Many emerging markets assets submerged in 2013 and continued to do so in early 2014. The negative reaction of currency and stock and bond prices in several emerging markets to a cautious statement (“taper talk”) by US Federal Reserve Chairman Ben Bernanke in May 2013 was swift. In early 2014, new-year recommendations by Wall Street´s biggest banks advised clients to cut their emerging-market allocations, for a diffuse variety of reasons such as elections, violence, lack of reform, and growing debt burdens.1

The downgrades were procyclical as they occurred after but reinforced the emerging-market slide. They also fail to differentiate countries as they do not consider diverse productivity trends. It seems that, once again, financial and pure contagion rules when it comes to emerging-market assets. Recent events indicate that holding down debt and portfolio inflows is what emerging countries need during boom periods. Mainstream advice against portfolio capital inflow controls, in the face of fresh evidence, should be taken with a grain of salt.

Several economists had declared earlier that the BRICs (Brazil, Russia, India, PRC) “party is over,”2 and recommended that emerging economies say farewell to state capitalism, referring to the prevalence of state enterprises in emerging economies. Other economists have recently declared the end of the emerging market miracle, too. Chile’s former finance minister, Andres Velasco,3 has pointed out how the well-known development economist Carlos Diaz-Alejandro remarked in the 1970s that the combination of high commodity prices, low world interest rates, and abundant international liquidity would amount to economic nirvana for developing countries. While in the 1970s such a state of grace was not expected to be realized, the combination of both ultra-light US monetary policy and Asia’s rise has, during the last decade, brought about these conditions that are so favorable to most developing countries.

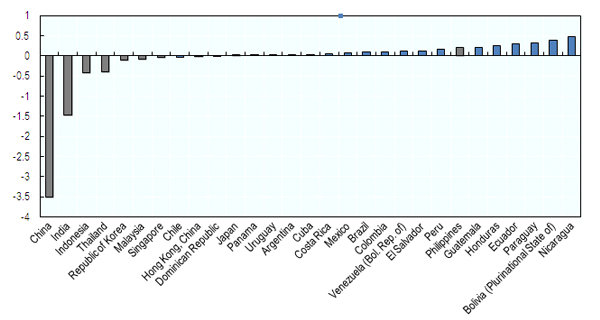

Graph 1: Productivity Gaps with the US, average annual % change 1980–2011

Source: OECD Latin American Outlook 2014.

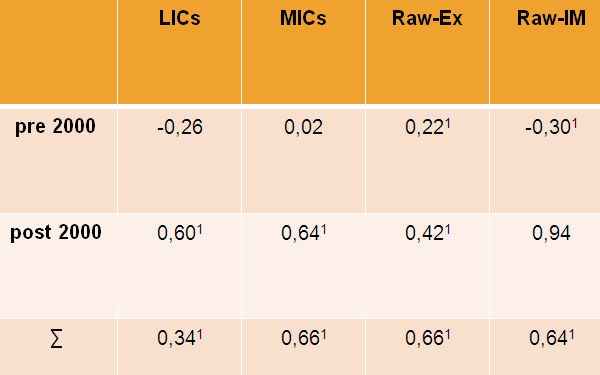

The convergence process in favor of emerging countries—their GDP growth leading richer countries so that their income levels are catching up—has not only been based on monetary factors, it has been closely linked with the People’s Republic of China’s (PRC) long rise. Table 1 shows the correlation coefficients between the PRC´s annual GDP growth rates and those of low-income countries (LICs), middle-income countries (MICs), raw material net exporters (Raw-Ex) and raw material net importers (Raw-Im). Before the year 2000, the PRC´s growth was only significantly correlated with countries that were either net exporters or net importers of raw materials, while its growth was not yet significant for the broad low-income and middle-income country groups. After 2000, by contrast, correlation coefficients turned significantly positive. Since then, every percentage point of the PRC´s growth has been translated by two-thirds into growth in both developing country income groups.

Table 1: Growth Engine PRC

Correlation Coefficients of the RPC’s Annual GDP Growth with Various Developing-Country Groups

LICs = low-income countries, MICs = middle-income countries, Raw-Ex = raw material net exporters, Raw-Im = raw material net importers.

Note: Coefficients marked with 1 denote significance level of 99%.

Source: Garroway, Cristopher, Burcu Hacibedel, Helmut Reisen, and Edouard Turkisch 2012. The Renminbi and Poor-country Growth. The World Economy. 35 (3). pp. 273–294.

While Velasco focused on Latin America, the lasting benefits of the PRC’s rise have been obtained by Asian countries embedded in an increasingly PRC centric manufacturing value chain. Graph 1 illustrates fundamental catch-up for countries in terms of total factor productivity. While the productivity gap between most Latin American and Caribbean countries and the more developed countries is increasing, Asia’s productivity gap is closing. So the Velasco perspective boils down to Latin America navel-gazing.

As for the future fortunes of emerging countries, much will depend on the PRC’s growth, as they have grown more PRC-centric. If it were for the endless stream of collapse scenarios advanced by so-called experts, the PRC´s long economic rise would have been over long ago. Yet, for 35 years its leaders have shown a commitment to reforms required to sustain growth. The decisions made at the PRC’s Third Plenary Session of the 18th CPC Central Committee in November 2013 seem to have identified key reform policies that will feed growth.

Urbanization and financial reform will help further exploit productivity gains embedded in the PRC’s rural-urban and firm-size duality. As a first step in the sequencing toward a fully convertible yuan, domestic financial reform is crucial. The risks are well advertised: eliminating the ceiling on interest rates paid on bank deposits, weaker banks are likely to fail. Exiting the cycle of investment-led growth financed by rapid credit expansion will expose non-performing loans. But a bank run should be contained thanks to the PRC´s vast foreign exchange, other state assets, and low government debt. The benefits of financial reform are easily underestimated, by contrast. Easing finance constraints for small and medium-sized enterprises will advance de facto privatization and shift resources to entrepreneurial firms, finance productive rather than politically connected investment and hence spur productivity and growth.

Land reform will help farmers by improving property rights and lessening corruption. Household savings will decline as a result of a loosening of the decades-long one-child policy. Plans for reducing restrictions on labor mobility and providing better social support systems in the PRC’s cities will reduce inequality; these plans not only help overcome vested interests that might block reform implementation but help urbanize the vast pool of underused rural labor. As rural-urban differences in productivity persist in the PRC, urbanization will continue to give a boost to mean productivity and growth. So there is still life in the PRC´s convergence; do not bet on its imminent collapse. And as long as the PRC flourishes, so will most emerging countries.

_____

1 Goldman to JPMorgan Say Sell Emerging Markets After Slide. Bloomberg. 7 January 2014.

2 Anders Aslund. 2013. The BRICs Party Is Over. VoxEu.

3 Andres Velasco. Emerging Markets Nirvana Lost. Project Syndicate.