The BRICS countries—Brazil, Russian Federation, India, People’s Republic of China (PRC) and South Africa—have been the recipients of much admiration for their high growth rates, which have helped to increase their share in the world economy and reduce global poverty. However, doubts have grown as to whether the process of income convergence will continue. “Sustainable governance” in the BRICS, or rather the lack thereof, lies at the heart of these doubts.

The BRICS countries—Brazil, Russian Federation, India, People’s Republic of China (PRC) and South Africa—have been the recipients of much admiration for their high growth rates, which have helped to increase their share in the world economy and reduce global poverty. However, doubts have grown as to whether the process of income convergence will continue. “Sustainable governance” in the BRICS, or rather the lack thereof, lies at the heart of these doubts.

The Sustainable Governance Indicators (SGI) study by the Bertelsmann Foundation, a German think tank, sheds light on the status of sustainable governance among the BRICS countries. The study found that economic and social governance appears sustainable in Brazil and the PRC, India is in the middle, and the Russia Federation and South Africa follow the least sustainable economic and social policies among the five BRICS.

With the support of an international network of experts, the Bertelsmann Stiftung has conducted an indicator-based inventory of the state and performance of governance in each BRICS country. Focusing on 15 policy areas, including economic, labor, education, health care, social welfare, environmental and research and innovation policy, this study draws upon the analytic tool of the Sustainable Governance Indicators (SGI). This inventory allows for a systematic documentation of the need for reform in core policy areas, which are presented in Tables 1 and 3.

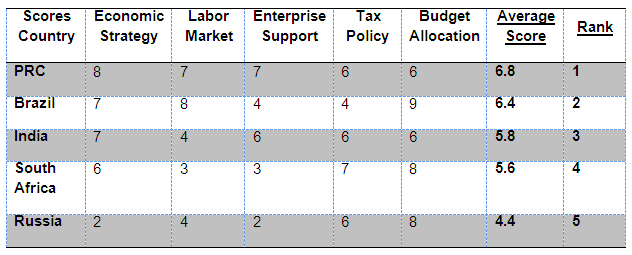

Table 1: Ranking BRICS Economic and Labor Governance

Source: SGI country studies

In Table 1, the economic strategy column scores a government’s economic development plan through the use of regulatory policy. The scores are satisfactorily high for four BRICS, but low for the Russian Federation, reflecting the absence of a long-term development strategy.

Insufficient labor market absorption is a widespread problem among BRICS because of low-quality public education systems and complex laws that protect jobs in the formal economy.

The PRC has the strongest overall performance among the BRICS countries. The PRC is first or second for all policy areas, except for budget allocation, where the PRC shares last place with India. A major challenge to sustainability in the PRC is the unsolved problem of fiscal federalism and widespread corruption; the insufficient allocation of public funds to provincial and local administrations has encouraged land grabs by the authorities, deepened corruption and endangered social stability.

Brazil outperforms the PRC in budget and labor policy, but has a big gap in taxes and enterprise policy. The SGI study attributes this to the unsolved problem of a small tax base with many exemptions and tax holidays, which undermines the progressivity of income taxation; this in turn imposes high tax rates on the remaining tax base, which hits corporate competitiveness. Competitiveness in Brazil is undermined by barriers to private-sector infrastructure investment and by monopolistic barriers to market entry and little corporate contestability.

India’s weak tax system and massive subsidies makes it the most fragile BRICS country in public finances.

The BRICS scored well on sustainability policy, such as the ability to withstand crisis and smooth out business cycles. The macroeconomic foundations for sustainable governance have been created in the BRICS, first and foremost in monetary policy, but also in improved tax revenues and budget policies. While public debt-GDP ratios have been exploding in the OECD, all five BRICS have been able to contain their public debt as a fraction of GDP (Brazil, India) over the past decade, while public debt ratios have been either reduced (Russian Federation, South Africa) or remained at low levels (PRC). The drop in public debt ratios has been a boon, creating fiscal space for more active policy intervention to sustain growth in the face of social and structural challenges. As such, lower debt and more space for fiscal expansion augur well for sustainability in the BRICS. However, high growth and raw material prices, which have been driving much of the improved tax revenues in resource-rich countries, have grown increasingly PRC-dependent (Cristopher Garroway et al 2012). Much of the improved state of developing- and emerging-country public finances will depend on growth being sustained, especially in the PRC, the new locomotive for global growth.

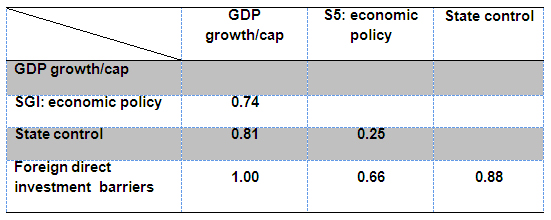

Table 2: Spearman Rank Correlation Coefficients

Source: Author’s calculation.

Note: Table 2 presents several Spearman rank correlation coefficients as a non-parametric variable of the association between the SGI for “quality of economic policy,” GDP/capita growth during the 2000s, restrictiveness of the foreign direct investment (FDI) regime, and the degree of state control. The rank correlation coefficients, as defined here, can move between +1 (perfect association) and 0 (no association).

Table 2 reveals several interesting insights in this regard: (i) a high degree of state control in the economy does not stand in the way of a good ranking in past growth performance; (ii) a high degree of FDI restrictiveness perfectly matches past growth performance, which does not imply causality, however, as high-growth countries may have more room for selectivity as FDI hosts than do low-growth countries; and (iii) a high rank correlation coefficient between the degree of FDI restrictiveness and the degree of state control indicates a political economy explanation: a high state involvement strengthens the vested interest of politicians in keeping foreign investors out of the country.

State involvement in the economy is high in the PRC and Russia. And state involvement in all BRICS is higher than the OECD on average.

Assessing BRICS

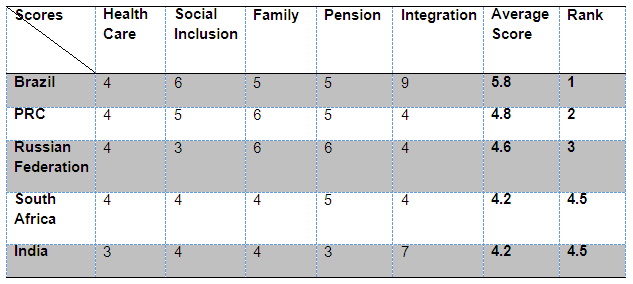

The BRICS do worse on governance indicators in the social affairs cluster, which comprises healthcare, social inclusion, family, pensions, and integration. Social policy reform is urgent in these areas for all BRICS, and failure to implement social policy reforms will likely lead to social instability arising from extreme social inequality and widespread corruption (Helmut Reisen 2011).

Table 3: Ranking of BRICS Social Affairs Governance

Source: SGI country studies.

The BRICS average scores in social affairs in Table 3 are a point below those in the economy and labor columns in Table 1. Brazil performs best among the BRICS, ranking first or second in all social policy areas, the PRC is second, followed by the Russian Federation. South Africa and India have the lowest grades in all policy areas, putting the sustainability of their development in doubt within the BRICS group. South Africa has very consistent, albeit low results, pointing to a need for policy reform and improvement in all social affairs. The Russian Federation’s most urgent areas for policy reform are in social inclusion, healthcare, and integration. The PRC’s most urgent policy challenges are in healthcare and integration.

Building fair and efficient systems of fiscal federalism, removing skills mismatches in labor markets, and acquiring skills for changing competitive scenarios are eminent policy challenges facing all five BRICS countries. Insights from development economics old and new suggest that the sustainability of growth will increasingly depend on how well the BRICS score on the SGI indicators as their per capita GDP rises beyond the $10,000 threshold, as their output mix, production procedures and related services approach the world’s leading “technology frontiers.” So far, Brazil and the PRC are leading the other three BRICS.

_____

References:

Garroway, Cristopher, Helmut Reisen and Edouard Turkisch. 2012. The Renminbi and Poor-country Growth. The World Economy. 35 (3). pp. 273–294.

Reisen, Helmut. 2013. Economic Policy and Social Affairs in the BRICS. Bertelsmann Foundation.

Comments are closed.