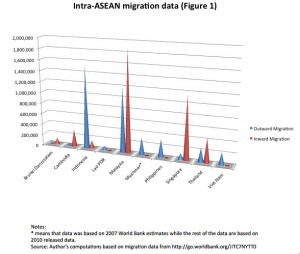

The movement of workers within the ASEAN region has been on the rise over the last two decades. In Malaysia, for example, the number of foreign workers grew from less than 250,000 in 1990 to more than 2 million in 2007, about 67% of whom come from ASEAN countries. Singapore, Brunei Darussalam and Thailand have become major labor recipients, while the other ASEAN countries are labor senders (Figure 1).

The movement of workers within the ASEAN region has been on the rise over the last two decades. In Malaysia, for example, the number of foreign workers grew from less than 250,000 in 1990 to more than 2 million in 2007, about 67% of whom come from ASEAN countries. Singapore, Brunei Darussalam and Thailand have become major labor recipients, while the other ASEAN countries are labor senders (Figure 1).

However, the ease of labor flows within ASEAN is not matched by the portability of migrants’ social security benefits. Some hosting countries have nationality conditions or minimum residency requirements that prevent migrants from participating in social security schemes. Even when allowed to contribute to such schemes, many migrant workers in ASEAN normally stand to lose some or all of the social security benefits they earn (particularly retirement income) once they return to their home countries.

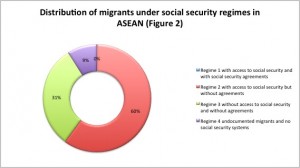

Holzmann et al (2005) classify migrants’ social protection into four regimes (see Figure 2 below).

Regime 1. Migrants have access to the social security and social services in host countries, and both labor-sending and receiving countries have social security agreements that keep migrants’ benefits intact even when they return to their home countries. EU countries are an example of Regime 1 countries. No intra-ASEAN migrants are classified under Regime 1 because no countries in ASEAN have signed any regional or bilateral social security agreements.

Regime 2. Migrants have access to host country social security arrangements but their host countries have no social security agreement with their countries of origin. Most of the world’s migrants fall under Regime 2, including ASEAN migrant workers in the Philippines and Thailand (where they have access to domestic social security regimes by law) and those in Indonesia and Malaysia who may voluntarily contribute to the employee provident funds of these countries. Together, migrants in Regime 2 countries constitute about 60% of all migrant workers in ASEAN.

Regime 3. Migrants have no access to social security and host and home countries have no social security agreements. Many countries in the Middle East fall into this category, as migrants are excluded from state-funded social security benefits but are not compelled to pay into pension systems. In ASEAN, migrant workers are not allowed to contribute into provident funds in Brunei Darussalam and Singapore unless they are permanent residents. About 31% of all migrant workers in ASEAN work in these two countries. (This is a maximum estimate as some migrant workers in these two countries are permanent residents and are thus required to contribute to the provident fund.)

Regime 4. The remaining 9% of migrant workers in ASEAN work in countries where there is no social security system (even for citizens) or in countries that provide no information on migrants’ social security. Cambodia, Lao PDR, Myanmar, and Viet Nam and are classified under Regime 4. An indeterminate number of undocumented migrants who have limited access to social security and whose work conditions are unregulated also fall under this regime.

ASEAN governments need to improve the depth and coverage of their domestic social security programs to address the needs not only of their own citizens, but those of migrants who constitute significant proportions of the region’s labor force. Another option for improving the rights of migrant workers is through social security agreements, whether bilateral or regional. Such agreements can be designed to coordinate the operation of social security systems by establishing mechanisms through which social security systems of different countries can work together to address the following issues:

- Equality of treatment. Countries may agree to remove residency or nationality requirements to enable migrants to access social security.

- Export of benefits. Benefits can be transferred from host to home country, or to another country which may be non-party to the agreement.

- Single taxation. Double tax agreements could end double coverage, which burdens most migrants who pay into home and host country tax and social security systems.

- Administrative support. Countries can assist migrants to facilitate claims and verify eligibility.

- “Totalization” or the adding together of periods of contribution. This allows migrants to enjoy benefits they have accrued by working in many countries upon retiring to their home countries. This feature is crucial to any agreement that aims to ensure social security in a region with a mobile workforce.

Such agreements are in place elsewhere, benefiting migrants in OECD countries, 86% of whom have access to social security and social protection in their host countries (Regime 1). Economic regional blocs such as the Caribbean Community (CARICOM) have also moved to enhance the portability of social security by applying higher accrual rates to migrant workers’ initial years of social security contributions (instead of the latter years). In such a totalized benefits system, migrant workers do not lose accrued benefits even if they decide to spend the last years of their career in their home country. In Mercosur, member countries have agreed to improve administration coordination to facilitate the processing of pension benefits claims within the bloc.

ASEAN has a real opportunity to facilitate accessible and portable social security for migrant workers within the region. The 2007 ASEAN Leaders’ Declaration on the Promotion and Protection of the Rights of Migrant Workers can serve as a framework to develop workable programs towards this end.

_____

This article is based on the author’s research policy brief, Social Security and Labor Migration in ASEAN, published in November 2011 by the Asian Development Bank Institute.