Public pension burdens in emerging Asia likely to rise dramatically, but remain understudied

The fiscal burden of public pensions in most emerging Asian economies is relatively small, reflecting relatively young populations and limited coverage of the retired-age population in public pension programs. Nonetheless, these conditions are likely to change dramatically in the coming decades. First, many Asian economies will face rapidly aging populations, which will raise pension and other old-age-related spending substantially. Second, as economies develop, political pressures to expand the coverage of public pensions and raise the level of pension benefits relative to income will likely increase.

Despite this daunting prospect, there have been relatively few studies of forecasts of public pension spending by emerging Asian economies. The Organisation for Economic Co-operation and Development (OECD) has published extensively on the prospects for its member countries (e.g., OECD [2013]), but, aside from Japan and the Republic of Korea, which are OECD members, its analysis of Asian economies has only covered the People’s Republic of China (PRC), India, and Indonesia, i.e., the other Asian members of the G20. The International Monetary Fund (2011) only covers five emerging Asian economies: the PRC, India, Indonesia, Malaysia, Pakistan, the Philippines, and Thailand.

Our recent study (Morgan and Trinh, 2017) aims to extend this work to a much broader and less-analyzed set of Asian countries. Our study has four aims: (i) to identify the current status of public pension spending in Asia; (ii) to develop models to explain public pension spending in Asia in terms of basic economic and demographic variables; (iii) to use the models to forecast the likely developments of spending on public pensions in 23 emerging economies through 2030 as a result of demographic and income trends; and (iv) to recommend policies to expand the financial capacity of emerging Asian economies to cover such expenditure increases.

In addition to covering many more emerging Asian economies than previous studies, our study explicitly models changes in the pension coverage (eligibility) ratio and in average pension benefits. (In contrast, the forecasts by the International Monetary Fund (2011) assume a constant coverage ratio.) Also, our study utilizes the latest data from the ADB Social Protection Index database and World Bank Pensions database.

Modelling the effects of aging, rising income, coverage ratios and benefits

In order to gauge the likely impacts of such shifts in income and demographics on public pension spending, we estimated models of: (i) the ratio of public pension expenditures to gross domestic product (GDP) (ppenex/gnp); (ii) the level of average pension benefits per beneficiary (ppenex/benif); and (iii) the share of the retirement-age population eligible to receive pension benefits (coverage). The ratio of the number of pension beneficiaries to the working-age population was found to be a significant determinant of the share of public pension spending in GDP, while pension benefits per beneficiary were found to rise faster than per capita GDP, and the coverage ratio for pension eligibility was found to rise with income. These findings all point toward upward pressure on pension spending as economies age and incomes rise.

Projecting public pension costs in 2030

We then used these models to project the level of average pension benefits per beneficiary, the share of the retirement-age population eligible to receive pension benefits, and the share of public pension expenditure in GDP in 2030. For the latter, we used two different projection methodologies.

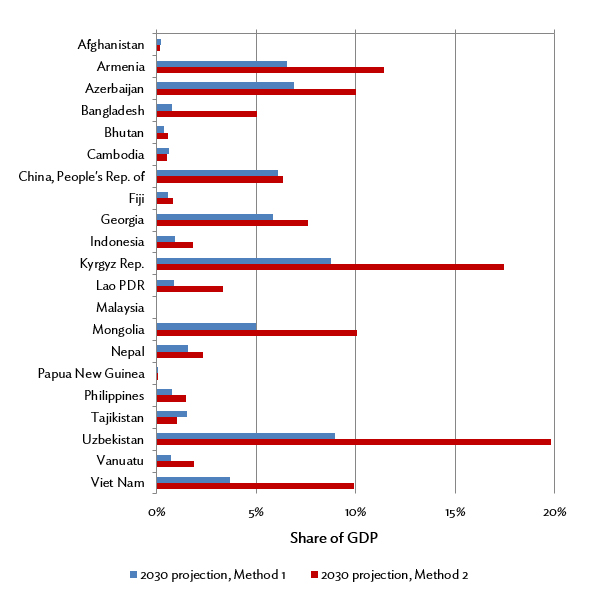

In Method 1, the estimate is derived directly from a regression equation that relates the share of pension benefits in GDP to per capita GDP, and the ratio of pension beneficiaries to the working-age population, based on exogenous projections of per capita GDP and the age structure of the population in 2030. Using Method 1, the average projected increase in public pension spending between 2013 and 2030 for the 23 economies is only 1.0 percentage point of GDP, although this still represents a 55% increase in the ratio on average. The biggest percentage point increases are seen in the PRC (3.9 percentage points), Armenia (2.6 percentage points), Azerbaijan (2.6 percentage points), Georgia (2.2 percentage points), and Mongolia (1.9 percentage points). The share for the PRC is estimated to hit 6.1% of GDP, somewhat lower than earlier published estimates, but still almost three times the 2013 level (see Figure 1).

Figure 1: Public Pension Spending as a Share of GDP: 2030 projections, Methods 1 and 2

GDP = gross domestic product, Lao PDR = Lao People’s Democratic Republic.

Source: Authors’ estimates.

The second method (Method 2) estimates the share of pension benefits in GDP by the following identity:

ppenex/gdp = ppenex/benif * coverage * retpop/pop / gdppc (1)

where:

ppenex/gdp = share of public pension expenditures in GDP

gdppc = GDP per capita (in 2010 US dollars)

ppenex/benif = average benefits per beneficiary (in 2010 US dollars)

retpop/pop = share of population of retirement age (normally aged 65 or over, but varies by country depending on the retirement age) in total population

coverage = ratio of pension beneficiaries to retirement-age population

and ppenex/benif and coverage are estimated by the regression equations described in the previous section. The other values are obtained exogenously as in Method 1.

Using Method 2 on 20 economies, the average projected increase in the pension expenditure share is significantly larger than that using Method 1, at 3.6 percentage points, with especially large percentage point increases in Armenia (7.5 percentage points), Azerbaijan (5.7 percentage points), the Kyrgyz Republic (9.8 percentage points), Mongolia (7.0 percentage points), Uzbekistan (12.1 percentage points), and Viet Nam (7.4 percentage points). We believe that the estimates using Method 2 are probably more accurate because they incorporate all three sources of potential cost increases—the coverage ratio, population aging, and economic growth. These results imply that the economies facing population aging will have to make substantial efforts to secure greater fiscal resources and increase the efficiency of their programs to fund the increasing demands.

To be sure, these estimates are still very crude. They do not attempt to distinguish between different kinds of public pension programs—only overall average expenditures and coverage. The accuracy of the regression estimates is limited due to the scarce number of observations. Better data availability would allow for greater refinement of the analysis.

Nevertheless, we believe that countries have the capacity to overcome these challenges and provide adequate public pension coverage for their populations. Risks to medium-term fiscal sustainability can be reduced by the timely adoption of various measures, including those directed specifically at social insurance programs and those more generally aimed at improving fiscal management. These include: enhancing the efficiency of social insurance programs; improving the balance of revenues and expenditures; implementing more explicit fiscal rules; and establishing stronger fiscal surveillance at the national and regional levels. However, it is important to start strengthening social protection systems early on to prepare for the aging of the populations in the region.

_____

References:

Asher, M., and F. Zen, eds. 2016. Age Related Pension Expenditure and Fiscal Space: Modelling Techniques and Case Studies from East Asia. Abingdon, Oxon; New York, NY: Routledge.

International Monetary Fund. 2011. The Challenge of Public Pension Reform in Advanced and Emerging Economies. Washington, DC: Fiscal Affairs Department, International Monetary Fund.

Morgan, P. J., and L. Q. Trinh. 2017. Costs and Potential Funding of Expanded Public Pension Coverage in Asia [1]. ADBI Working Paper No. 748. Tokyo: Asian Development Bank Institute.

Organisation for Economic Co-operation and Development (OECD). 2013. Pensions at a Glance 2013: OECD and G20 Indicators [2]. Paris: OECD Publishing.

United Nations, Department of Economic and Social Affairs, Population Division. 2013. World Population Prospects: The 2012 Revision, DVD Edition. New York: United Nations.

Zhuang, J. 2012. ASEAN, PRC and India Growth Projections: 2010-2030. Unpublished. Manila: Asian Development Bank.