Recent research has found that economic recoveries from banking crises tend to be weaker and more prolonged than those from traditional types of deep recessions (see for example IMF 2009). Japan’s “two lost decades” perhaps represent an extreme example of this, and the experience has now passed into the lexicon as “Japanese-style stagnation” or “Japanization” for short1. A long period of economic stagnation during peace time is not new, particularly among developing countries; the “lost decade” of Latin America in the 1980s is just one example. But Japanization was a surprising phenomenon observed in a mature market economy where the authorities were supposed to have sufficient policy tools to tackle banking crises and manage the economy.

Recent research has found that economic recoveries from banking crises tend to be weaker and more prolonged than those from traditional types of deep recessions (see for example IMF 2009). Japan’s “two lost decades” perhaps represent an extreme example of this, and the experience has now passed into the lexicon as “Japanese-style stagnation” or “Japanization” for short1. A long period of economic stagnation during peace time is not new, particularly among developing countries; the “lost decade” of Latin America in the 1980s is just one example. But Japanization was a surprising phenomenon observed in a mature market economy where the authorities were supposed to have sufficient policy tools to tackle banking crises and manage the economy.

Understanding how and why Japanization took place is critical to avoiding similar, prolonged economic stagnation in post-banking crisis periods in other countries, such as the United States (US) and the euro area economies. Our recent paper (Kawai and Morgan 2013) examines the characteristics of Japanization and the possible factors causing it, makes comparisons with other countries that experienced banking crises in the 1990s, conducts an econometric analysis of the economic factors affecting long-trend growth, and provides policy recommendations for ways that high-risk countries can avoid Japanization.

Factors contributing to Japanization

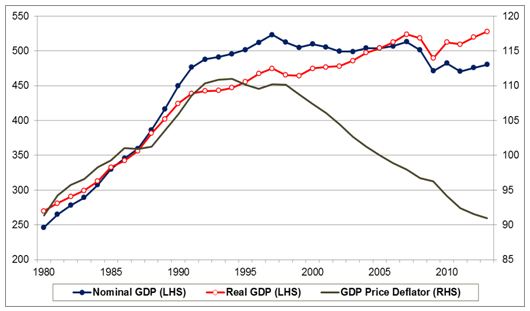

Japanization represents a broad-based and long-lasting stagnation in economic performance following the collapse of asset-price bubbles that led to a large-scale banking crisis. This stagnation in performance includes a significant slowdown in trend growth of per capita real GDP, a substantial period of deleveraging, slow or no growth in the capital-stock-to-GDP ratio, a decline in short- and long-term interest rates, and a substantial increase in the ratio of government debt to GDP. Other phenomena that may be more unique to Japan include a prolonged, substantial decline in stock and real estate prices, moderate but persistent price deflation, and a lack of nominal GDP growth (Figure 1). Japanization may have been aggravated by the rapid aging of the population.

Figure 1: Nominal and Real GDP (¥ trillion) and the GDP Deflator (2005 = 100)

Note: Nominal GDP and real GDP are in the left-hand side (LHS) axis, while the GDP deflator is in the right-hand side (RHS) axis. Real GDP is at 2005 constant prices. Data for 2013 are International Monetary Fund (IMF) projections.

Source: IMF, World Economic Outlook database, April 2013.

Several factors may have contributed to Japanization, such as inadequate macroeconomic policy responses, delayed banking sector restructuring, low levels of corporate investment, loss of industrial competitiveness, a slowdown in total factor productivity (TFP) growth, and an aging society. We believe that an inadequate policy response on the part of the Bank of Japan and financial authorities—the latter of which adopted forbearance toward the banking sector until 1997, when a systemic banking crisis erupted—was a key factor. Lack of policy urgency—facilitated by large domestic savings and foreign exchange reserves as well as by sustained fiscal stimuli—was a serious mistake2.

Comparisons with other countries experiencing banking crises in the 1990s

We have compared Japan’s experience with those of a number of other countries that also had banking crises in the 1990s3. Against these comparators, Japan’s performance stands out in several ways. First, the growth rate of per capita real GDP it achieved during the 1980s—4% per year—was quite high compared with its peer group of OECD countries, and more in line with the experience of Asia’s emerging economies with much lower per capita income levels. Second, the contribution of capital stock growth to real GDP growth was high among the OECD countries (but low in comparison to emerging economies) in the 1990s, but declined to the low end even among the OECD countries in the 2000s. Third, its ratio of domestic credit to GDP was significantly higher than the ratios in other OECD countries, and much higher than the norm for emerging economies, but fell unusually sharply in the 2000s. Fourth, housing prices declined on average throughout the decades of the 1990s and 2000s. In some ways, Japan’s experience most resembles those of the countries hit directly by the Asian financial crisis—Indonesia, the Republic of Korea, Malaysia, and Thailand. Specifically, the sharp decline in the contribution from the capital stock in Japan in the 2000s, which we identify with lower net investment, was found neither among the OECD peer group nor the Latin American countries, but was observed in the four Asian countries hit hardest by the Asian crisis. This suggests that the origin of “Japanization” may lie partly in the adoption of the investment-led growth model financed by the banking sector.

Econometric analysis

Our econometric analysis to identify key determinants of per capita (and per worker) real GDP growth had several innovations. It used net rather than gross investment, and quadratic specifications for CPI inflation and the share of the aged in the population. The results show that capital accumulation, the CPI inflation rate, economic openness measured by the stock of inward FDI as a ratio of GDP, and the share of the aged population (age 65 and over) in the total population are generally the most significant determinants of long-term growth of per capita (or per worker) real GDP. In particular, very low rates of CPI inflation (or deflation) and net investment (or capital stock growth contribution), coupled with the closed nature of the economy and an aged population, explain much of Japan’s slowdown. Although the very large yen appreciation in the mid-1990s may have had a negative impact on growth, the regression analysis did not find an overall negative impact of the real effective exchange rate on growth.

Risks of Japanization and how to avoid them

The question is whether the US and a number of major euro area economies that experienced recent large-scale financial (particularly banking) crises would face a similar risk of long-term stagnation. On the positive side, the experience of the US, the UK, and Italy shows that the average per capita GDP growth rates prior to the global financial crisis were much lower than the case of Japan, ranging from 1.2% for Italy to 2.5% for the UK. Therefore, the initial extent of “excess” growth was much less. The contribution to growth from the capital stock was also lower in these countries than in Japan, again indicating less “excess” investment. On the negative side, low CPI inflation and a decline in net investment as a share of GDP after the financial crisis—though not to the same extent as Japan—suggest some risk of Japanization. The very high levels of domestic credit relative to GDP in the pre-crisis period add to this risk. The slow response to banking sector problems in the euro area economies also points to a risk of long-term stagnation. Aging can be a significant negative factor for growth in major developed economies, such as Germany and Italy, but much less so in the UK and the US.

The first best solution to avoid the kinds of long-term stagnation Japan experienced is to prevent the bubbles themselves by containing economic overheating, excessive credit growth, overinvestment in fixed assets, and asset market speculation. From this perspective a combination of macroeconomic and macroprudential policy measures is essential to prevent asset-price bubbles. However, once the bubbles build up and then collapse, the second best policy is to quickly minimize the negative impact of such a collapse on the banking sector and overall economic activity through accommodative monetary policy and rapid financial policy responses to encourage banks to clean up their balance sheets.

In light of the importance of the slowdown in net investment in contributing to lower growth, our analysis suggests that structural policies to restore growth—directed toward promoting higher growth of investment and further opening of the economy—would be critical particularly in post-crisis periods. Measures to stimulate corporate investment should include deregulation, liberalization of trade and FDI, increased labor market flexibility, and lower taxation of investment. Aging is also a negative factor for growth. Although little can be done to affect the share of the aged population in the total population in the shorter term, policies can encourage greater labor force participation, higher fertility rates, and labor immigration. Higher real growth should be consistent with somewhat higher inflation, thereby reducing the negative impacts on growth from very low rates of inflation or outright deflation as well.

_____

1 As described in “After Five Years of Crisis, the Euro Area Risks Japanese-style Economic Stagnation,” Economist, 4 August 2012.

2 There have been several important studies of the various factors causing economic stagnation in Japan, a few of which include Hayashi and Prescott (2001), Ahearne et al (2002), Hamada and Okada (2009), Hoshi and Kashyap (2011), and Ueda (2012). More studies are cited in Kawai and Morgan (2013).

3 We used the data files from Reinhart’s website, which are associated with Reinhart and Rogoff (2010), www.carmenreinhart.com/data/browse-by-topic/topics/7/ (accessed on 1 July 2013). In many cases, the crisis periods are different from those in Reinhart and Rogoff (2009), including those for Japan.

References:

Ahearne, A., J. Gagnon, J. Haltmaier, and S. Kamin. 2002. Preventing Deflation: Lessons from Japan’s Experience in the 1990s. International Finance Discussion Papers No. 729. Washington, DC: Board of Governors of the Federal Reserve System.

Hayashi, F., and E. Prescott. 2001. The 1990s in Japan: A Lost Decade. Review of Economic Dynamics 5: 206-235.

Hoshi, T., and A. Kashyap.. 2011. Why Did Japan Stop Growing? NIRA Research Report. Tokyo: National Institute for Research Advancement. www.nira.or.jp/pdf/1002english_report.pdf.

International Monetary Fund (IMF). 2009. From Recession to Recovery: How Strong and How Soon? In: IMF World Economic Outlook. Washington, DC: International Monetary Fund.

Kawai, M., and P. Morgan. 2013. Banking Crises and “Japanization”: Origins and Implications. ADBI Working Paper 430. Tokyo: Asian Development Bank Institute. Available: www.adbi.org/working-paper/2013/07/29/5837.banking.crises.japanization.origins.implications/

Reinhart, C., and K. Rogoff. 2009. This Time is Different: Eight Centuries of Financial Folly. Princeton, NJ and Oxford, UK: Princeton University Press.

______.2010. From Financial Crash to Debt Crisis. NBER Working Paper No. 15795. Cambridge, MA: National Bureau of Economic Research.

Ueda, K. 2012. Deleveraging and Monetary Policy: Japan since the 1990s and the United States since 2007. Journal of Economic Perspectives 26:3. pp. 177–202.