The member countries of the Association of Southeast Asian Nations (ASEAN) have been experiencing a surge in energy demand due to their growing populations, expanding economies, and rising living standards. One reason for this rising energy demand is increased activity in the building and construction sector.

The building sector is a major energy consumer with massive potential for energy savings. While the sector accounts for 30% of final energy use, less than 9% of financing in building construction and renovation has been spent on energy efficiency projects. Therefore, tremendous scope exists to scale up investments in energy efficiency to maximize the energy-saving potential and address the lack of project financing in this sector. In Singapore, green buildings yield a higher return on investment than traditional buildings (Deng and Wu 2014), and in Malaysia, empirical evidence suggests that there are cost savings associated with green buildings.

Green bonds have recently been of interest to global impact investors who favor the targeted nature of project financing. Since green bonds mandate reporting on the investment’s contribution to sustainability, they represent a mechanism through which funding for green buildings in ASEAN can be secured. For example, green bonds issued in ASEAN attracted demand not only from local investors but also from international impact investors (mainly from the United States, Germany, the United Kingdom, the People’s Republic of China, and France) (Kapoor, Teo, Azhgaliyeva, and Liu 2020).

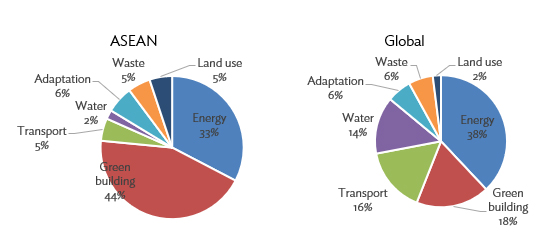

In the ASEAN context, green bonds enjoy high levels of institutional support (Azhgaliyeva and Kapoor 2020). In Indonesia, green bonds are issued by the government, while the Malaysia and Singapore governments have instituted grants to support the issuance of green bonds by private firms (Azhgaliyeva, Kapoor and Liu 2020). However, green bond issuances in ASEAN are still relatively low compared to the global market. A peculiar characteristic of the green bond market in ASEAN is that a larger proportion of green bonds has been issued to finance green buildings compared to the rest of the world (Figure 1). The growing demand for green buildings could be explained by increased awareness of sustainable design and energy-efficient buildings (BloombergNEF 2021). Building design also has a more sizeable impact on the energy efficiency of buildings in ASEAN since Southeast Asia is in the equatorial belt and, thus, investments in building design and energy efficiency improvements have a larger impact on energy efficiency savings and allow for shorter payback periods. This demonstrates opportunities for financing green buildings using green bonds in ASEAN.

Figure 1: Green Bond Issuances by Sector Share in ASEAN and Globally in 2018

Source: Kapoor, Teo, Azhgaliyeva, and Liu (2020).

Kapoor, Teo, Azhgaliyeva, and Liu (2020) identify barriers to financing green buildings using the green bond market in ASEAN. First, project sponsors may experience difficulty in creating a green bond framework due to knowledge and experience gaps. Second, if there is no standard for assessing the “greenness” of a building, potential project sponsors may be disincentivized by the high informational costs in verifying and labeling the project as “green.” Labeling buildings as “green” following regional, national, or internationally recognized standards or certifications is a requirement in most green bond standards, principles, or frameworks, including the ASEAN Green Bond Standards (ASEAN Capital Markets Forum 2018). Third, the perception of high transaction costs may also deter firms from issuing green bonds. These challenges necessitate a policy response to address information gaps and promote the use of green bonds for financing energy efficiency improvements in buildings.

Policy implications

The policy recommendations provided by Kapoor, Teo, Azhgaliyeva, and Liu (2020) can be summarized as follows:

- Promote knowledge and demonstration on the issuance of green bonds and green bond standards. Demonstrations of green bond issuance can be incentivized by temporary subsidies for the transaction costs incurred by firms for labeling bonds as “green.” Examples of such policies include green bond grant schemes and tax incentives.

- Promote green building codes and standards in order to provide project sponsors with a benchmarking mechanism and increase the visibility of green buildings as a potential investment. Green building codes and standards can be promoted using financial incentives associated with meeting countries’ national green building standards to ensure greater willingness among developers to transition to incorporating more green features.

Read the working paper here [1].

_____

References:

ASEAN Capital Markets Forum. 2018. ASEAN Green Bond Standards [2].

Azhgaliyeva, D., and A. Kapoor. 2020. Achieving Policy Objectives for Green Bonds in ASEAN [3], Asia Pathways, 10 July.

Azhgaliyeva, D., A. Kapoor, and Y. Liu. 2020. Green Bonds for Financing Renewable Energy and Energy Efficiency in Southeast Asia: A Review of Policies [4]. ADBI Working Paper 1073. Tokyo: ADBI.

BloombergNEF. 2021. China Green Bond Market 2020 [5], 22 February.

Deng, Y., and J. Wu. 2014. Economic Returns to Residential Green Building Investment: The Developers’ Perspective [6]. Regional Science and Urban Economics 47: 35–44.

Kapoor, A., E.-Q. Teo, D. Azhgaliyeva, and Y. Liu. 2020. The Viability of Green Bonds as a Financing Mechanism for Green Buildings in ASEAN [1]. ADBI Working Paper 1186. Tokyo: ADBI.