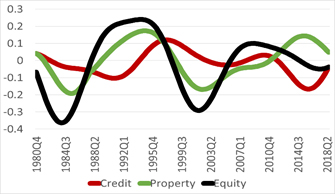

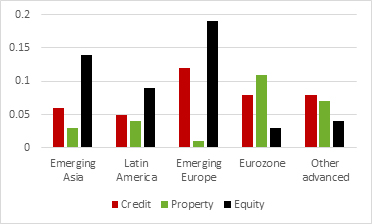

Recent ADBI research (Beirne 2019) addresses the gap in the literature in three main ways. First, the study attempts to evaluate different measures of the financial cycle (credit, property and equity, i.e., the core asset markets for financial intermediation) for a large set of 38 advanced and emerging economies and identify which measures may warrant more importance for policy makers. Second, the research paper carries out a comprehensive assessment of financial and business cycles in advanced and emerging economies. Third, as the literature has tended to focus on measuring the cycle as opposed to understanding the drivers, the paper disentangles the domestic and global factors driving the financial cycle across regions. Plotted in Figure 1 are the extracted financial cycles for emerging Asia, showing that cycles in credit, property, and equity are not fully synchronized, with differences evident in both amplitude and direction. Figure 2 provides a measure of the extent to which cycles in credit, property, and equity across regions are useful as early-warning indicators of systemic banking crisis events.

Figure 1. Financial Cycles in Emerging Asia

Note: Reported are the medium-term cyclical components extracted from the series using the Christiano Fitzgerald bandpass filter. Emerging Asia refers to the following economies: the People’s Republic of China; Hong Kong, China; India; Indonesia; the Republic of Korea; Malaysia; Singapore; and Thailand.

Source: Beirne (2019).

Figure 2. Early-Warning Properties

Note: Reported are the McFadden r2 values from a set of panel logistic regressions using the Laeven Valencia indicator for a systemic banking crisis as the dependent variable (based on a vulnerability horizon of 8 quarters).

Source: Beirne (2019).

The findings of the analysis conform with the prevailing literature on advanced economies regarding the important role of cycles in credit and property markets. However, as a gauge of the financial cycle, the study suggests that equity market cycles in emerging markets may be more useful compared to cycles in credit and property markets. Emerging equities are more susceptible to bouts of volatility and abrupt capital flow reversals in crisis times, as well as large capital inflows in non-crisis times as investors search for yield. Indeed, the paper finds that equity price cycles in emerging markets are better predictors of systemic banking crisis events than credit and property market cycles and, thus, should warrant close monitoring from a financial stability perspective.

It is also important to bear in mind the role played by underlying structural differences in the financial sector in emerging compared to advanced economies. For example, the greater depth of financial markets, the efficiency and effectiveness of financial intermediation, and the overall level of financial development in advanced compared to emerging economies may imply a stronger role for credit and property as a measure of the financial cycle in advanced economies. Similar to advanced economies, the paper finds that financial and business cycles in emerging economies are synchronized, albeit partially and with some cross-country heterogeneity. This underscores the importance for policy makers to be vigilant of the interlinkages between real and financial sectors, thus pointing toward a need for carefully designed macroprudential policies.

Finally, it is found that financial cycles in emerging markets in Asia in particular remain vulnerable to global risk aversion in financial markets and spillovers, especially from the United States. This highlights the need for these economies to continue to strengthen their domestic macroeconomic fundamentals and, in particular, further develop their local financial sectors through targeted structural reforms.

Read the working paper here.

_____

References:

Beirne, J. 2019. Financial Cycles in Asset Markets and Regions. ADBI Working Paper No. 1052. Tokyo: ADBI.

Detken, C., and F. Smets. 2004. Asset Price Booms and Monetary Policy. ECB Working Paper, No. 364. European Central Bank.

Drehmann, M., C. Borio, and K. Tsatsaronis. 2012. Characterising the Financial Cycle: Don’t Lose Sight of the Medium Term! BIS Working Paper No. 380. Bank for International Settlements.

Goodhart, C., and B. Hofmann. 2008. House Prices, Money, Credit, and the Macroeconomy. Oxford Review of Economic Policy, 24(1): 180–205.

Kindleberger, C.P. 1978. Manias, Panics, and Crashes: A History of Financial Crises. New York: Basic Books.

Minsky, H. 1986. Stabilizing an Unstable Economy. New Haven, CT: Yale University Press.

Schularick M., and A.M. Taylor. 2012. Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870-2008. American Economic Review, 102(2): 1029–1061.