Over the past few decades East Asia has become increasingly intertwined economically as the share of interregional trade in total trade has increased sharply across most economies, driven by regional supply chains and production networks. These production networks have also fostered greater investment links, with the production process being broken down into subprocesses within a particular industry. The high degree of economic integration indicates that there may be a case for exchange rate coordination, as exchange rate misalignments may result in loss of competitiveness for a country, possibly leading to an increase in protectionism, which in turn could promote a round of beggar-thy-neighbor devaluations. Large swings in bilateral exchange rates could influence decisions about the location of new and existing investments. In contrast, greater stability in exchange rates would support investment by increasing price transparency and reducing currency-related hedging costs for companies. Finally, sharp exchange rate movements in one currency could affect another country’s ability to maintain a particular exchange rate regime.

Despite the strong case for exchange rate coordination, such coordination continues to be a long-drawn process at the best of times, involving intensive policy dialogue. The creation of the euro was a culmination of more than two decades of deliberations among the member countries. Coming out of the Asian crisis, many pushed for the replication of the euro experiment in Asia. However, the heterogeneity of the Asian countries in terms of their institutional capability and policy frameworks will add to the difficulty of exchange rate coordination. Consequently, even the most enthusiastic admirers of exchange rate coordination in Asia have refrained from advocating a single currency for Asia, and instead propose creation of a parallel currency, which could circulate alongside national currencies (Eichengreen 2006).

A possible candidate for the parallel currency would be an Asian Currency Unit (ACU), based on the weighted average of participating currencies. An ACU in Asia would allow transactions such as exports, imports, lending, deposit taking and issuing bonds to be denominated in a more stable currency, thereby facilitating exchange rate coordination through market forces rather than political pressures. The recent global financial crisis emphasized the need for greater diversification out of the US dollar as an international reserve currency. With countries denominating transactions in ACU, central banks could hold part of their portfolio in the regional benchmark, thereby reducing their overwhelming dependence on the US dollar.

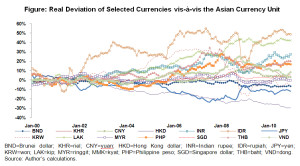

In a recent paper (Sen Gupta 2012), I find that the evidence over the past decade suggests limited progress on exchange rate coordination among the Asian economies studied: ASEAN+3; Hong Kong, China; and India. The different currencies have exhibited very diverse movements vis-à-vis the ACU in both nominal and real terms during the last decade.1 The diverse movements reflect the wide differences in the movement of the individual currencies and inflation rates vis-à-vis the regional benchmark. While the Japanese yen and the Hong Kong dollar show a sustained depreciating trend as a result of their low and sometimes negative inflation rates, the Indonesian rupiah, Philippine peso and the Indian rupee exhibit an appreciating trend because of their higher inflation. In contrast, the Korean won and Malaysian ringgit display irregular trends because of the interplay between exchange rate and inflation differentials. On a cumulative basis, the extent of deviation steadily increased after 2004, and peaked before the onset of the global financial crisis. In the immediate aftermath of the crisis, there was some moderation in the extent of deviation. However, this was short-lived and the extent of deviation started increasing again in 2010. Empirical analysis also indicates that during the past decade there were only a couple of years during which exchange rates among the Asian economies displayed any kind of convergence. Click on the figure below to enlarge it.

The increasing divergence across the participating currencies indicates that convergence on the eurozone model is not possible in the foreseeable future in Asia. First, the different exchange rate regimes followed by the economies indicate the different priorities of their monetary and exchange rate policies. These range from economies where the exchange rate serves as the nominal anchor or intermediate target of monetary policy and the monetary authority intervenes to influence the exchange rate to economies that have adopted an inflationary targeting framework with a greater degree of exchange rate flexibility. Second, the recent European experience has underlined the importance of developing strong crisis prevention and resolution mechanisms. Asia has only recently started developing a crisis response mechanism, and has a long way to go in if it is to be strengthened sufficiently. Third, political considerations will play a critical role in the decision to move towards exchange rate coordination. Key decisions involving inclusion of participating currencies and the weights accorded to these currencies will be driven by political as well as technical inputs.

Given the wide disparity in exchange rate regimes, intensive policy dialogue on the consequences of exchange rate misalignments in the region needs to be carried out on the lines suggested by Kawai (2010). The ACU could provide useful information on the extent of divergence between the currencies. The ACU could also be used as the invoicing currency for trade and bond issues. In time, a gradual coordinated regional adoption of currency baskets could be conceived, with the composition of the basket being harmonized at a further date. Further steps towards exchange rate coordination may be dictated by the experience of regional members of exchange rate cooperation.

The recent agreement to double the resources available to the Chiang Mai Initiative Multilateralization (CMIM) and to set up aregional surveillance agency, the ASEAN+3 Macroeconomic Research Office (AMRO) are steps in the right direction but more needs to be done, including reviewing the contentious linkage of the CMIM with the IMF and further strengthening the resources available to AMRO and CMIM. The ACU and the ACU divergence indicators would provide important information to AMRO for regional surveillance. Denominating the AMRO budget and the operations of AMRO and CMIM in ACU would also help to promote intra-regional exchange rate stability.

_____

1 The nominal deviation relates to the percentage change in the value of the individual currencies vis-à-vis the ACU compared to a base period. The real deviation combines the inflation differential between the individual country and the regional average and nominal deviation. For details please refer to Ogawa and Shimizu (2007) and Sen Gupta (2012).

References:

Eichengreen, B. 2006.The Parallel Currency Approach to Asian Monetary Integration.American Economic Review 96 (2): 432–436

Kawai, M. 2010. An Asian Currency Unit for Asian Monetary Integration. In The Future Global Reserve System— An Asian Perspective, edited by J.D. Sachs, M. Kawai, J.-W. Lee and W.T. Woo. Manila: ADB (http://aric.adb.org/grs/papers/Future_Global_Reserve_System.pdf).

Ogawa, E., and J. Shimizu. 2007. Progress Toward a Common Currency Basket System in East Asia. RIETI Discussion Paper Series 06-E-038.Available:http://www.rieti.go.jp/jp/publications/dp/07e002.pdf

Sen Gupta, A. 2012. Exchange Rate Coordination in Asia: Evidence Using an Asian Currency Unit. ADBI Working Paper 356. Tokyo: Asian Development Bank Institute. Available: http://www.adbi.org/working-paper/2012/04/19/5052.exchange.rate.coordination.asia/

This post is based on the author’s paper “Exchange Rate Coordination in Asia: Evidence using the Asian Currency Unit,” ADBI Working Paper No. 356.

Dear colleagues, what is working legislation in the ACU creation and mastering, please…

On your opinion, please …Can CIS-Union use your experience to create new (regional) monetary union?

Yours sincerely,

Galina Mojsejchik, Ph.D., NB of Belarus

It is true that “An ACU in Asia would allow transactions such as exports, imports, lending, deposit taking and issuing bonds to be denominated in a more stable currency, thereby facilitating exchange rate coordination through market forces rather than political pressures.” This may become more important if the dollar weakens in the medium-term (3–5 years), which could leave many exporters out of pocket if the dollar decreases in value over the period of a dollar-denominated contract. However, the history of ASEAN seems to show that there is little appetite for cooperation among political leaders in Asia beyond bland statements of intent. If the dollar is to be replaced in Asia, I feel it is more likely to be by the renminbi, rather than the ACU.