The coronavirus disease (COVID-19) pandemic and the resulting lockdowns have led to an unprecedented economic contraction and turbulence in financial markets, which initially caused the largest ever outflows of portfolio capital from emerging market economies (EMEs). Globally, governments have responded to the crisis with substantial fiscal stimulus packages. In addition, central banks around the world have eased monetary policies, with many EME central banks also implementing quantitative easing (QE) measures for the first time. Recent Asian Development Bank Institute research examined the impact of COVID-19 on bond yields, stock prices, and exchange rates for a sample of 38 advanced and emerging markets (Beirne et al. 2020). In addition, the effect of the pandemic on EME equity and bond flows across 14 EMEs was assessed. This research also estimated the effectiveness of monetary and fiscal policies implemented in response to COVID-19 on asset markets and capital flow dynamics.

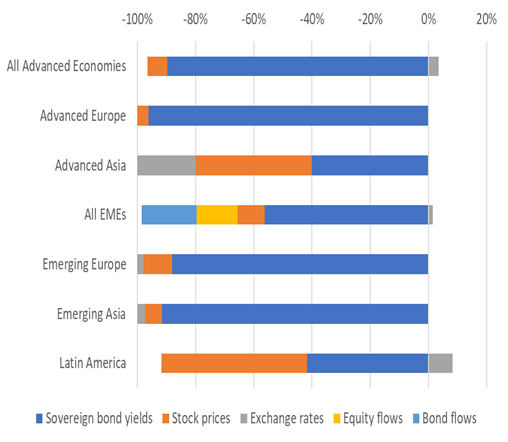

Figure 1: Relative Impact of COVID-19 across Asset Markets and Capital Flows

Note: The estimation period runs from 4 January 2010 to 30 April 2020, with COVID-19 defined as the number of daily new confirmed COVID-19 cases per 1 million population. The statistically significant coefficients for the COVID-19 variable are reported via a panel regression that uses each of the asset markets and capital flows as dependent variables, expressed as a percentage relative to the total. These results on relative impacts are consistent with an updated estimation by the authors over the period from 4 January 2010 to 31 August 2020.

Source: Beirne et al. (2020).

Figure 1 demonstrates that COVID-19 has had the greatest relative effect on sovereign bond markets across both advanced and emerging economies. In addition, based on an empirical analysis over the period from 4 January 2010 to 30 April 2020, Beirne et al. (2020) show that the magnitude of the effect of COVID-19 on financial markets is notably higher for emerging rather than advanced economies by a factor of around 2 across bond, stock, and exchange rate markets. In particular, bond yields in European and Asian EMEs are estimated to have declined by 24 and 14 basis points over the sample period, respectively, due to COVID-19. A preliminary update of the estimation by the authors to the end of August 2020 suggests that the sharp initial impact of COVID-19 on EME bond markets has waned somewhat, and this is undoubtedly related to the adjustment of markets to the shock, with expectations priced in, as well as the longer duration for monetary and fiscal rescue packages to pass through to bond prices.2 While EME bond yields rose sharply at the onset of COVID-19, coupled with substantial net capital outflows, it is striking that the overall effect on bond yields was negative, which may seem counterintuitive since an increase in COVID-19 cases might be expected to worsen financial market turmoil and increase sovereign bond yields. There are two explanations for why the overall effect on bond yields was negative. First, government bonds were perceived as safer assets than corporate bonds given that the corporate sector, with few exceptions, was very heavily affected by COVID-19 lockdowns. With many businesses fighting for survival, sovereign bonds were seen as the better alternative, even if the crisis also cast questions on the sustainability of public debt. Second, the crisis gave way to extremely accommodative central bank policies in most economies, with slashes in interest rates and new rounds of QE policies in all major advanced economies. Turning to the impact on stock markets, the greatest relative impact of COVID-19 is estimated to have been in advanced Asian economies and Latin America, whose markets plunged sharply. On exchange rates, advanced Asian economies were most affected in relative terms, experiencing currency depreciations due to COVID-19, although the magnitude of these effects was not as large overall when compared to the effects on stock and bond markets. With regard to EME capital flows, COVID-19 has led to significant outflows of both equities and bonds, reflecting investors’ flight to safety.

While there has been substantial heterogeneity across regions in the magnitude of the effects of COVID-19 on markets, the results in Beirne et al. (2020) show that this has also been the case in relation to the effectiveness of policy responses. Compared to EMEs, fiscal stimulus packages in advanced economies have had around twice the impact in terms of compressing sovereign bond yields. On monetary policy, while interest rate reductions passed through along the yield curve with similar magnitudes in both advanced and emerging economies, the impact on bond yields due to QE was statistically significant for advanced economies only. However, the advanced economy QE measures spilled over to EMEs, reducing EME bond yields by around 27 basis points. For stock markets, interest rate reductions were more effective in advanced compared to emerging economies overall by a factor of around 2. In addition, QE measures in advanced economies, as well as spillovers to EMEs, helped to boost domestic stock prices by around 12% and 16%, respectively. Moreover, QE by central banks in emerging Asia helped to increase stock prices by around 6%. The impact of fiscal policy on stock markets was confined to European advanced economies and EMEs overall, increasing stock prices by an average of around 8%. At the global level, while the magnitude of the effect of policy responses on exchange rates was much lower than in other markets, QE measures in EMEs led to a rise in net capital inflows by around 14% in the case of equities and around 16% in the case of bonds. Moreover, fiscal stimulus packages in EMEs increased net equity inflows by around 9%.3

Overall, although heightened uncertainty due to the COVID-19 pandemic has affected the financial markets of EMEs more detrimentally than advanced economies, it appears that most EMEs have performed well in their policy responses to the pandemic. Whereas fiscal stimulus packages have contributed to restoring confidence in domestic financial markets, QE policy measures and interest rate reductions have also been effective in Asian economies by supporting stock prices. Notably, these measures also helped to stabilize capital flows. The scale of bond and equity capital outflows from EMEs at the onset of the pandemic shock reinforces the importance of strengthening the domestic investor base to be less reliant on international portfolio investment. Going forward, the COVID-19 crisis has illustrated the need for concerted efforts at bolstering domestic financial resource mobilization in EMEs and for reducing exposure to international portfolio capital and financial contagion. The extent of capital outflows also strengthens the case for reviving discussions around the management of capital flows and the development of a global financial safety net. Finally, the COVID-19 pandemic has highlighted the importance for EMEs to develop further their overall policy toolkits to respond to spikes in financial market volatility and crisis episodes, notably with the use of QE measures. With conventional monetary policy having easing limits and fiscal policy space constrained by excessive public debt, using QE policies can be a potent stimulator in domestic markets, particularly where inflation expectations are contained and exchange rates are flexible.

_____

1 Note: A similar version of this article appears in the November 2020 issue of the Asia Bond Monitor of the Asian Development Bank.

2 The preliminary updated estimation also reveals a similar dynamic with EME capital flows, whereby the magnitude of the COVID-19 effect was much greater in the earlier phase of the pandemic. By contrast, the magnitude of the impact of COVID-19 on stock prices and exchange rates has been very similar across earlier and later sample estimation periods. Investor flight to safety at the onset of the pandemic shock may help to explain the different effects on bond markets and capital flows across the period to the end of April 2020 compared to the period to the end of August 2020.

3 The preliminary update of the estimation period to the end of August 2020 by the authors indicates a broadly very similar effect in terms of the magnitude and statistical significance of monetary and fiscal policies implemented due to COVID-19 on financial markets and capital flows. Over the longer sample period, however, the effect of QE policies on bond yields appears to exhibit no significant effect, while QE by central banks in emerging Asia seem to have a much more pronounced impact on domestic stock markets.

References:

Beirne, N. Renzhi, E. Sugandi, and U. Volz. 2020. Financial Market and Capital Flow Dynamics During the COVID-19 Pandemic [1]. Asian Development Bank Institute Working Paper. No. 1158. Tokyo: Asian Development Bank Institute.