Climate change will have major impacts on economies and lives in the near future through “physical” risks and “transition” risks. Physical risks arise from a higher frequency and greater scale of natural disasters as global warming progresses, while transition risks can drive corporate and sectoral restructuring and an increase in stranded assets in the transition process toward carbon neutrality through climate mitigation policies. These policies include carbon pricing, environmental regulations, the provision of subsidies for low-carbon technology development, and public investment to support decarbonization. Companies should prepare for both rising physical risks and transition risks.

Companies also need to be aware of climate-related liability risks. Lawsuits will be more likely in the future if plaintiffs or victims of natural disasters can scientifically prove that greenhouse gas (GHG) emissions-intensive companies are directly responsible for extreme natural disaster events and the resultant losses. Companies should also recognize that lawsuits or the payment of compensation will increase in the transition process. For example, emissions-intensive companies that officially set time-bound carbon-neutral targets might be sued by civil society, including nongovernmental organizations, if their actions are inconsistent with the targets. When companies advertise and use labels stating that their products are environmentally friendly, caution may be needed to ensure that they are not viewed as “greenwashing” practices. Consumers who believe that they were misled by such advertisements and labels may sue the companies. In addition, the world may see a growing number of lawsuits or punishments against companies violating environmental regulations. Companies may lose reputation and customers as the physical and transition risks increase.

Why should central banks focus on climate-related financial risks?

As companies increasingly face physical risks, transition risks, and associated liability risks, the financial institutions financing those companies will face potential losses. Financial institutions, including banks, have to understand that their loans and investments provided to emissions-intensive companies may become nonperforming in the future if those companies find it difficult to recover the costs of the fixed asset investment—thus, making those assets stranded and lowering companies’ repayment capacity and returns. If there are many financial institutions that finance such industries and companies, there is a risk that the stability of the financial system will be threatened.

With growing awareness of such climate-related financial risks, central banks—which used to distance themselves from global warming issues by claiming that those issues were not directly relevant to their operations—have increasingly recognized that they can no longer ignore climate change and other environmental issues. Moreover, global financial markets have been facing the problem of mispricing due to the presence of low-carbon prices that do not reflect the social costs associated with climate change. If these issues are left unaddressed, the transition process toward decarbonization will remain too slow to achieve carbon neutrality. Thus, the current so-called “sustainable” financial market may not contribute much to achieving carbon neutrality in the true sense.

In general, central banks hold the view that (elected) governments should take the lead in adopting ambitious climate policy measures and that central banks should contribute to governments’ efforts by helping to correct mispricing in financial markets as much as possible within their existing mandates.

Central bank mandates and possible climate-related actions

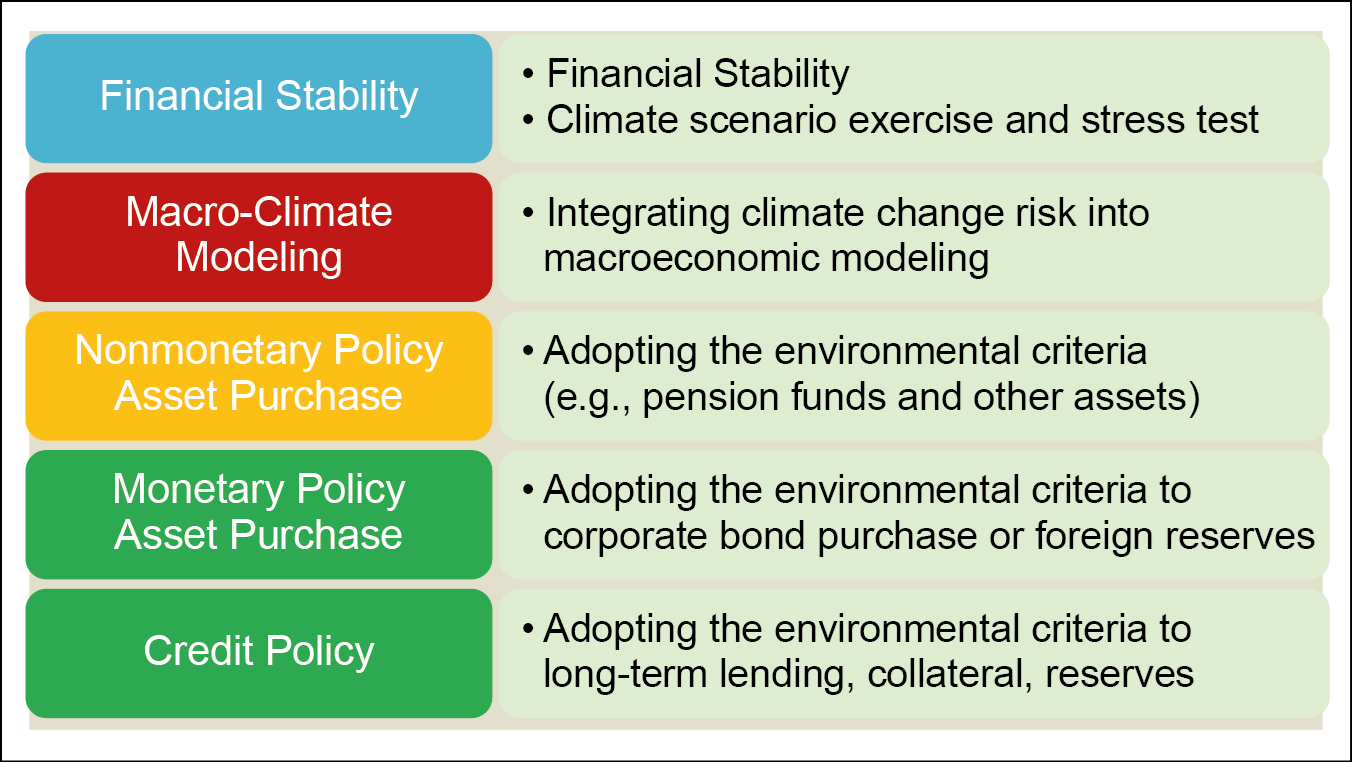

Normally, central banks cope with financial stability mainly through macroprudential policy, including financial supervision and monitoring, while price stability is dealt with through monetary policy. Meanwhile, financial regulators tend to focus on microprudential policy, although some central banks are also responsible for both macro- and microprudential policy. There is a growing consensus globally that central banks and financial regulators should view climate risks as major financial risks. The Financial Stability Board (FSB 2021) stressed the need to improve companies’ and financial institutions’ disclosure and data collection, conduct climate scenario analysis targeting financial institutions, and improve surveillance, as specified in the roadmap. Meanwhile, a consensus has not yet emerged as to whether central banks should incorporate climate risks in their price stability mandates and, thus, in their monetary policy frameworks. Some central banks appear to place more emphasis on climate-related financial risks and prudential perspectives to cope with financial institutions rather than relating climate risks to price stability and monetary policy (Shirai 2023).

Indeed, many central banks and financial regulators have already begun to consider climate-related financial risks as part of prudential policy. In particular, climate scenario analysis and/or climate stress tests are central to maintaining financial stability against climate risks. More than 30 central banks and financial regulators have implemented climate scenario analysis. Some central banks, such as the People’s Bank of China (PBOC), have already conducted climate stress tests that consider the implications for capital adequacy. There have been growing discussions in recent years on how to include climate-related financial risks with respect to the capital adequacy requirements regulation applied to banks in the Basel framework—particularly, the standard Pillar 1 capital requirement and/or Pillar 2 capital requirement. Active arguments have been conducted, especially among the Bank of England, the European Central Bank (ECB), various European Union financial regulators, and the Bank for International Settlements. Due to the available data and methodological constraints, the adoption of the Pillar 1 framework may not be feasible in the near future and, thus, Pillar 2 could be used flexibly (Shirai 2023). Moreover, various macroprudential policy tools, including the systemic risk buffer (SyRB), which could cope with climate-related systemic risks as a complement to the Pillar 2 framework, could be used (ECB and ESRB 2022).

Central banks are also encouraged to lead by example by disclosing the impact of climate risks in their own balance sheets in accordance with the guidelines compiled by the Task Force on Climate-Related Financial Disclosures (TCFD). The Bank of England was the first central bank to implement comprehensive disclosure of their balance sheets and operations in line with the TCFD guidelines. A comprehensive disclosure was also conducted recently by the Monetary Authority of Singapore. Moreover, central banks are expected to impose GHG emissions-reduction targets on their operations and adjust the composition of various domestic and foreign assets held by central banks for non-monetary policy objectives (NGFS 2021). Some central banks have already integrated the environmental factor into their monetary policy measures, such as corporate bond purchases and credit operations, although these measures have not yet become common practice across the globe. The ECB has already incorporated environmental criteria into its corporate bond reinvestment program. The Central Bank of Brazil, the Bank of Japan, and the PBOC have adopted environmental criteria into their lending programs. The Monetary Authority of Singapore has set an emissions target on its foreign reserves and gradually adjusted the portfolio accordingly.

Figure 1: Central Banks’ Possible Climate Actions

Source: Prepared by the author based on NGFS (2021).

Source: Prepared by the author based on NGFS (2021).

Concluding remarks

The Russian invasion of Ukraine and the associated energy shortages since 2022 have reminded the world that investment in clean and low-emission energy projects needed to achieve net-zero GHG emissions has been inadequate for many years because of the limited scale of climate and energy policies adopted around the world. As a result, the planet faces climate risks posed by an overdependence on fossil fuels. While an increase in overdependence on fossil fuels might be inevitable for some time, the world needs to accelerate transition strategies to achieve net-zero GHG emissions targets. As many countries have begun to take greater climate action, such as by expanding renewable energy and promoting electric vehicle production, central banks and financial regulators must also make greater efforts to foster more effective sustainable financial markets. They can start by promoting banks and other financial institutions to deepen their understanding of climate-related financial risks and improve their risk management strategies.

References

European Central Bank and the European Systemic Risk Board (ECB and ESRB). 2022. The Macroprudential Challenge of Climate Change. European Central Bank and European Systemic Risk Board Project Team on Climate Risk Monitoring, July.

Financial Stability Board (FSB). 2021. FSB Roadmap for Addressing Climate-Related Financial Risks. 7 July.

Network of Central Banks and Supervisors for Greening the Financial System (NGFS). 2021. Adapting Central Bank Operations to a Hotter World: Reviewing Some Options. NGFS Technical Document, March.

Shirai, S. 2023. Green Central Banking and Regulation to Foster Sustainable Finance. ADBI Working Paper No. 1361. Tokyo: ADBI.

Comments are closed.