A key lesson of the 2008 global financial crisis (GFC) was the importance of containing systemic financial risk and maintaining financial stability. At the same time, developing economies are seeking to promote financial inclusion, such as greater access to financial services for low-income households and small firms, as part of their overall strategies for economic and financial development. This raises the question of whether financial stability and financial inclusion are, broadly speaking, substitutes or complements. In other words, does the move toward greater financial inclusion tend to increase or decrease financial stability?

A number of studies suggest both positive and negative ways in which financial inclusion could affect financial stability, but very few empirical studies have been made of the relationship. Our recent study contributes to the literature on this subject by estimating the effects of various measures of financial inclusion (together with some control variables) on some measures of financial stability. We find evidence that an increased share of lending to small and medium-sized enterprises (SMEs) aids financial stability, mainly by reducing the number of non-performing loans (NPLs) and lowering the probability of default by financial institutions. This suggests that policy measures to increase financial inclusion, at least by SMEs, would have the side-benefit of contributing to financial stability as well.

Possible interactions of financial stability and financial inclusion

Khan (2011) suggests three main ways in which greater financial inclusion can contribute positively to financial stability. First, greater diversification of bank assets as a result of increased lending to smaller firms could reduce the overall riskiness of a bank’s loan portfolio. This would reduce the relative size of any single borrower in the overall portfolio and reduce its volatility. Second, increasing the number of small savers would increase the size and stability of the deposit base, reducing banks’ dependence on “non-core” financing, which tends to be more volatile during a crisis. Third, greater financial inclusion could also contribute to a better transmission of monetary policy, also contributing to greater financial stability.

Hannig and Jansen (2010) argue that low-income groups are relatively immune to economic cycles, so that including them in the financial sector will tend to raise the stability of the deposit and loan bases. They note anecdotal evidence that suggests that financial institutions catering to the lower end tend to weather macro-crises well and help sustain local economic activity. Prasad (2010) also observes that a lack of adequate access to credit for SMEs and small-scale entrepreneurs has adverse effects on employment growth since these enterprises tend to be much more labor intensive in their operations.

Khan (2011) also cites a number of ways in which increased financial inclusion could contribute negatively to financial stability. The most obvious example is if an attempt to expand the pool of borrowers results in a reduction in lending standards. This was a major contributor to the severity of the “sub-prime” crisis in the United States. Second, banks could increase their reputational risk if they outsource various functions such as credit assessment in order to reach smaller borrowers. Finally, if microfinance institutions (MFIs) are not properly regulated, an increase in lending by that group could dilute the overall effectiveness of regulation in the economy and increase financial system risks.

Data on financial inclusion and financial stability

The single most important cross-country database in this area is the World Bank’s Global Financial Development database (GFDD).1 It includes a large number of variables related to financial inclusion, together with macroeconomic variables and some variables related to financial development and financial stability. Examples of variables related to financial inclusion include the number of bank branches per 100,000 people, the number of bank accounts per 1,000 people, the percentage of firms with a line of credit to total firms, the percentage of adults either saving at or borrowing from a financial institution in the past year, and the percentage of adults with at least one account at a formal financial institution. Examples of data on financial stability in the GFDD include bank Z-scores (an indicator of the probability of default of the country’s banking system), the ratio of non-performing loans (NPLs), the ratio of bank credit to bank deposits, the ratio of bank regulatory capital to risk-weighted assets, and the ratio of bank liquid assets to deposits and short-term funding.

The International Monetary Fund’s (IMF) Financial Access Survey (FAS)2 provides additional useful data, including inclusion data for non-bank financial institutions such as credit unions, insurance companies, and MFIs, as well as the availability of ATMs and the amount of commercial bank loans and deposits to SMEs. Because it also includes total commercial loans and deposits, the data can be used to calculate the share of SMEs in total commercial bank loans and deposits, an important measure of inclusion. The database covers 193 economies and has time series for up to nine years (2004–2012), although again there are many missing values, so the effective size of the database is much smaller.

Stylized facts of financial stability and financial inclusion

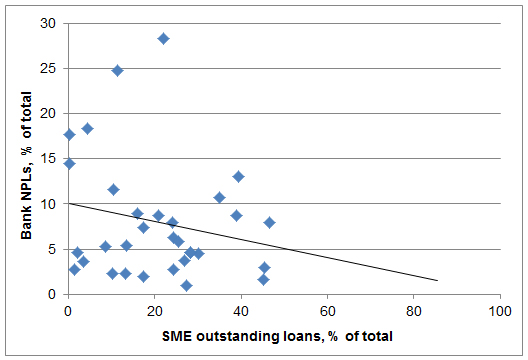

Figure 1 shows some correlation between the share of SMEs obtaining finance and bank NPLs. The downward sloping line implies that increasing access of SMEs to finance tends to reduce the share of bank NPLs, which is in line with the positive factor identified above. However, the number of data points is small and the degree of dispersion is fairly wide, so these results have to be taken with caution.

Figure 1: Bank NPLs and the Share of SMEs in Total Commercial Bank Loans

NPL = non-performing loan, SME = small and medium-sized enterprise.

Source: IMF Global Financial Access Survey. 2013. 2001–2011 average.

Model, data and results

To formally verify the link between financial stability and financial inclusion, we estimated the following dynamic-panel equation:

finstabi,t = α(fininclusioni,t )+ βXi,t + εi,t, (1)

where finstabi,t is the measure of financial stability; fininclusioni,t is the measure of financial inclusion; X is a vector of controls (logarithm of GDP per capita [lgdpi,t], private credit by deposit money banks and other financial institutions to GDP [cgdpi,t], liquid assets to deposits and short-term funding [liqi,t], non-FDI capital flow to GDP [nfdii,t] and financial openness [opnsi,t]); β are a set of nuisance parameters; εi,t is an error term; i = 1, …, N represents the country; and t = 1, …, T represents time. Finally, α is the coefficient of interest to us, which measures the effect of financial inclusion on financial stability.

To estimate equation (1), this study employed panel data for the period 2005–2011. The two measures of financial inclusion used in the analysis are SME outstanding loans as a proportion of total outstanding loans of commercial banks (smeli,t), and the number of SME borrowers as a proportion of the total number of borrowers from commercial banks (sembi,t). We also used two measures of financial stability in the regressions, namely, bank Z-score (bzsi,t) (defined as the sum of capital to assets and return on assets divided by the standard deviation of return on assets) and bank NPLs as a proportion of gross loans by banks (npli,t). Both measures of financial stability were obtained from the GFDD.

The detailed results are reported in Morgan and Pontines (2012). Our first measure of financial inclusion (smeli,t) enters positively and significantly, that is, greater lending to SMEs leads to a lower probability of default by financial institutions (bzsi,t). We also obtain a consistent finding, in which smeli,t enters negatively, that is, greater lending to SMEs leads to lower bank NPLs (npli,t), though this result is only weakly significant at the 10% significance level. Using our second measure of financial inclusion (sembi,t), we find it to be positive and significant, that is, a greater number of SME borrowers leads to a lower probability of default by financial institutions. We also find sembi,t to be negative and significant, that is, a greater number of SME borrowers leads to lower bank NPLs.

Conclusion

Our study provides evidence of positive effects of greater financial inclusion on financial stability, i.e., the two tend to be complementary rather than there being a trade-off between them. Specifically, we find evidence that an increased share of lending to SMEs in total bank lending aids financial stability, mainly by a reduction of NPLs and a lower probability of default by financial institutions. This suggests that policy measures to increase financial inclusion, at least by SMEs, would have the side benefit of contributing to financial stability as well. Future work could consider the effects of measures of household inclusion, such as the percentage of adults with deposits or loans at a formal financial institution, on financial stability measures. We could also examine other measures of financial stability, such as the volatility of GDP growth, bank loans, bank deposits, or the presence of financial crises.

_____

1 The GFDD database is available at: http://econ.worldbank.org/ [1]. A description of the database can be found in Chapter 1 of World Bank. 2013, and also in Cihák et al. 2012.

2 The FAS can be accessed at http://fas.imf.org/

References:

Hannig, A., and S. Jansen. 2010. Financial Inclusion and Financial Stability: Current Policy Issues [2]. ADBI Working Paper Series No. 259. Tokyo: Asian Development Bank Institute

Khan, H. R. 2011. Financial Inclusion and Financial Stability: Are They Two Sides of the Same Coin? Address by Shri H. R. Khan, Deputy Governor of the Reserve Bank of India, at BANCON 2011, organized by the Indian Bankers Association and Indian Overseas Bank, Chennai, India. 4 November.

Lane, P., and G. Milesi-Ferretti. 2007. The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970–2004. Journal of International Economics 73(2): 223–250.

Morgan, P., and V. Pontines. 2014. Financial Stability and Financial Inclusion [3]. ADBI Working Paper Series No. 488. Tokyo: Asian Development Bank Institute

Prasad, E. 2010. Financial Sector Regulation and Reforms in Emerging Markets: An Overview. NBER Working Paper 16428. Cambridge, MA: National Bureau of Economic Research