Japan is almost fully dependent on energy imports. In March 2011, a devastating earthquake and tsunami hit eastern Japan and damaged the nuclear power plant in Fukushima. This disaster led to the shutdown of all nuclear power plants due to the lack of government safety approvals. Japan replaced this significant loss of nuclear power with energy generated from imported natural gas, low-sulfur crude oil, fuel oil, and coal. Based on the importance of oil for Japan, Taghizadeh-Hesary, Rasolinezhad, and Kobayashi (2015) investigated the effects of oil price fluctuations on the oil consuming economic sectors of Japan from Q1 1990 to Q1 2014. Their research questions are the following: Considering the new, energy-related technologies and energy resources, and government-mandated energy efficiency targets, do economic micro sectors still react to oil price movements? If the answer is yes, are the responses of all economic sectors to oil price impulses of the same scale? Which sectors show higher sensitivity?

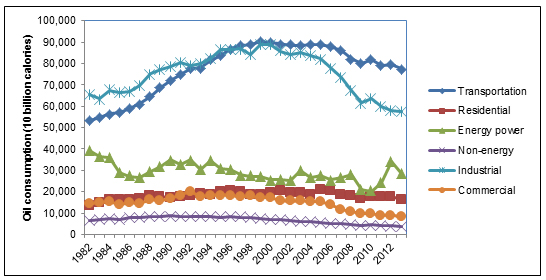

Overview of oil consumption in Japan by sector

Generally, there are six oil-consuming sectors in an economy: the commercial, energy power generation, industrial, non-energy, residential, and transportation sectors.

As can be seen in Figure 1, the transportation and industrial sectors consumed the most oil in Japan during 1982–2013, and importantly, until early 1990, the industrial sector consumed more oil than the transportation sector. However, after the burst of the Japanese asset price bubble in the 1990s, the Japanese economy started suffering from sluggish economic growth and recession (Japan’s so-called “lost decade”) and the industrial sector’s demand for oil started to fall. Another reason for the reduced demand for oil in the industrial sector was the huge foreign direct investment (FDI) from Japan to other Asian countries, including the People’s Republic of China, Thailand, and Malaysia, which moved a significant share of industrial production to other countries. Since that period, the transportation sector has remained the major consumer of oil in the country, and consumption in the sector has been almost constant. However in recent years, mainly because of the increasing number of hybrid cars and higher energy efficiency of Japanese automobiles, demand for oil in the sector has started to decrease. Industrial sector demand shows a negative slope and demand for oil for energy power generation has also been decreasing because of substitution for liquefied natural gas (LNG).

Figure 1: Crude oil consumption by sector in Japan, 1982–2013

Source: Energy Data and Modelling Center (EDMC) database of the Institute of Energy Economics, Japan (IEEJ).

In 1982, shares of the transportation, residential, energy power, non-energy, industrial, and commercial sectors in total oil consumption were 28%, 7%, 20%, 3%, 33%, and 9%, respectively. However, it is interesting to mention that by 2013, these ratios had changed and the shares of the transportation, residential, energy power, non-energy, industrial, and commercial sectors were measured at 40%, 8%, 15%, 2%, 30%, and 5%, respectively.

What are the impacts of crude oil price volatility for each sector in Japan?

Empirical results show that oil is still the main energy carrier in Japan, although the share of oil consumption in total energy consumption in the country declined from about 80% in the 1970s to 43% in 2011. Furthermore, crude oil consumption in Japan is a pro-cyclical variable. This means that increases in the GDP growth rate boosted the consumption of crude oil, and economic downturns had the effect of reducing oil consumption.

Research by Taghizadeh-Hesary, Rasolinezhad, and Kobayashi (2015) examines the accumulated response of oil consumption in six economic sectors in Japan to oil price fluctuations. The results conclude that the transportation, industrial, and commercial sectors in Japan have a high, negative sensitivity to oil price positive impulses. For the industrial sector, higher oil prices led to increased energy efficiency and reduced energy intensity, and hence a decrease in demand for oil. Moreover, higher oil prices affected total costs and final prices in the sector as well as sales, so hence demand for oil diminished. The same reasons are applicable to the commercial sector. As for the transportation sector, with higher oil prices, Japanese households used their private automobiles less and demand for public transportation increased. On the other hand, however, Japanese automotive manufacturers have increased the energy efficiency of their products in recent years and the share of hybrid cars has risen.

The power generation sector shows a positive response to an oil price increase. This means that due to higher oil prices, demand in this sector increased. The reason for this is the lack of energy resources in Japan and the almost full dependency of the economy on energy imports, especially of oil. Oil is the main mover of the Japanese economy, so hence even at higher prices, the country needs oil for generating energy.

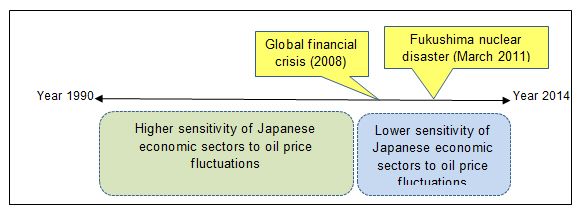

Taghizadeh-Hesary, Rasolinezhad, and Kobayashi (2015) also divided their analysis into two periods, with the Fukushima nuclear disaster included in the second period. Their results show that in the second period, in the wake of the Fukushima nuclear incident, because of the country’s increased dependency on oil, almost all economic sectors had a lower sensitivity to oil price fluctuations. Figure 2 illustrates this result.

Figure 2: Sensitivity of Japanese economic sectors to oil price fluctuations during 1990–2014

The policy implication is that Japan needs to raise the share of non-fossil fuel energy carriers in its energy basket. This is because the prices of fossil fuels, such as oil and LNG, have strong co-movements, so if the price of one rises, the prices of others will increase too. If a country has low sensitivity to oil prices it means this will also exist for other energy carriers, so in the case of an oil price increase, the whole economy will lose. This highlights the need for Japan to increase the share of non-fossil fuels.

_____

References:

Taghizadeh-Hesary, F., E. Rasolinezhad, and Y. Kobayashi. 2015. Oil Price Fluctuations and Oil Consuming Sectors: An Empirical Analysis of Japan. ADBI Working Paper 538. Tokyo: Asian Development Bank Institute.

Taghizadeh-Hesary, F. and Yoshino, N. 2014. Monetary Policies and Oil Price Determination: An Empirical Analysis. OPEC Energy Review 38(1): 1–20.

Taghizadeh-Hesary, F., N. Yoshino, M. M. H. Abadi, and R. Farboudmanesh. 2015. the Response of Macro Variables of Emerging and Developed Oil Importers to Oil Price Movements. Journal of the Asia Pacific Economy.

Taghizadeh-Hesary F., N. Yoshino, G. Abdoli, and A. Farzinvash. 2013. An Estimation of the Impact of Oil Shocks on Crude Oil Exporting Economies and Their Trade Partners. Frontiers of Economics in China 8(4): 571–591.

Yoshino, N., and F. Taghizadeh-Hesary. 2015. What’s behind the Recent Oil Price Drop? In Monetary Policy and the Oil Market, edited by N. Yoshino and F. Taghizadeh-Hesary. Tokyo: Springer.

Photo: By tsuna72 from Fukuoka, Japan (Tanks) [CC BY 2.0 [1]], via Wikimedia Commons [2]