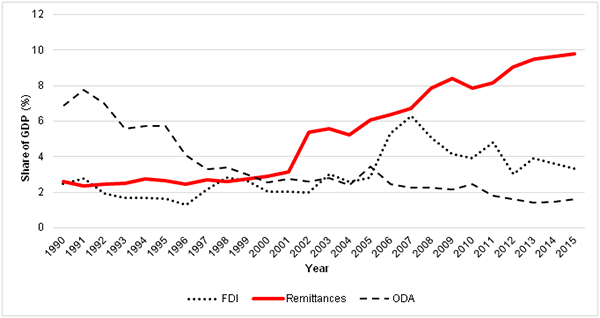

International remittances represent the second most important source of external funding for developing countries after foreign direct investment (FDI). The World Bank (2014) estimates that international remittances to developing countries reached $436 billion in 2014. Remittances to the East Asia and the Pacific region and the South Asia region account for the largest and second-largest shares in the world. For South Asia, the economic effects of the remittances are quite robust. International remittances are the largest source of external resource flows in the region and have been stably increasing compared to other factors, such as FDI and official development assistance (ODA) (Figure 1).

Figure 1: External Resource Flows in South Asia

FDI = foreign direct investment, GDP = gross domestic product, ODA = official development assistance.

Note: The data include that on Bangladesh, India, Maldives, Nepal, Pakistan, and Sri Lanka.

Source: Authors’ compilation based on the World Bank’s World Development Indicators (2016).

Remittance flows have accounted for a large proportion of external resources in South Asia, especially since the beginning of the 21st century. Data for South Asia shows that in 2013, international remittance flows in Nepal were equivalent to 25% of gross domestic product (GDP) and 98% of international reserves, while for Pakistan, international remittance flows were equivalent to 284% of international reserves (World Bank 2014).

Yoshino, Taghizadeh-Hesary, and Otsuka (2017) examine the impact of international remittances on poverty reduction using panel data for 10 Asian developing countries over the period 1981–2014 to determine whether international remittances contributed to a reduction in various indicators of poverty in Asian developing countries. The countries examined were Bangladesh, India, Nepal, Pakistan, and Sri Lanka from the South Asia region, and the People’s Republic of China (PRC), Indonesia, Malaysia, the Philippines, and Thailand from the East Asia and the Pacific region.

They investigate the effect of international remittances on three poverty measures: the poverty headcount ratio, the poverty gap ratio, and the squared poverty gap ratio. The poverty headcount ratio refers to the proportion of the population living beneath the poverty line (calculated as $1.90 per day in 2011 purchasing purchasing power parity). The poverty gap ratio indicates how far below the poverty line the average poor household’s income or expenditures fall. For example, a poverty gap of 10% means that the average poor person’s income or expenditures equate to 90% of the poverty line. Finally, the squared poverty gap ratio averages the squares of the poverty gaps relative to the poverty line.

The results show that a 1% increase in international remittances as a percentage of gross domestic product (GDP) is associated with a 22.6% decline in the poverty gap ratio and a 16.0% decline in the poverty severity ratio in the sample of the 10 Asian developing countries. However, international remittances do not have a significant impact on the poverty headcount ratio. This result could be because the poverty headcount ratio does not reflect the gap among the poor. There might be people who live on $1.90 per day, but at the same time, there might be people who live on $0.50 per day. Even if remittances are distributed to people in developing countries, those who receive the remittances might be from high-income families because of the significant costs of leaving their home countries and working abroad. This could lead to an expanding gap among the poor. Compared with the poverty headcount ratio, the poverty gap ratio and poverty severity ratio take into account the average poor household’s income or expenditure against the poverty line. Therefore, these two variables more closely reflect reductions in poverty and can be affected by international remittance inflows.

The findings show the important role of international remittances on poverty reduction. Remittance-receiving countries in Asia need to reduce the costs of sending remittances for immigrants. Lowering the transaction costs of sending remittances can be a way of reducing poverty in developing countries in Asia and encouraging increasing shares of remittances through formal channels rather than unofficial ones. The World Bank (2015) shows that the cost of sending remittance transfers tends to increase according to the income level of migrant-receiving countries. For example, remittance transfers from the US, Japan, Germany, and the United Kingdom, which account for a large part of the total GDP in high-income countries, impose high costs on people. In contrast, remittance transfers from India, Saudi Arabia, and the United Arab Emirates, which generally have lower GDP than the countries above, impose lower costs.

For the case of remittances of less than $300 to home countries, it is estimated that about 8%–10% of remittance transfers charge fees. The fees increase as the remittance amount decreases. In order to reduce the cost of sending remittances, one possible solution is to encourage partnerships between international banking services and remittance transfer operators. Another solution could be to create Internet-based remittance transfer networks and promote financial technologies to make good use of remittances in migrant-sending countries.

Reducing the costs of sending remittances can increase the disposable income of migrants and their families, which can accelerate the reduction of poverty in migrant-sending countries.

To read the full working paper, click here [1].

_____

References:

Yoshino, N., F. Taghizadeh-Hesary, and M. Otsuka. 2017. International Remittances and Poverty Reduction: Evidence from Asian Developing Countries [1]. ADBI Working Paper 759. Tokyo: Asian Development Bank Institute.

World Bank. 2014. Migration and Development Brief.22. Migration and Remittances Team, Development Prospects Group 22: 4–27.

World Bank. 2015. Remittance Prices Worldwide [2]. World Bank.

World Bank. 2016. PovcalNet: An Online Analysis Tool for Global Poverty Monitoring [3]. World Bank.