Interest in developing carbon markets is growing across Asia, as governments increasingly recognize their role in supporting corporate emissions reduction and incentivizing private-sector climate action. Carbon markets help bridge investment and financing gaps by generating income from the sale of carbon credits.

In light of this momentum, the Asian Development Bank Institute (ADBI) conducted a survey of 12 financial regulators across Asia to explore their approaches to carbon credit use and strategies to promote carbon market development. This survey was conducted as part of the ADBI-ADB Asian Climate Finance Dialogue project.

Rising Expectations for Carbon Credit Disclosure

The International Sustainability Standards Board (ISSB) standards require companies to disclose the use of carbon credits when reporting on emissions targets. Information on whether carbon projects are technology- or nature-based is gaining importance. If voluntary carbon credits are used, stakeholders are increasingly concerned about their alignment with the Core Carbon Principles (CCPs) developed by the Integrity Council for the Voluntary Carbon Market (ICVCM). CCPs are respected as a framework for high-quality voluntary carbon credits since there are serious concerns about the quality of voluntary carbon credits globally.

At the 29th Conference of the Parties to the United Nations Framework Convention on Climate Change in November 2024, key decisions were adopted on market-based mechanisms, enabling host countries to secure financing for emissions reduction projects through cross-border carbon credit trading. Counterparty countries can purchase and use these credits to offset emissions as part of their Nationally Determined Contributions. Thus, there is growing interest in carbon credits issued under Article 6 of the Paris Agreement.

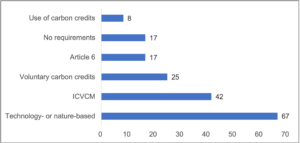

Against this backdrop, the ADBI survey asked financial regulators whether the disclosure of specific characteristics of carbon credits is required in relation to net emissions reduction targets. Approximately 67% of respondents indicated that they already require or plan to require companies to disclose whether the carbon credits used are technology-based or nature-based (Figure 1). Around 42% said they intended to require or recommend disclosure of whether the credits meet high-quality standards, such as the CCPs. Additionally, about 17% intended to do so for credits issued under the Article 6 framework.

Figure 1. Disclosure of Certain Features of Carbon Credits

(multiple answer choices, %)

Source: Author.

The survey also examined whether regulators require voluntary carbon credits to align with the ICVCM’s crediting principles. Only 17% of respondents indicated that they have adopted or plan to adopt such requirements, while the majority had yet to make a decision.

Among the CCPs, the principle of “additionality”—i.e., that credits represent actions that would not have occurred without the incentive created by carbon credit revenues—is among the most important. Thus, the survey asked whether respondents have adopted the internationally accepted principle of additionality as a basic definition for voluntary carbon credits. About 33% of respondents indicated that they have already applied this definition of additionality, while 17% plan to do so. Meanwhile, about 42% of respondents had yet to decide on this matter.

Measures for Building Carbon Markets

Governments can help to foster the development of voluntary carbon markets by establishing national registries and integrating those carbon credits. A national carbon credit registry offers several benefits, such as the streamlined tracking of issuances, transactions, and the retirement of carbon credits through a centralized platform. The quality of carbon credits could also be enhanced by listing only those that meet specific criteria.

In recent years, stock exchanges in several jurisdictions have taken on a more active role in promoting price discovery and expanding the base of both issuers and purchasers. Given this background, the survey asked respondents to describe measures they have taken to improve the quality of the voluntary carbon market. Several key initiatives were highlighted, including issuing carbon offset guidelines, developing domestic voluntary carbon credit systems, and adopting well-known crediting programs, such as Verra.

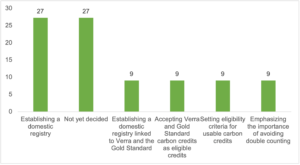

As preventing double-counting is also crucial for maintaining the integrity of carbon markets, the survey asked respondents about the specific measures they have implemented. 27% of respondents cited “establishing a domestic registry” as a measure taken (Figure 2). Additionally, about 9% of respondents identified establishing a domestic registry linked to Verra and the Gold Standard, accepting Verra and Gold Standard carbon credits as eligible credits, setting eligibility criteria for usable carbon credits, and emphasizing adherence to the no-double-counting principle as possible approaches.

Figure 2. Detailed Measures for Preventing Double-Counting

(%)

Source: Author.

Overall, the survey found that financial regulators across Asia widely recognize both the key features of voluntary carbon credits and the need to improve their quality. Many respondents have begun to consider measures such as adopting internationally recognized crediting standards, establishing domestic registries, and promoting transparency through disclosure requirements. However, the level of implementation remains uneven, with several jurisdictions still in the early stages of decision-making.

The findings indicate the importance of continued policy dialogue, capacity-building, and knowledge-sharing to support the development of robust and credible carbon markets that can mobilize private finance and contribute to national climate goals.

Learn more about the ADBI-ADB Climate Finance Dialogue.