Current account surpluses have persisted in a number of Asian and European economies throughout the global financial crisis and thereafter. Along with Germany, Japan has a decades-long history of recording current account surpluses. Due to rapid improvements in the competitiveness of its manufacturing sector, Japan has almost continuously recorded trade surpluses since the mid-1960s, and as a result, record current account surpluses (Shirakawa 2011). Japan faced harsh criticism from the United States (US) of its current account surplus in the 1980s. Germany’s story is similar to that of Japan. To allow for macroeconomic rebalancing, both Japan and Germany agreed to let their currencies appreciate against the US dollar as part of the Plaza Agreement in 1985. The People’s Republic of China (PRC) started to build up large current account surpluses after joining the World Trade Organization in 2001, recording a stunning current account surplus of 9.9% of gross domestic product (GDP) in 2007. Although the PRC’s surplus as a share of GDP has declined substantially since then, the country is now running the world’s largest current account surplus and continues to face enormous pressure from the US, not unlike the pressure exerted on Japan in the 1980s (Ito 2009).

The question remains as to whether such imbalances require corrective policy action or whether they can be viewed as being a logical outcome of the economic environment. It has been suggested that excessive current account surpluses have hampered growth in deficit countries. The Economist (2017) even identified “the German problem” and asserted that Germany’s current account surplus is “damaging the world economy”. The literature to date has tended to focus on the internal adjustments necessary within countries to address current account imbalances, rather than assessing their impact at the regional and global levels.

Recent work by Beirne, Renzhi, and Volz (2021) addresses the gap in the literature by examining the regional and global growth effects of current account imbalances in Japan, Germany, and the PRC—the three largest persistent surplus countries—and the US and United Kingdom (UK), the two largest persistent deficit countries. Conceptually, the transmission channels between current account balances and regional/global growth include potential effects on global interest rates via savings and investment and competitiveness spillover effects. Other channels through which current account imbalances may impact abroad are related to the effects on global demand/consumption and employment (and prices and wages), the relative competitiveness of economies due to exchange rate valuation effects, and financial stability effects related to enhanced international capital flows.

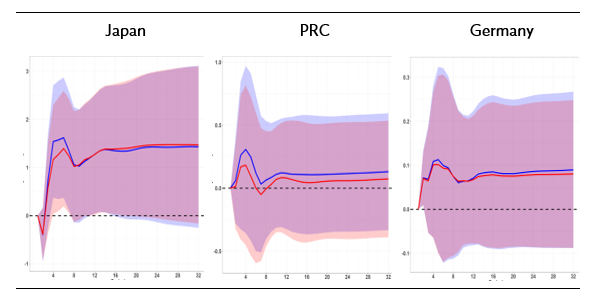

Controlling for a set of macroeconomic determinants, Beirne, Renzhi, and Volz (2021) use a structural vector autoregression (SVAR) framework and find that positive shocks to current account balances in the PRC, Germany, and Japan transmit positive regional and global growth effects, with the magnitude of the effect being, as expected, larger on regional growth. Figure 1 plots the responses of regional GDP growth to positive current account balance shocks in the three largest current account surplus countries. For the PRC and Germany, a 1 percentage point rise in the current account balance increases regional growth by around 0.3 and 0.1 percentage points, respectively. For Japan, the effect on regional growth is much stronger at the peak, at around 1.5 percentage points.

The strong reaction of regional growth for the case of Japan may be related to the size of its net foreign assets, with Japan investing heavily abroad and particularly in Asia. While a large current account surplus is indicative of a strong and competitive export sector and weaker domestic demand and investment, the expectation may prima facie be that this should detrimentally affect growth abroad. However, our findings are very much in line with expectations from international macroeconomic theory. A current account surplus by definition means an excess of national savings over investment and net capital outflows invested abroad—the productive use of such investment has clear positive implications for growth abroad. We also find that the magnitude of the effect on growth is amplified by greater trade in intermediate goods. This suggests that growing exports from current account surplus countries enhance the demand for imports in intermediate goods that are required as inputs for export production. Indeed, some work has supported the view that Germany acts as a regional hub for growth via global value chains (GVCs) (e.g., Baldwin [2013]).

Figure 1. Responses of regional GDP growth to positive current account shocks in persistent current account surplus countries

Note: The x-axis denotes the duration in quarters, and the y-axis denotes the accumulated responses of regional GDP growth to a 1 percentage point positive shock to the current account balance, defined in percentage points. The blue line refers to the impulse response in the framework that includes GVCs. The red line refers to the impulse response in the framework that excludes GVCs. The blue shaded area refers to the 95% standard error bands of the impulse response in the framework that includes GVCs. The red shaded area refers to the 95% standard error bands of the impulse response in the framework that excludes GVCs.

Source: Beirne, Renzhi, and Volz (2021).

For current account deficit countries, the magnitudes of the responses of growth to shocks are much lower on average than in the case of current account surplus countries. The impulse response analysis finds some marginal positive effects on regional and global growth emanating from a positive shock on the UK current account—i.e., a reduction in the deficit. For the US, a positive shock to its persistent current account deficit marginally drags on global growth, possibly reflecting declining import demand and wealth effects linked to the US dollar’s status as the global reserve currency.

The findings in the paper have important policy implications at the global level, particularly in light of the re-emergence of discussions on global imbalances in recent years. The results suggest that countries with large and persistent current account surpluses do not necessarily drag on regional growth, contrary to conventional wisdom that their inherent lower levels of domestic demand and investment and highly competitive export sectors negatively affect the growth of their trading partners. Therefore, rather than focusing on measures aimed at reducing high and persistent current account surpluses per se, it is important for policy makers to understand more closely the nature of trade between countries, notably in relation to trade in intermediate goods at the regional level. Going forward, future research may consider examining the channels through which different characterizations of a current account imbalance affect extra-country growth at the regional and global levels.

_____

References:

Baldwin, R. 2013. Global Supply Chains: Why They Emerged, Why They Matter, and Where They Are Going. In Global Value Chains in a Changing World, edited by D. Elms and P. Low. Geneva: WTO Secretariat, 13–59.

Beirne, J., N, Renzhi, and U. Volz. 2021. Persistent Current Account Imbalances: Are they Good or Bad for Regional and Global Growth? [1] Journal of International Money and Finance.

Ito, H. 2009. U.S. Current Account Debate with Japan Then, with China Now [2]. Journal of Asian Economics 20(3): 294–313.

Shirakawa, M. 2011. “Global Imbalances and Current Account Imbalances [3]”, speech by Masaaki Shirakawa, Governor of the Bank of Japan, at the Banque de France Financial Stability Launch Event, Paris, 18 February.

The Economist. 2017. The German Problem. Why Germany’s Current-Account Surplus is Bad for the World Economy [4]. July 8.