Introduction

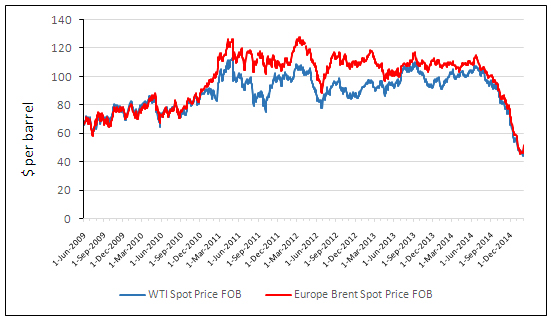

The price of oil has more than halved in the period of less than 5 months since September 2014. After nearly 5 years of stability, the price of a barrel of Brent crude oil in Europe fell from $117.15 on 6 September 2014, to $45.13 on 14 January 2015. Figure 1 shows the movements in the spot price of crude oil from June 2009 to February 2015, including the recent price drop.

There are several reasons for this rapid drop, relating to the supply and demand conditions and expectations in the oil market. In this article, we will explain these reasons and shed light on a crucial additional reason, which has largely been neglected in other interpretations. First, we will discuss the conventional reasons for the oil price drop.

Figure 1: Spot price for crude oil

FOB = free on board, WTI= West Texas Intermediate.

Note: WTI prices are the Cushing, Oklahoma FOB spot prices.

Source: Spot prices for crude oil and petroleum products, Thomson Reuters (release date 4 February 2015).

The role of supply in the recent oil price collapse

The price of oil is partly determined by actual supply and demand, and partly by expectations.

Part of the recent price collapse can be attributed to a new glut in oil supply. Unconventional energy resources, such as shale oil, shale gas, and oil sands, have raised the global oil supply. Massive discoveries of oil in North Dakota and Texas have driven down prices, even amid tensions in the Middle East and Ukraine, and roughly 3 million more barrels a day are being produced now than in 2011.

In addition to this, the failure of the Organization of Petroleum Exporting Countries (OPEC), which controls nearly 40% of the world market, to reach an agreement on production curbs at a meeting in Vienna on 27 November while oil prices were falling, sent prices down even further.

The role of demand in the recent oil price collapse

There are two mains reasons for the reduction in oil demand. The first reason is that demand for energy is closely related to economic activity, so weaker economic activity has resulted in a fall in demand for oil. The second channel that led to shrunken oil demand is not related to economic activity but comes from monetary policy, which will be described in the final section. (For more information regarding this impact please see Taghizadeh-Hesary and Yoshino [2014] and Yoshino and Taghizadeh-Hesary [2014]).

Weaker economic activity reduced oil demand

The International Monetary Fund (IMF) has downgraded its forecast for global economic growth for 2015 by 0.3%, to 3.5%. The downgrade comes despite the economic boost provided by lower commodity prices. The IMF has cited weaker investment outside the United States and growth fears in emerging markets such as the Russian Federation, the People’s Republic of China, and Brazil as the primary reasons for the downgrade in growth (JP Morgan 2015). This has reduced oil demand in certain areas and resulted in weak growth for global oil demand, which has had a negative impact on oil prices.

Weaker global oil demand growth has contributed to rising global oil inventories. In January, the Organisation for Economic Co-operation and Development (OECD) estimated that total commercial oil inventories had reached their highest levels since August 2010 (EIA 2015a).

Figure 2 shows the world liquid fuel production and consumption balance from 2010 to 2014, and the forecast for 2015 and 2016. It is clear that global oil demand dropped toward the end of 2014. A part of this drop in demand is due to the aforementioned reasons, however this is not the whole story. The following section will shed light on the second channel in the demand side of the oil market, which seems to be the main reason for the recent collapse.

Figure 2: World liquid fuel production and consumption balance

Source: EIA 2015b.

How was monetary policy behind the drop in oil price?

Before discussing how monetary policy was behind the oil price drop, let’s look further back to the sub-prime mortgage crisis of 2008–2009 and review what happened to the US money market and global oil prices at that time.

After the subprime mortgage crisis, the weak exchange rate of the US dollar, caused by the country’s quantitative easing, pushed oil prices in US dollars upward over the period 2009–2012 by causing investors to invest in the oil market and other commodity markets while the world economy was in recession. As a result, huge amounts of capital entered the crude oil market as investors found it safer than the capital markets, which had collapsed (Yoshino and Taghizadeh-Hesary 2014). Because of this new demand, oil prices started to rise sharply in 2009, when the US and many other economies were in recession. This trend had the effect of imposing a longer recovery time on the global economy, as oil has been shown to be one of the most important production inputs.

Now, let’s move to the end of 2014 to see what has happened more recently. In 2014, financial conditions eased compared to 2013. In particular, long-term interest rates declined in advanced economies because of the economic recovery and expectations of a lower neutral policy rate in the US over the medium term.

Equity prices have generally risen and risk premiums declined in advanced economies and emerging markets. In the US, both the Dow Jones Industrial Average and the S&P 500 have powered to record highs, boosted by the strengthening US economy and liquidity provided by the Federal Reserve’s unprecedented quantitative easing. The Dow, up 8.5%, surpassed two key psychological levels during 2014—17,000 and 18,000—and the S&P 500, 12.8% higher, also surpassed the 2,000 milestone.

This means that the liquidity mainly provided by the Federal Reserve, especially during the 2008–2009 financial crisis, transferred to the oil market and created a huge demand causing a surge in oil prices. Now, because the US and some other advanced and emerging capital markets are recovering, it has moved back to the capital markets. This is the reason for the reduced global oil demand shown in Figure 2, which resulted in the price collapse in the market. This means that this factor may have played a stronger role than the effects of supply and lower economic growth.

_____

References:

Energy Information Administration (EIA). 2015a. This Week in Petroleum. January 28. Available here [1].

Energy Information Administration (EIA). 2015b. Short-Term Energy Outlook. United States Energy Information Administration.

International Monetary Fund (IMF). 2014. World Economic Outlook. Washington, DC: IMF.

JP Morgan. 2015. Review of Markets over January. London: JP Morgan Asset Management.

Taghizadeh Hesary, F. and Yoshino, N. 2014. Monetary Policies and Oil Price Determination: An Empirical Analysis. OPEC Energy Review 38 (1): 1–20.

Yoshino, N. and Taghizadeh Hesary, F. 2014. Monetary Policies and Oil Price Fluctuations following the Subprime Mortgage Crisis. International Journal of Monetary Economics and Finance 7(3): 157–174.